Ubisoft 2006 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

themselves to pool their shares and, if necessary, to purchase

or sell the number of shares or rights forming the odd lot nee-

ded.

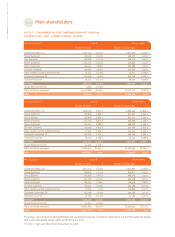

Voting rights double those conferred on other shares, based

on the proportion of the share capital they represent, shall be

attributed to all fully paid-up shares that are proved to have

been registered for at least two years in the name of the same

shareholder.

In the event of an equity issue by the capitalization of reserves,

profits or issue premiums, this right is also conferred at the

time of issue on registered shares allotted free of charge to a

shareholder in exchange for old shares for which this right was

enjoyed.

It should be noted that Article L225-124 of the French

Commercial Code stipulates that double voting rights

are automatically revoked for shares which are converted to

bearer shares or for which ownership is transferred, with the

exception of transfer of ownership between registration

accounts resulting from succession, inter-family gifts or

liquidation of communal property.

4.2.1.6 Provision delaying

a change in control

None

4.2.1.7 Consent clause

None

4.2.1.8 Provision governing

changes in capital when said

conditions are stricter

than the law

None

4.2.1.9 Amendment of the Articles

of Association

The Articles of Association may be amended based on a

decision by the Extraordinary General Meeting.

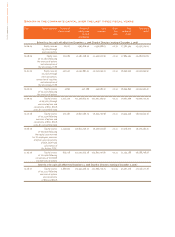

4.2.2.3 Share buyback program

4.2.2.3.1 Authorizations

Legal framework

The Ordinary General Meeting of September 25, 2006,

in Resolution Seven, authorized the Board of Directors

to launch a share buyback program pursuant to Article

L 225-209 of the French Commercial Code.

Features of the Share Buyback Program

The Share Buyback Program was adopted for a period of 18

months from the date of the meeting, ie. until March 25

2008. Pursuant to that authorization, the maximum price

was fixed at 35 euros (following the halving of the share

value) and the number of shares available to be acquired

under the Share buyback Program was fixed at 10% of the

capital at the date of the meeting. The various objectives of

the Share Buyback Program are defined as follows, in

conformity with the applicable laws and the market practices

accepted by the French Stock Exchange Commission

(AMF):

- The completion of sales or purchases of shares as part of a

liquidity contract made with an investment service provider,

in accordance with a code of professional ethics recognized

by the AMF.

- The delivery of shares in connection with the exercise of

rights attached to securities granting entitlement by

any means, either immediately or subsequently, to the

company’s capital.

- The allotment of shares to employees and corporate officers

of the Ubisoft Entertainment group, including as part of (i)

a company gainsharing plan, (ii) any employee stock

purchase plan or stock allotment plan under the conditions

established by law, and specifically by Articles L. 443-1

& seq. of the French Labor Code, or (iii) any stock option

plan for the benefit of some or all employees or corporate

officers.

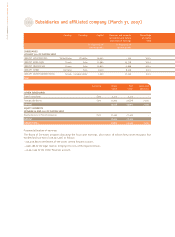

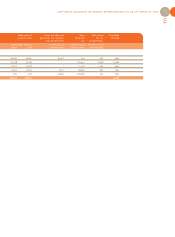

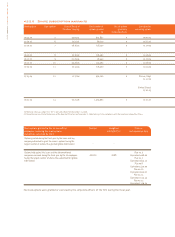

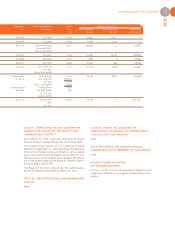

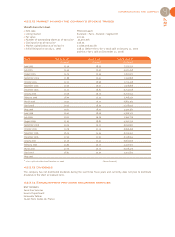

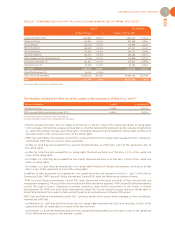

4.2.2.2 Comparison between the number of outstanding shares

on the start and end dates of the fiscal year

Share capital

4.2.2.1 Subscribed capital

As of March 31, 2007, the share capital was €7,036,577.78 representing 45,397,276 shares. At its meeting on December 5,

2006, the Board of Directors decided, pursuant to powers delegated by the Extraordinary General Meeting of September 25,

2006, first, to make a 2-for-1 split in the nominal value of each share with effect from December 11, 2006, and second,

to delete the reference in the Articles of Association to the nominal value of a share.

4.2.2

As of 04.01.06 19,434,336

Exercised options 445,953

Bond conversions 69

OCEANE conversions 475,998

Subscription conversions 851,141

PEG-PEE/Increase in capital reserves 46,691

Subtotal (before 2-for-1 split in nominal value*) 21,254,188

Subtotal (after 2-for-1 split in nominal value*) 42,508,376

Exercised options 261,224

Exercise of BSAR 2,627,676

As of 03.31.07 45,397,276

* On December 5, 2006, the Board of Directors of Ubisoft decided to make

a 2-for-1 split in the nominal value of a Ubisoft share with effect from

December 11, 2006.