Ubisoft 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

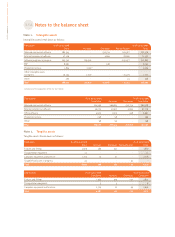

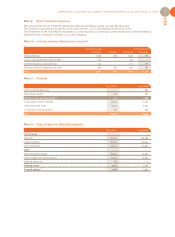

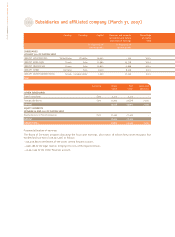

The breakdown of borrowings by currency is as follows:

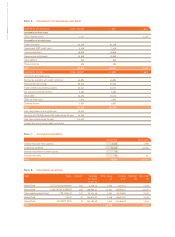

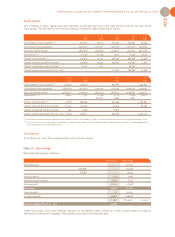

Bond debentures:

Bond debenture - Bonds convertible/exchangeable into new and/or existing shares (OCEANE)

Chief characteristics of this bond debenture:

Maximum amount: €172.5 million

Number: 3,150,000 bonds (as a result of the adjustment made in connection with the issue of

warrants for the purchase of existing shares and/or the subscription of new shares in

May 2003). One bond entitles its holder to subscribe for 1,037 shares.

Nominal issue price: €47.50

Dated date and settlement date: November 30, 2001

Bond term: Five years from settlement date.

Expiration date: November 30, 2006

Annual yield: 2.5% per year, payable in arrears on November 30 of each year

Gross redemption yield: 4.5% on the settlement date (if no conversion into and/or exchange for shares and no

early redemption)

Normal redemption: Redemption in full on November 30, 2006 at a price of €52.70, i.e. 110.94% of face

value.

Transactions completed during the fiscal year ended March 31, 2007:

The settlement date was November 22, 2006.

During the fiscal year ended March 31, 2007, 475,998 shares with a face value of €0.31 were created following the

conversion of 459,013 OCEANE, and 1,290,288 OCEANE were redeemed.

OBSAR (bonds with redeemable share subscription warrants).

Characteristics of the bonds:

Number: 716,746 bonds

Nominal issue price: €76.70

Bond term: Five years from the settlement date.

Nominal rate, yield: The bonds will bear interest at a variable rate payable quarterly in arrears. The annual

nominal rate is based on the 3-month Euribor.

Normal redemption: The bonds will be redeemed on one occasion on December 2, 2008 by redemption

at par, i.e. €76.70 per bond.

Characteristics of the BSAR (redeemable share subscription warrants):

Number of BSAR: 1,433,492 BSAR (two BSAR are attached to each bond).

Parity: One BSAR entitles its holder to subscribe for one new share with a face value of €0.31.

Strike price: €38.35

Exercise period: The BSAR may be exercised between December 3, 2003 and December 2, 2008,

subject to the provisions governing the early redemption of BSAR at the discretion of

the issuer and the provisions concerning circumstances under which the exercise of

BSAR may be suspended.

03/31/2007 03/31/2006

Euros 37,517 196,117

US dollars 18 -

Pounds sterling 46 17

Canadian dollars 7,093 5,436

Danish kroner 11 11

Borrowings 44,685 201,581