Ubisoft 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189

|

|

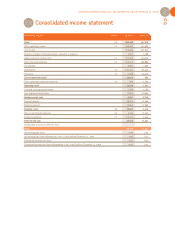

UBISOFT • FINANCIAL REPORT 2007

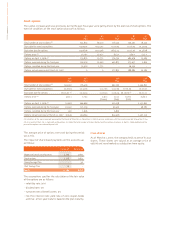

Deferred taxes are shown on the balance sheet as separate

items from current tax assets and liabilities and are classi-

fied as non-current items.

Segment information

In light of the group's organizational structure and the

commercial links among the various subsidiaries, we pro-

ceed on the basis that the group operates in a single mar-

ket in several geographic areas.

Dividends

No dividends were paid at March 31, 2007 on 2005/2006

earnings.

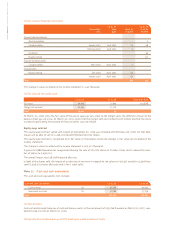

Earnings per share

• Earnings per share

This figure is the ratio of net income to the weighted ave-

rage number of outstanding shares less own shares held.

• Fully diluted earnings per share

This figure is obtained by dividing:

- net earnings before dilution, plus the after-tax amount of

any savings in financial costs resulting from the conversion

of the diluting instruments,

- by the weighted average number of ordinary outstanding

shares, less directly own shares, plus the number of shares

that would be created as a result of the conversion of

convertible instruments into shares and the exercise of

rights.

Net result at March 31, 2007: 40,558 K€

Dividends paid to shareholders: 0 K€

After tax financial costs

relating to bond debenture: 984 K€

Restated net result 41,542 K€

Weighted average number

of outstanding shares: 42,481,273

Potential shares:

Stock options 3,020,002

Weighted average number of shares

after exercise of rights relating to

diluting instruments 45,501,275

Diluted net earnings per share

at March 31, 2007 = €0.91