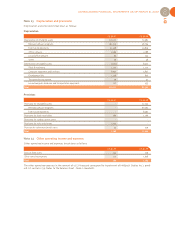

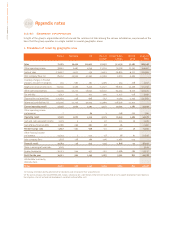

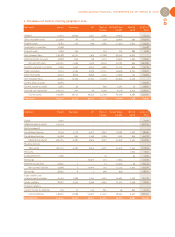

Ubisoft 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

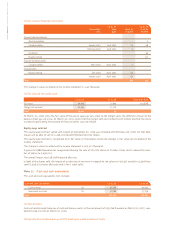

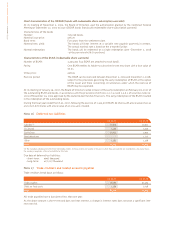

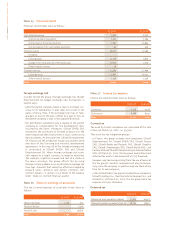

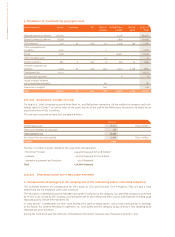

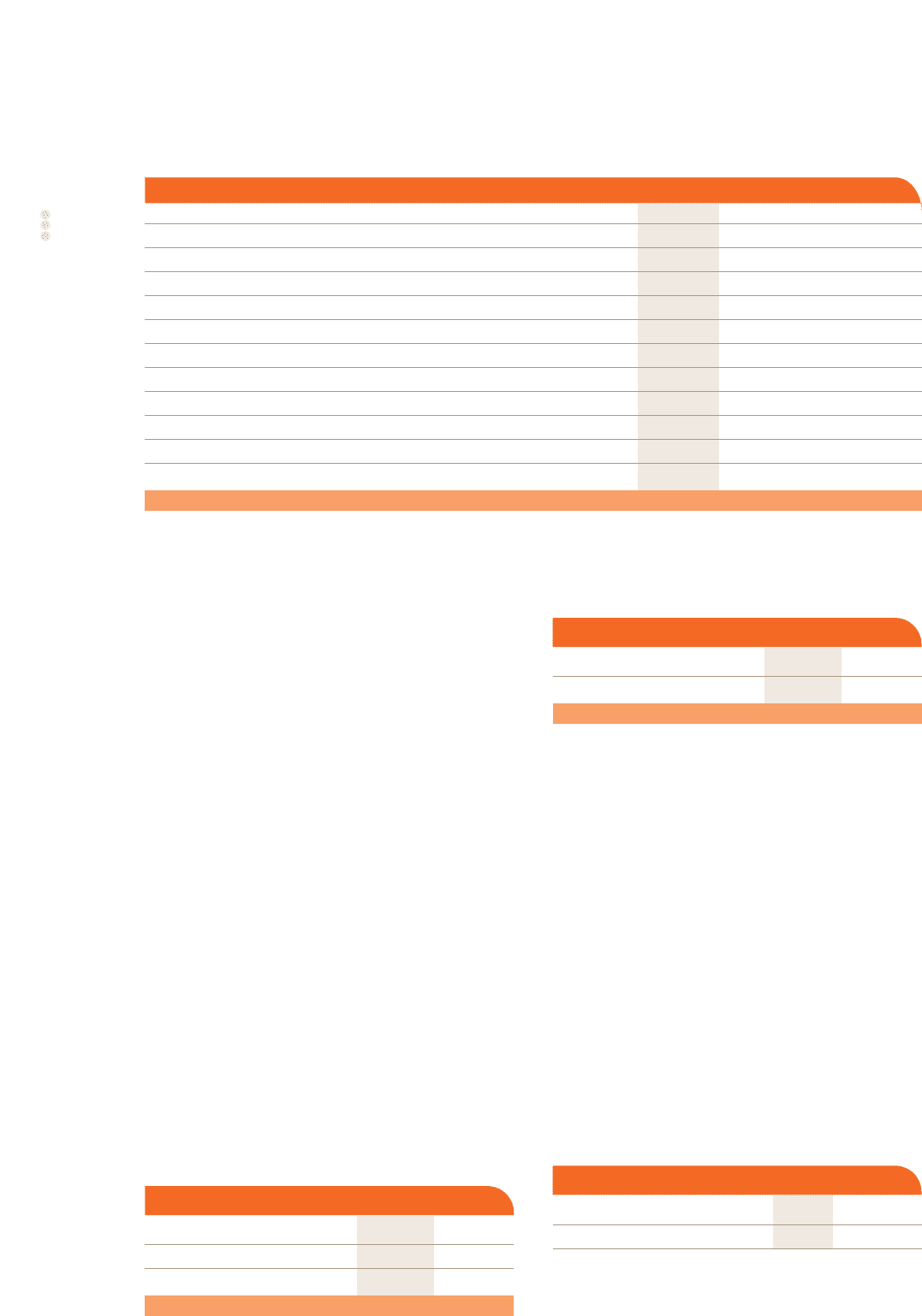

Note 25 Financial result

Financial result breaks down as follows:

Foreign exchange risk

In order to limit the group's foreign exchange risk, Ubisoft

Entertainment SA hedges exchange rate fluctuations in

several ways:

- when the parent company makes a loan in a foreign cur-

rency to its subsidiaries, it also takes out a loan in the

same currency. Thus, if the exchange rate rises or falls,

any gain or loss on the loan is offset by a gain or loss on

the parent company’s loan in the opposite direction;

- the distribution subsidiaries pay a royalty to the parent

company as compensation for the development costs

incurred by the latter. Moreover, Ubisoft EMEA SAS

centralizes the purchases of finished products for the

entire region and then resells them in local currencies to

the subsidiaries. At the same time, Ubisoft Entertainment

SA finances all the production studios around the world

and most of the licensing and external development

agreements. In this way, all of the foreign exchange risk

is centralized at Ubisoft EMEA SAS and Ubisoft

Entertainment SA. When foreign exchange risk exists

with regard to a single currency in opposite directions

(for example, royalties received and cost of a studio in

the same currency), the group offsets this by using

foreign currency advances or investments to manage the

time lags. Amounts that cannot be offset are hedged by

forward sales contracts and option contracts (for

contract details, cf. section 2.5.4 Notes to the balance

sheet - Note 10. Current financial assets).

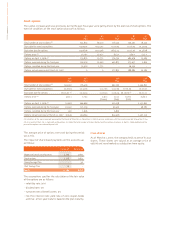

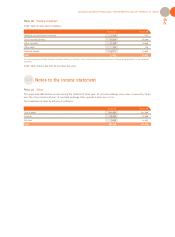

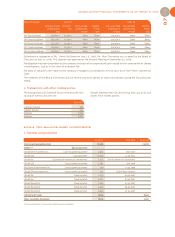

Note 26 Share in earnings of associates

The net income/expenses of associates break down as

follows:

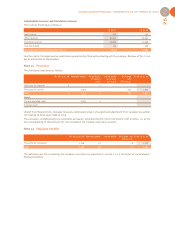

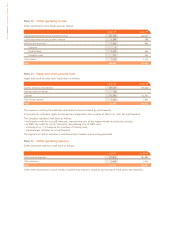

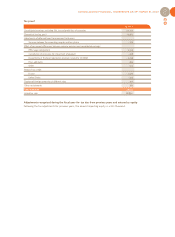

Note 27 Income tax expense

Income tax expense breaks down as follows:

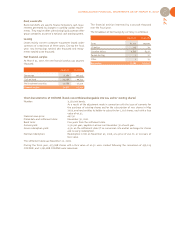

Current tax

Tax owed by French companies was calculated at the rate

in force at March 31, 2007, i.e. 33.33%.

There are two tax integration groups:

- in France, the group includes nine companies: Ubisoft

Entertainment SA, Ubisoft EMEA SAS, Ubisoft France

SAS, Ubisoft Books and Records SAS, Ubisoft Graphics

SAS, Ubisoft Organisation SAS, Ubisoft World SAS, Ludi

Factory SAS and Ubisoft Manufacturing et Administration

SAS. At March 31, 2007, the tax group had written back

deferred tax assets in the amount of €2,153 thousand;

however, any tax savings arising from the use of losses at

the tax group’s member companies will only be tempo-

rary, since the company in question may use them at any

time for its own purposes;

- in the United States, the group includes three companies:

Ubisoft Holdings Inc., Red Storm Entertainment Inc. and

Ubisoft Inc. At March 31, 2007, the tax group had a tax

expense of €1,951 thousand.

Deferred tax

03.31.07 03.31.06

Cost of net borrowings - 5,591 - 8,510

Interests earned on placements 1,521 1,764

Interest paid on financing operations - 7,067 - 10,693

Income/expenses from cash hedging operations - 45 419

Financial income 38,201 17,369

Dividends --

Exchange gains 11,108 9,850

Change in fair value and sale of the equity swap 27,057 7,519

Other financial incomes 36 -

Financial expenses - 14,563 - 17,969

Exchange losses - 12,807 - 16,531

Other financial expenses - 1,756 - 1,438

Total 18,047 - 9,110

03.31.07 03.31.06

Share in earnings 3,149 707

Result of dilution - 2,576

Result of sales - 15,826

Total 3,149 19,109

03.31.07 03.31.06

Current tax - 7,129 - 5,018

Deferred tax - 8,088 8,342

Total - 15,217 3,324

03.31.07 03.31.06

Deferred tax assets (see details in Note 6)

37,630 42,321

Deferred tax liabilities (see details in Note 16)

28,214 22,854