Ubisoft 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

circumstances. They therefore serve as a basis for the

exercise of judgment made necessary for the determina-

tion of the accounting values of assets and liabilities that

cannot be obtained from any other sources. Actual values

can differ from estimated values.

Given that the decisions made by management when

applying the IFRS can have a significant impact on the

financial statements and that the estimates pose a serious

risk of variations during subsequent periods, these deci-

sions and estimates are explained in notes concerning

impairment tests on goodwill, other intangible assets and

tangible assets.

The accounting methods described below have been

applied consistently to all the periods presented in the

consolidated financial statements.

The accounting methods have been applied consistently by

the Group entities.

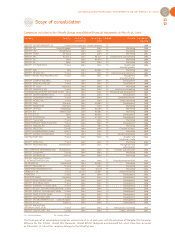

2.5.2.3 Principles of consolidation

Subsidiaries

A subsidiary is an entity controlled by Ubisoft

Entertainment SA. Control exists when the company has

the power to manage, either directly or indirectly, the

entity’s financial and operational policies in order to obtain

benefits from its activities.

To assess control, potential voting rights that are currently

exercisable or convertible are taken into account.

Subsidiaries’ financial statements are included in the

consolidated financial statements from the date on which

control is transferred to the Group up to the date at which

it ceases.

Associates

Associates are entities in which Ubisoft Entertainment SA

exercises significant influence on the financial and opera-

tional policies but no control. The consolidated financial

statements include the group share in the total amount of

profits and losses recorded by the associates, using the

equity accounting method, starting from the date when

significant influence was exercised up to the date at which

it ended.

As of March 31, 2007, the companies controlled by the

Group are fully consolidated; only Gameloft SA, where the

percentage held is 18.89%, is consolidated by the equity

method.

Transactions eliminated in the consolidated

financial statements

The balances, losses and unrealized gains, revenue and

expenses resulting from transactions between group com-

panies are eliminated during the preparation of the conso-

lidated financial statements. The unrealized gains

resulting from transactions with associates and entities

under joint control are eliminated in proportion to the

group interests in the entity. Unrealized losses are elimi-

nated in the same way as unrealized gains, but only to the

extent that they are not representative of a loss in value.

Translation of foreign currency transactions

Transactions in foreign currency are measured by applying

the exchange rate prevailing at the date of the transaction.

At year-end, the monetary assets and liabilities denomina-

ted in foreign currency are translated into euros at the

exchange rate at closing. Any exchange rate differences

that result are recognized in the income statement.

The non-monetary assets and liabilities denominated in

foreign currency, and measured at historical cost, are

translated by using the exchange rate at the transaction

date.

The non-monetary assets and liabilities denominated in

foreign currency, and measured at market value, are

translated using the exchange rate prevailing at the time

the market value was determined.

Translation of foreign subsidiaries’ financial

statements into euros

The assets and liabilities of foreign subsidiaries, including

goodwill, are translated into euros by using the closing

exchange rate. The items in the income statement are

translated into euros at a rate approximating the exchange

rate at the transaction date. Equity are kept at the histori-

cal rate. The resulting exchange rate differences are boo-

ked to the translation reserves, as a distinct component of

equity.

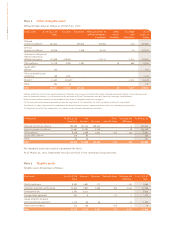

Goodwill

All companies reorganizations are recorded using the

acquisition method. Goodwill result from the acquisition of

subsidiaries, associates and joint enterprises and corres-

pond to the difference between the acquisition cost and the

fair value of the assets, liabilities and contingent liabilities

identified at the date of acquisition.

Positive goodwill are not amortized but are subject to

impairment tests at each year-end closing. The recovera-

ble value of goodwill is then estimated based either on fair

value or value in use. The value in use is defined as the pre-

sent value related to the cash-flow generating units with

which the goodwill are associated. When the market value

or the value in use is less than the accounting value, a

depreciation is recorded and is irreversible.

The cash-flow generating units used to calculate the

impairment tests correspond to the subsidiaries present in

a single country, with the exception of goodwill related to

the acquisition of companies whose acquired brands are

distributed by all the group’s subsidiaries (Redstorm

Entertainment Inc. (US) or Blue Byte) where the cash-flow

generating unit corresponds to the Group’s consolidated

financial statements.

The discount rate used is the treasury bond rate adjusted

to exclude market risks related to Ubisoft Entertainment

SA and tax.

Negative goodwill (which, according to IFRS 3, are defined

as “the excess of the cost over the acquirer's interests in

the net fair value of the identifiable assets, liabilities and

contingent liabilities acquired”) are booked immediately in

the results.

Since business assets entered in the corporate accounts are

of the same nature as goodwill, they are treated as good-

will in the consolidated financial statements.