Ubisoft 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

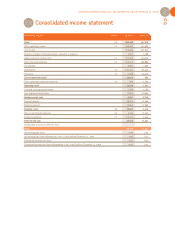

THE GROUP'S ACTIVITY AND RESULTS FOR FISCAL YEAR 2006-2007

51

1

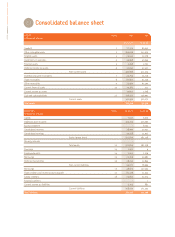

With the exception of a loan in the amount of €20 million,

financial debt consists mainly of intra-group cash pooling

transactions as shown in the accounts.

In order to finance temporary needs related to the

increase in working capital during especially busy periods,

the group has a syndicated loan in the amount of €100 mil-

lion, confirmed lines of credit for €30 million, and other

lines of credit with banking institutions totaling €93 million

at March 31, 2007.

The syndicated loan and the confirmed bank loans are

governed by financial covenants that are based on the ratio

of net debt to equity and that of net debt to cash flow from

operating activities.

Risk related to future

acquisitions and

integration of acquired

companies

The company may undertake external growth operations in

the medium and/or long term. The company’s sound

balance sheet, which shows a positive net financial position

of €55 million and the level of available capital (including

a syndicated loan of €100 million and €30 million in confir-

med lines of credit) should minimize the risks related to

these operations.

However, there is a possibility of certain risks:

the dilution of current share ownership as a result of a

share-based acquisition,

the creation of significant long-term debt,

possible losses that could have a negative impact on pro-

fitability,

the setting aside of provisions for goodwill and other

intangible assets.

The possible loss of key staff at the target company must

be considered among the risks related to mergers and

acquisitions. Such a loss could have a negative effect on the

acquired company’s sales, earnings and/or financial posi-

tion. Ubisoft has, however, always demonstrated a high

level of proficiency in integrating its acquired companies.

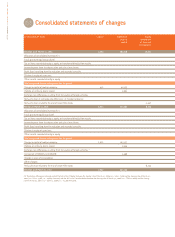

Commitments

On April 6, 2007, acquisition of the AnnoTM brand through the buyout of the German publisher Sunflowers Interactive

Entertainment Software GmbH for €14.2 million.

Through the transaction, Ubisoft will acquire a 30% stake in Related Designs Software GmbH, which developed Anno 1701.

Ubisoft reinforces its position in the real-time strategy market. AnnoTM, along with Ubisoft’s The Settlers®, is one of the

most well known franchises in Germany.

The group’s management has made no firm commitments on other future investments.

Insurance

1.9.12

1.10

1.11

Description of insurance

The group carries third-party liability insurance held by Ubisoft Entertainment SA which covers the entire world except the

United States, Canada and Japan.

Each subsidiary has coverage for:

risks related to property damage,

vehicles,

apartments rented to employees on assignment,

inventory,

transport provided to customers, etc.

Foreign subsidiaries adapt and manage their local coverage based on their business activity and each country’s specific

requirements.

Ubisoft has signed a personal assistance contract for employees on business-related assignments in France and abroad. This

contract covers all employees of French sites who require assistance and foreign repatriation.

The group’s business operations do not in themselves pose an exceptional risk with regard to work-related accidents.

Certain companies, particularly those in the US, the UK, Italy and Denmark, are insured against loss of business continuity.