Ubisoft 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

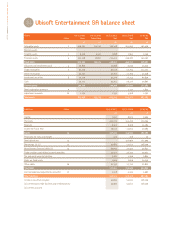

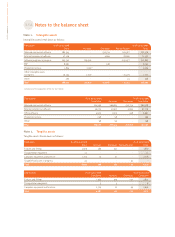

Listed company Gameloft SA

Book value at 03/31/07 (€) 27,343,883

Number of shares held by

Ubisoft Entertainment SA 13,367,923

Value of one share at 03/31/07 (€) 5.03

Balance sheet date December 31

Write-back over fiscal year -

Depreciation over fiscal year -

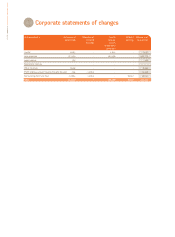

CORPORATE ACCOUNTS OF UBISOFT ENTERTAINMENT SA AS OF MARCH 31, 2007

99

3

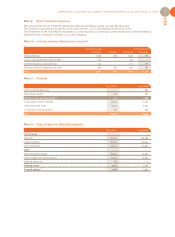

The increase in securities is primarily due to the share

capital increase of Ubi Games SA (Switzerland) in the

amount of €1,537 thousand.

It is also linked to the capitalization of professional fees concer-

ning the acquisition of Sunflowers Interactive Entertainment

Software GmbH in the amount of €153 thousand.

The decrease is related to the liquidation of the

Ubi Computer Software Beijing Co. Ltd subsidiary in China.

The change in other long-term investments reflects

the purchases and sales of directly held stocks under the

liquidity contract (cf. section 3.5.2).

General information on the listed company Gameloft SA:

The increase in provisions of equity holdings is primarily

due to the decrease of the value in use of the securities of

Ubisoft EMEA SAS, based on the present value of the cash

flows realised on out of group sales and on net cash posi-

tion at the end of fiscal year.

Note 3. Financial assets

Financial assets break down as follows:

Fixed assets Gross As of Increases Decreases Gross As of

03/31/2006 03/31/2007

Equity holdings 238,529 1,739 170 240,098

Other long-term investments 680 26,151 26,033 798

Deposits and guarantees 349 75 92 332

Total 239,558 27,965 26,295 241,228

Provisions As of 03/31/2006 As of 03/31/2007

Cumulative Increases Decreases Cumulative

Equity holdings 378 20,504 88 20,794

Own shares -13 -13

Total 378 20,517 88 20,807

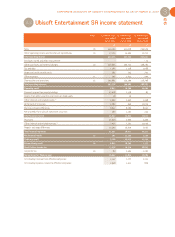

Note 4. Advances and installments paid

These are primarily guaranteed advances paid on licensing contracts.

(1) The reclassification pertains to outstanding amounts of 409100 at 03/31/2006.

The trade receivables item consists mainly of intra-group receivables.

Note 5. Trade receivables

The “trade receivables” item breaks down as follows:

As of 03/31/2006 New Reclassification Depreciation As of 03/31/2007

Net guarantees Net

Licenses 9,039 26,065 15,476(1) 20,682 29,898

Total 9,039 26,065 15,476 20,682 29,898

As of 03/31/2007 As of 03/31/2006

Gross Provision Net Net

Trade receivables 63,538 - 63,538 55,794

Total 63,538 - 63,538 55,794