Ubisoft 2006 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

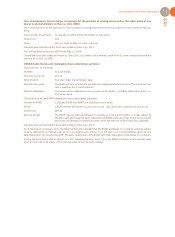

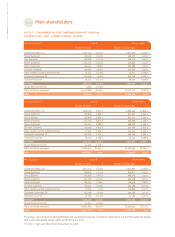

FMR Corp and Fidelity International Limited (FIL), acting on behalf of the mutual finds managed by their subsidiaries,

informed the AMF that following share acquisitions, they had exceeded the threshold of 10% for capital on February 28,

2007, and the 10% threshold for voting rights on March 1, 2007, and held, as of then, 10.92% of the capital and 10.12%

of voting rights.

In addition to their declaration of exceeding the thresholds, and pursuant to Article L. 233-7 of the French Commercial

Code, FMR Corp and Fidelity International Limited (FIL) made a declaration of intent in similar terms to that of October

2006 referred to above.

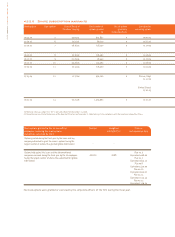

Following a change to the number of shares in the company’s capital, the Caisse des Dépôts et Consignations (CDC), which

as of March 31, 2006 held 5.08% of the capital of the company, fell below the threshold of 5% of the capital on September

14, 2006, holding as of that date 4.74% of the capital and 4.39% of voting rights.

Following a change to the number of voting rights in the company, the Caisse des Dépôts et Consignations (CDC) informed

the company by letter of December 8, 2006, that it had on December 8, 2006, fallen below the threshold in the Articles of

4% of the voting rights in the company, and held as of that date 4.30% of the capital and 3.98% of the voting rights.

As of March 31, 2007, the Caisse des Dépôts et Consignations (CDC) held 4.018% of the capital and 3.742% of the voting

rights in the company.

Morgan Stanley & Co. International Ltd. stated that it had:

- on July 31, 2006 exceeded and on August 1, 2006 fallen below the 5% threshold of capital in the company, and held 5.26%

of the capital as of July 31, 2006 and 4.52% of the capital as of August 1, 2006;

- on September 4, 2006 exceeded and on September 5, 2006 fallen below the 5% threshold of capital in the company, and

held 5.27% of the capital as of September 4, 2006 and 4.06% of the capital as of September 5, 2006.

As of March 31, 2007, Morgan Stanley & Co. International Ltd held 3.478% of the capital and 3.239% of the voting rights

in the company.

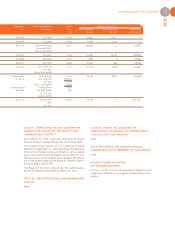

Guillemot Brothers SA informed the company that it had:

- fallen below the 10% capital threshold on April 21, 2006, following an equity issue, and as of that date held 9.902% of the

capital and 13.849% of the voting rights;

- fallen below the 12% threshold in the Articles of voting rights in the company on March 16, 2007, following the sale of

shares, and as of that date held 8.474% of the capital and 11.989% of the voting rights;

- on April 17, 2007, following the repayment in Ubisoft Entertainment shares of the debt to it on the books of Guillemot

corporation, exceeded the 12% threshold in the Articles for voting rights and as of that date it held 8.502% of the capi-

tal and 12.010% of voting rights.

As of March 31, 2007, Guillemot Brothers held 8.408% of the capital and 11.928% of the voting rights.

The group (consisting of Guillemot Brothers SA, Guillemot Suisse SA, Guillemot Corporation SA and the Guillemot

family) informed the AMF that:

- October 18, 2006 it had fallen below the 15% capital threshold and held as of that date 14.966% of the capital and

21.186% of voting rights,

- March 14, 2007, following the monthly publication of the number of shares and voting rights in the company, it had

fallen below the 20% voting rights threshold, and held as of that date 13.503% of the capital and 19.310% of voting rights.

As of March 31, 2007, the group held 13.414% of the capital and 19.226% of the voting rights.

4.2.3.3 Shareholders’ agreement

To the company’s knowledge, there is no declared or undeclared shareholders’ agreement concerning Ubisoft shares.