Ubisoft 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

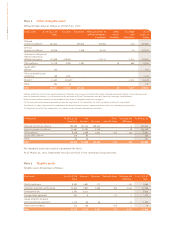

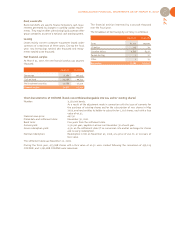

The expiry dates of tax deficits break down as follows:

- less than 1 year: €117 thousand

- 1 to 5 years: €88 thousand

- more than 5 years: €214 thousand

- unlimited: €16,446 thousand

Due dates of deferred tax assets at March 31, 2007:

- short-term: €16,199 thousand

- long-term: €21,431 thousand

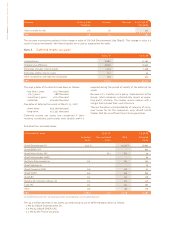

Deferred income tax assets are recognized if their

recovery is probable, particularly when taxable profit is

expected during the period of validity of the deferred tax

assets.

Because of a transfer price policy implemented at the

Group, retail companies systematically report an opera-

ting profit; similarly, the studios invoice salaries with a

margin that includes their costs structure.

There is therefore a real probability of recovery of carry-

over losses for all the companies; only Ubisoft World

Studios SAS has no sufficient short-term guarantees.

The €4.5 million decrease in tax assets was tied mainly to use of deferred depreciation as follows:

- 1 M€ by Ubisoft Entertainment SA,

- 0.9 M€ by Ubisoft EMEA SAS,

- 2.1 M€ by the France tax group.

The increase in provisions pertains to the change in value of Ubi Soft Entertainment Ltda (Brazil). This change in value is a

result of equity movements. No financial assets were used as a guarantee for debts.

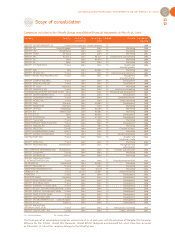

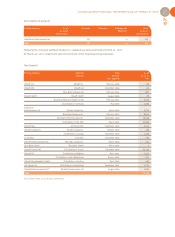

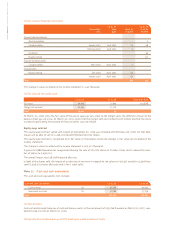

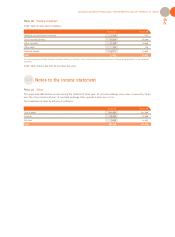

Note 6 Deferred income tax assets

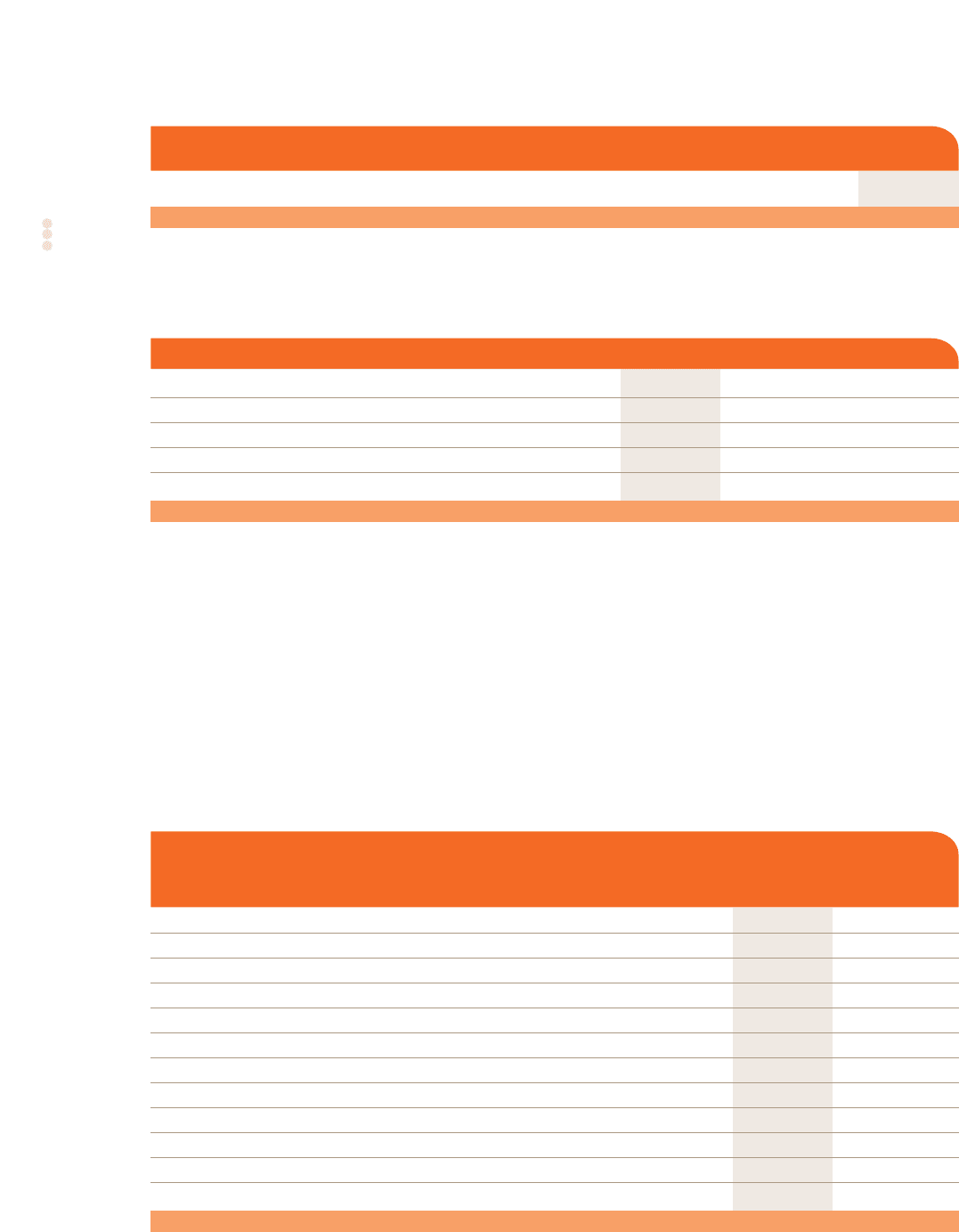

(1) Ubisoft Entertainment SA’s activated losses before fiscal integration came to €4,626 thousand.

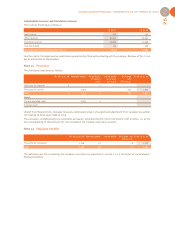

Activated/non-activated losses:

Provisions As of 03.31.06 Increases Decreases As of 03.31.07

Cumulative Cumulative

Assets available for sale 176 26 - 202

Total 176 26 - 202

03.31.07 03.31.06

Activated losses 16,865 21,365

Temporary tax differences 18,906 19,450

Elimination of studios’ internal margin 1,303 1,008

Elimination of other internal results 117 44

Other restatements with regard to consolidation 439 454

Total 37,630 42,321

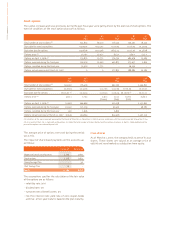

in thousands of euros 03.31.07 03.31.06

Activated Non-activated Total Activated

losses losses losses

Ubisoft Entertainment SA 15,521(1) - 15,521(1) 18,693

Ubisoft EMEA SAS - - - 930

Ubisoft World Studios SAS - 871 871 49

Ubisoft Warenhandels GmbH - - - 94

Red Storm Entertainment Inc. 101 - 101 199

Ubisoft Holdings Inc. - - - 19

Ubisoft Computing SARL 100 - 100 93

Ubisoft GmbH 553 - 553 654

Ubisoft BV 121 - 121 118

Shanghai Ubi Computer Software Ltd 172 - 172 227

Tiwak SAS 151 - 151 160

Other 146 - 146 129

Total 16,865 871 17,736 21,365