Ubisoft 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

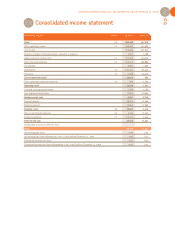

UBISOFT • FINANCIAL REPORT 2007

Foreign exchange risk

The group is exposed to foreign exchange risk on its opera-

ting cash flow and its investments in its foreign subsidiaries.

The group protects only its positions related to its opera-

ting cash flow in the major currencies (i.e. the US dollar,

Canadian dollar, pound sterling and Australian dollar).

The strategy is to hedge one fiscal year at a time, which

means that the hedge period does not exceed 15 months.

The group relies mainly on natural hedges resulting from

two-way transactions (i.e. development expenses in foreign

currencies offset by royalties received from subsidiaries in

the same currency). For non-hedged balances and non-

commercial transactions (i.e. internal loans in foreign cur-

rencies), the parent company borrows in these currencies

or sets up forward sales contracts or options.

At March 31, 2007, the company had hedged GBP 5 mil-

lion and CAD 17.8 million through forward sales contracts

and loans in foreign currencies.

Impact of a change of ±1% in the principal foreign curren-

cies on sales and operating income in thousands of euros

for FY 2006/2007:

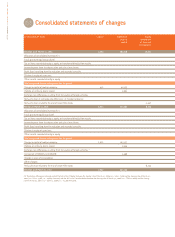

Equity price risk

The company has four main types of equity investments.

Long-term strategic investments in sectors related to video

games, such as the investment in Gameloft SA, in which

Ubisoft owns 13,367,923 shares, i.e. 18.89% of capital. This

investment is valued at €34 million on the company’s

consolidated balance sheet, while the fair market value of

these shares was €67 million as of March 31, 2007.

Stocks held directly under a market-making and liquidity

contract signed with Exane BNP: these purchases are

governed by a market-making contract pursuant to cur-

rent regulations and are intended to ensure liquidity on

stock sales and purchases. At March 31, 2007, Ubisoft held

22,059 of its own shares valued at €795 thousand.

Money market funds: these funds involve temporary

investments of liquid assets. They are therefore invested in

products offering a high degree of security and very low

volatility.

Equity swap contract: this derivative is recorded at its fair

value on the balance sheet. Any variations in the share

price in relation to the sale price of €9.33 are recorded on

the income statement. Given the 1,436,274 shares sold

under the equity swap contract at March 31, 2007, the

impact of a reduction in the share price of one euro would

be €1,436 thousand.

Liquidity risk

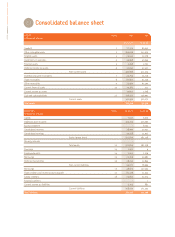

At March 31, 2007, the group's financial debt was €71 mil-

lion and its net cash flow position (reflecting liquid assets

and short-term investment securities) was €55 million.

Variable-rate debt Effective

Nominal

Annual interest Annual interest Difference

interest rate with a change

o

f 1%

Bank Ioan 4.18% 20,000 835.8 1,036 200.0

Cash 3.99% - 55,281 - 2,204.2 - 2,757 - 552.8

Investments 3.98% - 30,786 - 1,225.5 - 1,533 - 307.9

Total - 66,067 - 2,593.9 - 3,254 - 660.7

Currency Impact on sales Impact on operating income

in K€ in K€

USD 2,830 944

GBP 1,084 835

CAD 410 376

AUD 211 173

DKK 225 183

JPY 65 27

rity to fixed-rate loans for long-term financing needs and

variable-rate loans to finance specific needs related to an

increase in working capital during particularly busy periods.

At March 31, 2007, the group's net debt consisted of a

variable-rate loan and bank overdrafts which, given its

positive net cash flow position, are mainly intended to

finance the group’s high year-end capital requirement lin-

ked to the strong seasonal variation in its business.

Based on its financial position at March 31, 2007, the

group’s sensitivity to changes in interest rates is as follows:

Debts and cash availability at variable rates (In K€)