Ubisoft 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS AS OF MARCH 31, 2007

69

2

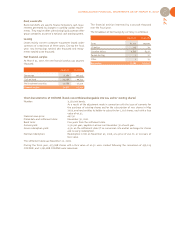

No tangible assets were used as a guarantee for debts.

At March 31, 2007, impairment tests did not result in the recording of any provisions.

Increase

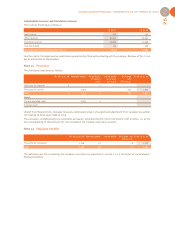

Following the exercise of options by Gameloft SA employees, Ubisoft Entertainment SA’s percentage of interest decreased

from 19.416% to 18.893% at March 31, 2007.

The €3,964 thousand impact on equity in subsidiaries breaks down as follows:

- -€275 thousand dilutive effect

- €3,149 thousand share of earnings

- €1,090 thousand portion of share capital increase

Gameloft SA’s contribution to Ubisoft Entertainment SA's earnings was €3,149 thousand as of March 31, 2007.

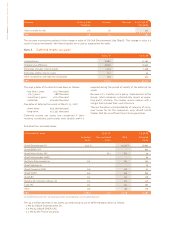

General information concerning Gameloft SA related to the accounts closed at December 31, 2006:

The increase of €153 thousand in other financial assets pertains to the capitalization of professional fees concerning the

acquisition of Sunflowers Interactive Entertainment Software GmbH (cf. section 2.5.9 Events after closing of accounts).

The change in other long-term receivables reflects the purchases and sales of securities under the liquidity contract.

Due dates of financial assets as of March 31, 2007:

short-term: €338 thousand

long-term: €2,322 thousand

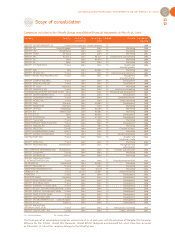

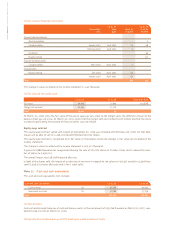

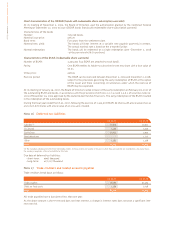

Depreciation As of 03.31.06 Increases Decreases Reclassifications Exchange rate As of 03.31.07

Cumulative differences Cumulative

Plant & machinery 2,054 1,722 229 - - 108 3,439

Computer equipment and furniture 8,896 6,937 1,709 152 - 651 13,625

Development kits 1,273 2,156 - - - 3,429

Transportation equipment 84 59 - -8 - 135

Leased computer hardware

and transportation equipment 874 117 26 - - 63 902

Total 13,181 10,991 1,964 144 - 822 21,530

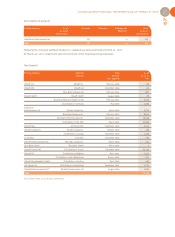

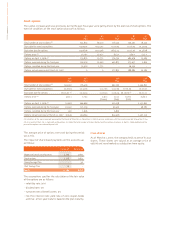

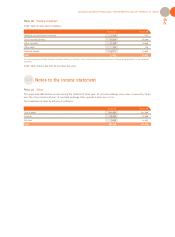

Fixed assets As of 03.31.06 Increases Decreases Exchange rate As of 03.31.07

Gross differences Gross

Goodwill 25,719 - 65 - - 25,654

Share of equity 4,315 4,029 - - 8,344

Total equity in subsidiaries 30,034 3,964 - - 33,998

in thousands of euros 12.31.06

Total assets/liabilities 58,390

Sales 68,421

Net income 16,258

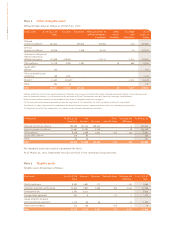

Fixed assets As of 03.31.06 Increases Decreases Exchange rate As of 03.31.07

Gross differences Gross

Assets available for sale 849 - 148 - 9 692

Other financial assets - 153 - - 153

Deposits and guarantees 2,028 387 539 - 63 1,813

Other long-term receivables 1 15,391 15,390 - 2

Total 2,878 15,931 16,077 - 72 2,660

Note 4 Investments in associates

Note 5 Financial assets