ADT 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

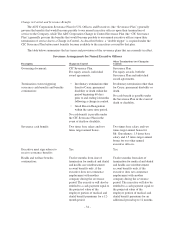

The following table describes the conversion methodology for each of our named executive officers:

Tyco Equity Award Post-Separation Equity Award

Stock Options Converted to ADT stock options

RSUs granted prior to Oct. 2011 Converted to RSUs in ADT, Tyco and Pentair

RSUs granted in Oct. 2011 and later Converted to ADT RSUs

PSUs Converted to ADT RSUs

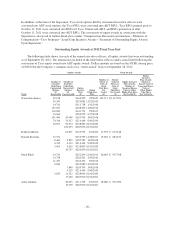

Although the conversions described above preserved the intrinsic value of each type of award, in some cases

they constituted a modification under the authoritative guidance for accounting for stock compensation, which

requires a comparison of fair values of awards immediately before the Separation and the fair values immediately

after the Separation. In certain instances, the fair value immediately after the Separation was higher. As a result,

incremental compensation costs for certain of these awards were recognized and are included in the Summary

Compensation Table and Grants of Plan Based Awards Table below. In general, neither the vesting terms for

converted options and RSUs, nor the period of exercisability for converted options changed as a result of these

conversions.

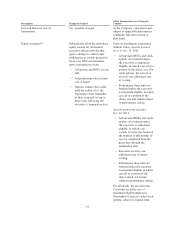

Executive Benefit Plans and Other Elements of Compensation

While employed by Tyco, our named executive officers participated in the benefit plans that were available

to substantially all of Tyco’s U.S. employees. Our named executive officers were also eligible to participate in

Tyco’s SSRP, which is identical to our SSRP. In recent years, the Tyco Compensation Committee reviewed the

other elements of compensation that were historically part of its executives’ total compensation and took steps to

phase-out programs that it believes are not in line with best practices. Tyco provided limited perquisites and other

benefits to certain of its executives, including certain of our named executive officers, consisting of the

following:

Supplemental insurance benefits (executive life, disability and long-term care). Prior to the Separation, Tyco

provided life insurance, long-term disability insurance and long-term care insurance to certain executives.

Mr. Gursahaney was the only one of our named executive officers eligible for these benefits. Tyco’s executive

life insurance program typically provided a death benefit equal to approximately two times the executive’s base

salary at the time the policy was initiated, and allowed the executive to elect to pay additional premiums into the

plan. Tyco’s executive disability insurance program ensured salary continuation above the $15,000 monthly

benefit limit provided by its broad based disability plan. The executive long-term care insurance program

covered certain executives in the event of chronic illness or disability. Under the program, Tyco paid the long-

term care premium for 10 years, after which the insurance was fully paid. If the executive left prior to the end of

the 10-year payment period, he or she had the option to continue making the premium payments to maintain the

coverage. Tyco did not pay tax gross-ups for its senior executives on life insurance and long-term disability

insurance programs.

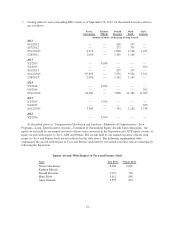

Cash perquisite allowance plan. In fiscal year 2012, the Tyco Compensation Committee decided to end the

cash perquisite allowance program for all officers of Tyco that received the benefit, including Messrs.

Gursahaney, Boerema and Edoff. This program, which was instituted in 2003 to eliminate costly and

administratively burdensome perquisites such as company cars, club dues and tax preparation services, provided

for a cash payment equal to 10% of the officers’ base salary (up to a maximum of $70,000) that the officer could

use without limitation. The Tyco Compensation Committee discontinued this plan as of January 2012. In

connection with the discontinuance of this plan, Tyco made a one-time grant of RSUs to each of the officers who

were receiving the benefit at the time of its termination. The fair value of the grant was equal to two times the

annual value of the cash allowance for such officer, and the RSUs have a pro-rata vesting schedule of two years.

The RSUs received by Messrs. Gursahaney, Boerema and Edoff with respect to the discontinuance of the cash

perquisite allowance program were treated in the same manner as the RSUs described in “—Treatment of

Outstanding Equity Awards Upon Separation” above.

-42-