Ubisoft 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INFORMATION ON THE COMPANY

129

4

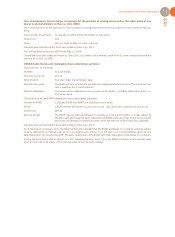

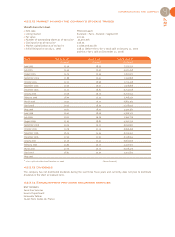

(1) Company 100% owned by the Guillemot family

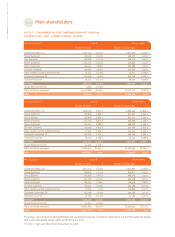

Shareholders holding more than 5% of the capital of the company as of March 31, 2007(2)

(2) Information based on statements made to the company

(3) Acting on behalf of mutual funds managed by their subsidiaries

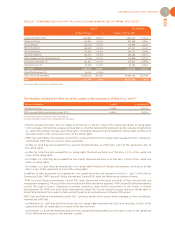

The US Company Electronic Arts Inc, holder as of March 31, 2006 of 17.99% of the capital and 16.56% of voting rights

in the company, informed the company on November 9, 2006 that following the publication by the company on September

21, 2006 of the number of shares and voting rights, it had fallen below the 16% threshold for voting rights and held as of

that date 16.95% of the capital and 15.97% of the voting rights.

FMR Corp and Fidelity International Limited (FIL), acting on behalf of the mutual funds managed by their subsidiaries,

informed the AMF that as a result of share acquisitions

- on May 16, 2006 they had exceeded the 5% capital threshold and held, as of that date, 5.04% of the capital and 4.55% of

the voting rights,

- on May 18, 2006 they had exceeded the 5% voting rights threshold and held, as of that date, 5.57% of the capital and

5.04% of the voting rights

- on October 10, 2006 they had exceeded the 10% capital threshold and held, as of that date, 10.60% of the capital and

9.80% of voting rights,

- on October 11, 2006, they had exceeded the 10% voting rights threshold of Ubisoft entertainment, and held, as of that

date, 11.13% of the capital and 10.29% of the voting rights.

In addition to their declaration of exceeding the 10% capital threshold, and pursuant to Article L. 233-7 of the French

Commercial Code, FMR Corp and Fidelity International Limited (FIL) made the following declaration of intent:

“FMR Corp and Fidelity International Limited (FIL) make the present notification on behalf of their mutual funds and

management companies. The acquisitions were made for portfolio investment purposes. FMR Corp and Fidelity International

Limited (FIL) may in future, depending on market conditions, make further acquisitions or sell shares in Ubisoft

Entertainment SA. FMR Corp and Fidelity International Limited (FIL) do not intend to acquire shares or voting rights in

Ubisoft Entertainment SA in order to take control thereof or be represented on its Board of Directors.”

FMR Corp and Fidelity International Limited (FIL), acting on behalf of the mutual funds managed by their subsidiaries,

informed the AMF that

- on November 22, 2006 they had fallen below the 10% voting rights threshold and held, as of that date, 10.64% of the

capital and 9.84% of voting rights as a result of the sale of shares,

- on November 27, 2006 they had fallen below the 10% capital threshold and held, as of that date, 9.79% of the capital and

9.07% following the increase in the company’s capital.

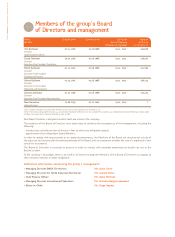

4.2.3.2 Distribution of capital and voting rights as of April 30, 2007

Capital Voting rights

Number of shares % Number of voting rights %

Guillemot Brothers SA(1) 3,859,893 8.500% 5,857,451 12.012%

Claude Guillemot 342,622 0.754% 625,548 1.283%

Yves Guillemot 418,304 0.921% 701,898 1.439%

Michel Guillemot 335,492 0.739% 557,222 1.143%

Gérard Guillemot 279,910 0.616% 540,124 1.108%

Christian Guillemot 263,090 0.579% 466,484 0.957%

Other members of the Guillemot family 77,146 0.170% 110,896 0.227%

Guillemot Corporation SA 431,937 0.951% 431,937 0.886%

Guillemot Suisse SA 81,184 0.179% 81,184 0.166%

In Concert 6,089,578 13.409% 9,372,744 19.221%

Ubisoft Entertainment SA 24,136 0.053% - -

Public and Group employees 39,298,754 86.538% 39,390,139 80.779%

Total 45,412,468 100 % 48,762,883 100 %

Name of shareholder % capital % voting rights

Electronic Arts Inc 15.406% 14.347%

FMR Corp and Fidelity International Limited (FIL)(3) 10.261% 9.555%