Ubisoft 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

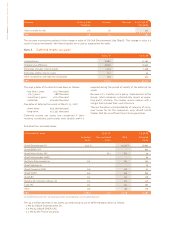

CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2007

61

2

nature of the fixed assets held, no distinct component of

the main fixed assets was noted.

No borrowing costs are included in the costs of fixed

assets.

Depreciation, which is calculated using rates standardized

throughout the group, is determined on the basis of the

methods and periods of use set out below:

equipment: 5 years (straight-line),

fixtures and fittings: 5 and 10 years (straight-line),

computer equipment: 3 years (straight-line),

office furniture: 10 years (straight-line).

Fixed assets acquired through direct finance

leasing arrangements

Lease contracts that transfer nearly all risks and benefits

inherent to ownership of the asset are considered direct

finance lease arrangements.

Capital assets financed through leasing agreements are

restated in the consolidated financial statements as if the

company had acquired the assets directly using loan finan-

cing.

The amount recorded as an asset is equal to the fair value

of the goods leased or, if this value is less than the present

value of the minimum lease payments, the fair value less

depreciation cost and the sum of the losses in value.

Deferred taxes related to the restatement of finance lease

contracts are activited.

Investments in associates

Investments in associates include the Group share of equity

held in associates, as well as any related goodwill.

Inventory and work-in-progress

Inventory is valued at cost or net realizable value, whiche-

ver is lower.

Cost includes purchase price plus accessory expenses.

Inventory is valued using the FIFO method.

Net realizable value is the estimated selling price in the

normal course of activity less estimated completion costs

and estimated selling costs, which include marketing and

distribution costs.

No borrowing costs are included in the costs of invento-

ries.

A provision for depreciation is recorded when the proba-

ble net realizable value is less than the book value. Write-

backs of inventory depreciation are recognized as a

reduction of the amount of inventory recorded as an

expense during the fiscal year in which the write-back

occurs.

Trade receivables

Trade receivables are measured at fair value when they are

initially recorded. Since receivables are due in less than

one year, they are not discounted. Where applicable, a

provision for depreciation is recorded based on the degree

of certainty that recovery will ultimately be made.

Business assets are therefore not amortized but, like good-

will, are subjected to impairment tests at each year-end

closing.

Brands

Trademarks and patents are recorded at their fair value by

applying IFRS 3 concerning business combinations. They

are not amortized, but annual impairment tests are

conducted. The recoverable value of the brand is then esti-

mated either on the basis of fair value or on the basis of

value in use. The value in use is defined as the present

value relative to the cash-flow generating units with which

the trademark is associated. When the fair value or the

value in use is less than the accounting value, a deprecia-

tion is booked.

Other intangible assets

The other intangible assets that were acquired by the

group are recorded at their cost minus the total of amor-

tization and losses in value (amortization). In accordance

with IAS 38 “Intangible assets”, only elements whose cost

can be determined reliably and for which it is probable that

future benefits exist are recorded as fixed assets.

No borrowing costs are included as costs of fixed assets.

The group companies do not conduct any basic research.

Development costs correspond to the development of

commercial software (video games) and are activated as

described below.

The production costs for commercial software, whether

produced internally or outsourced, are entered in the

accounts under “Intangible assets in progress” as the soft-

ware development advances. Upon the software’s first

commercial release, it is transferred to the “Released soft-

ware programs” or “External developments” accounts.

Other intangible assets are amortized over their expected

useful life:

office software: amortized over 1 year (straight-line),

ERP-related expenditures: amortized over 5 years

(straight-line),

commercial software: amortized over 3 years (straight-

line) with additional amortization to adapt to the pro-

ducts’ life cycles,

external developments: amortized based on the pro-

ducts’ life cycles.

Commercial software and external developments are

amortized starting on the date of the product’s commer-

cial release.

At the close of each fiscal year and for each program,

when there are indicators of a loss of value (basically when

sales are lower than forecast), the present forecast cash

flows are calculated (over a maximum period of three

years). When the latter are below the net book value of the

commercial software, a depreciation is applied.

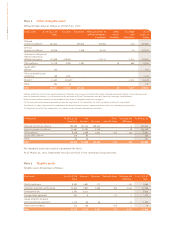

Tangible assets

The gross value of tangible assets includes the cost of

acquisition, minus cash discounts and any investment

grants allowed. This is then reduced by the sum of the

depreciations and of losses in value (see the accounting

method described in the note on goodwill). Given the