Ubisoft 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

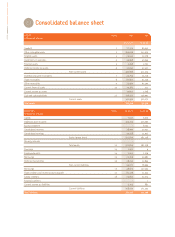

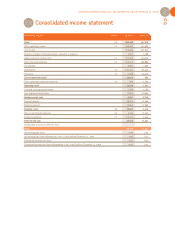

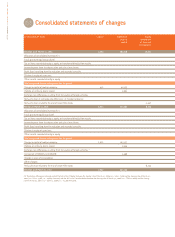

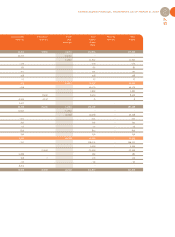

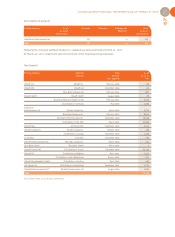

CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2007

59

2

Notes to the consolidated financial statements

The figures in the following notes and statements are shown in thousands of euros unless otherwise indicated.

Highlights

of the fiscal year

Change in the percentage holding in Gameloft SA

Following the exercise of options by Gameloft SA

employees, Ubisoft Entertainment SA’s percentage of

interest decreased from 19.416% to 18.893% at March 31,

2007.

Sale of assets

On April 1, 2006, Ubisoft Warenhandels GmbH sold its

business assets to Ubisoft GmbH.

Conversion of share subscription warrants issued in May

2003

In April and May 2006, increase in Ubisoft Entertainment

SA’s share capital of €24 million as a result of the conver-

sion of 12,767,115 of the share subscription warrants

issued in May 2003.

Acquisition

On August 3, 2006, acquisition from Atari Inc. and

Reflections Interactive Ltd of the intellectual property and

technology rights to the Driver®franchise, as well as most

of the assets and all of the staff of the Reflections

Interactive Ltd development studio for US$ 24 million.

2-for-1 stock split

On December 11, 2006, 2-for-1 stock split of Ubisoft

Entertainment SA shares from €0.31 to €0.155.

Performance of Ubisoft's share and unrealized equity

swap gain

Despite the 2-for-1 stock split in December 2006 through

an increase in the number of shares, the share price rose

by 92% between March 31, 2006 and March 31, 2007. This

explains the increase in the unrealized equity swap gain of

€25.2 million, this despite the sale of 200,000 shares which

resulted in a capital gain of €1.9 million.

Conversion of some of the OCEANE

In November 2006, €24.2 million increase in Ubisoft

Entertainment SA’s equity through the conversion of

459,013 OCEANE bonds into 475,998 new shares with a

face value of €0.31 at a rate of €50.84.

Creation of a new studio in Quebec

In February 2007, opening of a new studio Ubisoft Digital

Arts Inc. specializing in the creation of digital content for

the film industry.

Early conversion of 92% of the 2008 BSAR

In February 2007, €50 million increase in Ubisoft

Entertainment SA’s equity through the conversion of

1,313,907 BSAR into 69 shares with a face value of €0.31

and 2,627,676 shares with a face value of €0.155 at a rate

of €19.175.

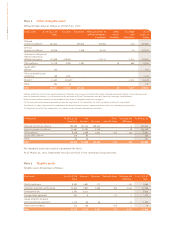

Significant accounting

policies

Ubisoft Entertainment SA is a company domiciled in

France.

The company's consolidated financial statements for the

fiscal year ended March 31, 2007 include the company and

its subsidiaries (together called “the Group”) and group

shares in associates.

The financial statements have been approved for issue by

the Board of Directors on May 29, 2007.

2.5.2.1 Statement of conformity

The consolidated financial statements to March 31, 2007

have been prepared in accordance with the IFRS internatio-

nal accounting standards (“International Financial

Reporting Standards”) applicable at March 31, 2007, as

approved by the European Union.

New standards, amendments to standards and interpreta-

tions are not yet in effect for the fiscal year ending March

31, 2007 and have not been applied in preparing the conso-

lidated financial statements.

IFRS 7 “Financial Instruments: Disclosures” and amend-

ment to IAS 1 “Presentation of Financial Statements:

Capital Disclosures”

IFRIC 7 “Applying the Restatement Approach under IAS

29 Financial Reporting in Hyperinflationary Economies”

IFRIC 8 “Scope of IFRS 2, Share-Based Payments”

IFRIC 9 “Reassessment of Embedded Derivatives”

IFRIC 10 “Interim Financial Reporting and Impairment”

The application of these new standards should have no

impact on the consolidated financial statements.

2.5.2.2 Basis of preparation

The financial statements have been prepared under the

historical cost convention, with the exception of the follo-

wing assets and liabilities, which are evaluated at fair value:

Derivative financial instruments, financial instruments

held for transaction purposes and financial instruments

treated as available for sale.

Non-current assets intended for sale are valued at their

accounting value or fair value less the costs of the sale,

whichever is less.

Preparation of consolidated financial statements according

to IFRS requires that the group’s management make esti-

mates and assumptions that impact the application of the

accounting methods and the amounts recorded in the

financial statements.

These estimates and underlying assumptions are establi-

shed and reviewed continuously based on past experience

and other factors considered reasonable in light of the

2.5

2.5.1 2.5.2