Ubisoft 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INFORMATION ON THE COMPANY

121

4

- The retention of shares for delivery at a later date

in exchange or as payment for future external growth

operations up to the limit of 5% of the existing capital.

- The cancellation of shares.

- The implementation of any practice that may be recognized

by law or by the AMF.

Pursuant to Article 212-13 of the General Rules of the

AMF as referred to in Article 241-1 of the General rules of

the AMF, a summary of the share buyback program

was published online on the company’s website and on the

website of the AMF.

4.2.2.3.2 Liquidity contracts

The company awarded a liquidity contract to Exane BNP

PARIBAS, which adheres to the AFEI code of ethics

recognized by the AMF, with effect from January 2, 2006

for a term of one year renewable by tacit agreement.

The company allocated a sum of €1,500,000 to implement

this contract during the fiscal year just ended.

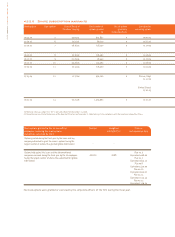

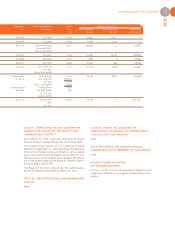

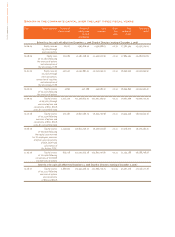

4.2.2.4 Authorized unissued capital

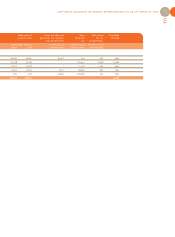

Status of current authorizations to the Board of Directors to increase the capital

showing their use during the fiscal year ended on March 31, 2007

(1) Charging to the overall ceiling of €2,000,000 fixed by the General Meeting of September 25, 2006 (Resolution 14) authorizing equity issues without pre-emptive

rights

(2) On August 31, 2006 the Board of Directors, pursuant to the similar authorization voted by the General Meeting of September 21, 2005

(superseded by the authorization voted by the General Meeting in its Resolution 11) decided to issue equity with a nominal amount of €7,736.36.

(3) Charging to the overall ceiling of €4,000,000 fixed by the General Meeting of September 25, 2006 (Resolution 15)

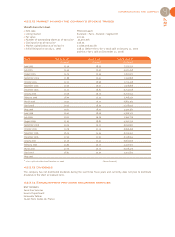

Percentage of capital held directly and indirectly 0.049%

Number of shares cancelled in the last 24 months NONE

Number of shares held in the portfolio (a) 22,059

Book value of the portfolio €795,343.59

Market value of the portfolio (b) €806,256

(a) All shares were acquired under the liquidity contract made with Exane BNP PARIBAS.

(b) closing price at March 31, 2007: €36.55.

4.2.2.3.3 Situation as of March 31, 2007

Type of authorization

Authorization granted to the

Board of Directors to issue

shares to employees in

connection with the company

savings scheme

Authorization granted to the

Board of Directors to grant

employees options giving a right

to new shares and/or stock

options

Delegation of authority to the

Board of Directors to proceed

with an equity issue reserved for

employees of company

subsidiaries headquartered

outside France

Authorization granted to the

Board of Directors to issue

ordinary shares and securities as

compensation for contributions

in kind made to the company

and consisting of equity and/or

investment securities granting

entitlement to the capital

General authorization granted to

the Board of Directors to carry

out equity issues with pre-

emptive rights

General authorization granted to

the Board of Directors to carry

out equity issues without pre-

emptive rights

Meeting date

September 25, 2006

Resolution 9

September 25, 2006

Resolution 10

September 25, 2006

Resolution 11

September 25, 2006

Resolution 12

September 25, 2006

Resolution 13

September 25, 2006

Resolution 14

Term -

Expiration

26 months

(November 24,

2008)

38 months

(November 24,

2009)

18 months

(March 24,

2008)

26 months

(November 24,

2008)

26 months

(November 24,

2008)

26 months

(November 24,

2008)

Authorized amounts

1% of the amount of the share capital as

of the date the authorization used1by the

Board of Directors

3.5% of the number of shares existing as

of the date the authorization used

1% of the amount of the share capital as

of the date of the decision by the Board

of Directors1

10% of the company’s capital as of the

date of the meeting

(4,120, 471 shares)

Total face value of the shares or securities

that can be issued: €2,000,0003

Face value of the debt securities that can

be issued: €100,000,000

Total face value of the shares or securities

that can be issued: €2,000,0003

Face value of the debt securities that can

be issued: €100,000,000

Use of the

authorization during

the fiscal year

NONE

NONE

NONE 2

NONE

NONE

NONE