Ubisoft 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189

|

|

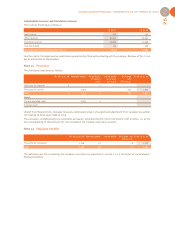

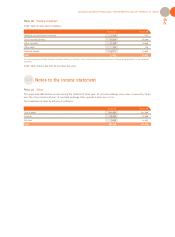

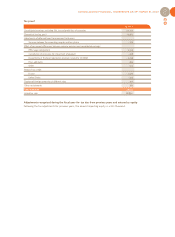

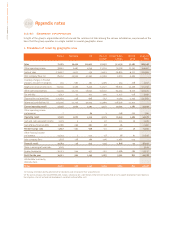

UBISOFT • FINANCIAL REPORT 2007

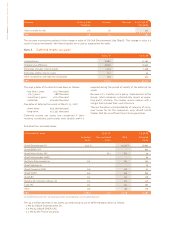

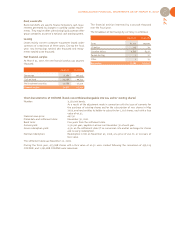

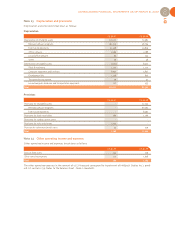

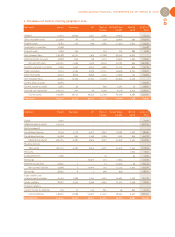

Note 20 Other operating income

Other operating income breaks down as follows:

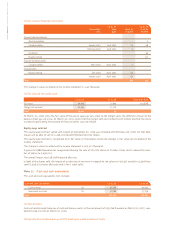

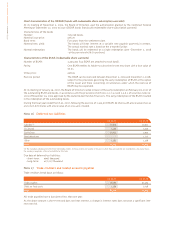

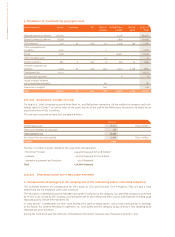

Note 21 Wages and social security costs

Wages and social security costs break down as follows:

The expenses resulting from defined-contribution schemes totaled €5,290 thousand.

A provision for individual rights to training was recognized in the accounts of March 31, 2007 for €56 thousand.

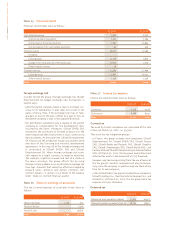

The Canadian subsidies break down as follows:

- multimedia credit for €25,398 thousand, representing 50% of the wages related to production activity,

- an R&D tax credit for €3,567 thousand, representing 50% of R&D costs,

- a subsidy of €1,773 thousand for a portion of training costs,

- miscellaneous subsidies for €726 thousand.

The payment of certain subsidies is conditional upon taxable income being generated.

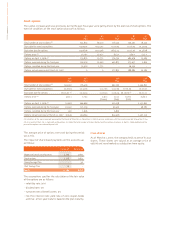

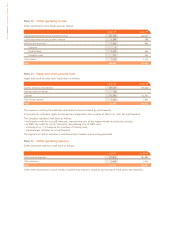

Note 22 Other operating expenses

Other operating expenses break down as follows:

Other external expenses consist mainly of advertising expenses, royalties and leasing of fixed assets and movables.

03.31.07 03.31.06

Capitalized commercial software production costs 161,196 130,475

Capitalized production costs on other software 1,488 488

Write-back of provisions 1,644 865

Litigation 5-

Doubtful debts 1,526 600

Intangible assets 113 265

Other income 2,139 1,137

Total 166,467 132,965

03.31.07 03.31.06

Salaries and social security taxes 199,102 169,034

Individual right to training 56 -

Subsidies - 31,464 - 31,052

Share-based payments 3,344 2,692

Total 171,038 140,674

03.31.07 03.31.06

Other external expenses 170,836 183,880

Other expenses 3,439 3,003

Total 174,275 186,883