Ubisoft 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

Financial assets and liabilities

Financial assets and liabilities consist of assets available for

sale, loans and receivables, cash and cash equivalents,

derivative instruments and borrowings.

• Assets available for sale

Non-consolidated securities are classified as “assets avai-

lable for sale” since they do not meet the definition of

other categories of financial assets. They are shown on the

balance sheet at their fair value and changes in fair value

are posted directly to equity.

• Loans and receivables

Loans and receivables include deposits and guarantees, as

well as subsidies to be received from the Canadian govern-

ment.

• Cash and cash equivalents

Cash and cash equivalents include cash on hand and depo-

sits held at call with banks, with maturity of generally less

than three months, which can be easily liquidated or salea-

ble on very short notice, can be converted into cash and do

not have significant risk of loss in value. They are valued

based on the category of assets measured at market value

based on earnings.

Reimbursable bank overdrafts that are an integral part of

the group’s cash flow management constitute a component

of cash and cash equivalents for the purposes of the cash

flow statement.

• Derivative instruments

In order to limit the Group's foreign exchange risk, Ubisoft

Entertainment SA uses forward sales contracts and foreign

currency options to hedge the risk of exchange rate fluc-

tuations. As transactions do not meet the criteria of the

hedge accounting method, they are recorded as transac-

tion instruments.

These derivative instruments are shown on the balance

sheet at their fair value as of the transaction date under

current financial assets or liabilities. The profit or loss

resulting from the revaluation at fair value is recorded

immediately in the income statement.

The company has set up an equity swap contract. This

contract is a derivative instrument. It is shown on the

balance sheet at its fair value as of the transaction date

under current financial assets or liabilities. Changes in fair

value are recorded in the income statement.

• Borrowings and other financial liabilities

These include borrowings and bank overdrafts.

Bond debentures related to the OCEANE (bonds converti-

ble/exchangeable into new or existing shares) and OBSAR

(bonds with redeemable share subscription warrants) are

compound financial instruments that consist of a liability

component and an equity component.

The liability component is valued at amortized cost based

on the effective interest rate method. The equity compo-

nent is determined by the difference between the total

value of the compound instrument and the value assigned

to the liability component. Accrued interest is recognized

based on an actuarial rate yield to maturity that includes

the costs, fees and redemption premiums.

Own shares

Own shares are recognized at their acquisition cost as a

deduction from equity. The results of the sale of these sha-

res are applied directly to the equity and do not affect the

profit or loss for the period.

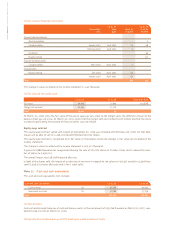

Employee benefits

• Retirement benefit costs

Ubisoft participates in retirement, social security and pen-

sion plans in accordance with the laws and practices of each

country. These benefits can vary according to a range of

factors, including seniority, salary and payments to com-

pulsory general schemes.

These plans may be either defined-contribution plans or

defined-benefit plans:

in defined-contribution plans, the pension supplement is

determined by the total capital that the employee and

the company have paid into external funds. The charges

correspond to contributions paid over the course of the

fiscal year. The Group has no subsequent obligations to

its employees. For Ubisoft, this generally involves public

retirement plans and specific defined-contribution plans

(such as a 401k plan in the United States);

in a defined-benefit plan, the employee receives a fixed

pension benefit from the group, determined on the basis

of several factors, including age, years of service and

compensation level. Within the group, such plans are

used in France, Italy and Japan.

The employer’s future obligations are valued on the basis

of an actuarial calculation called “the projected unit credit

method”, in accordance with each plan’s operating proce-

dures and the data provided by each country. This method

involves determining the value of probable discounted

future benefits of each employee at the time of his/her

retirement. The assumptions used as of March 31, 2007

are as follows:

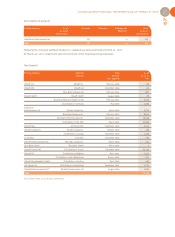

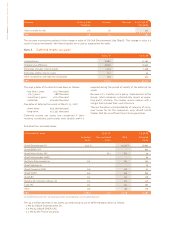

Japan Italy France

Rate of salary change 5% 1.50% 3-6%

Discount rate 4.49% 4.49% 4.49%

Average remaining years of service 23 years 29 years 31.5 years