Ubisoft 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INFORMATION ON THE COMPANY

119

4

- the company’s participation in any operations that may be

related to its corporate purpose through the creation of

new companies, the subscription or purchase of shares or

ownership interests, mergers or other means ;

- and, in general, operations of any kind related directly or

indirectly to the above corporate purpose or any similar or

related purpose likely to promote the company’s growth.

4.2.1.2 Statutory distribution

of profits (Article 17

of the Articles of Association)

The proceeds from the fiscal year, minus operating expenses,

depreciation and provisions, constitute the income. The

following sums are deducted from the fiscal year income,

minus any losses carried forward from previous years, where

applicable:

- the sums added to reserves as required by law or by the

Articles of Association and, in particular, at least 5% to form

the legal reserve fund. This deduction ceases to be compul-

sory when said fund reaches an amount equal to 1/10th of the

share capital. If, for any reason, the legal reserve falls below

this percentage, the deduction is again made,

- any sums that the General Meeting, on the recommenda-

tion of the Board of Directors, deems necessary to allocate

to any extraordinary or special reserve or to carry forward.

The balance is distributed to shareholders. However, except

in case of a reduction in capital, no distribution may be made

to shareholders if, following this distribution, the equity is or

would be less than the amount of capital plus reserves which,

by law or according to the Articles of Association, may not

be distributed.

The General Meeting may, in accordance with the provisions

of Article L. 232-18 of the French Commercial Code, grant

each shareholder the option of receiving all or part of the

dividend distributed or the interim dividends in cash or in

shares.

4.2.1.3 General Meetings (Article 14

of the Articles of Association)

General Meetings comprise all the shareholders of Ubisoft

Entertainment SA, with the exception of the company itself.

They represent the totality of shareholders.

They are called and deliberate under the conditions stipulated

by the French Commercial Code.

General Meetings are held at the registered office or at any

other place specified in the notice of meeting.

They are chaired by the Chairman of the Board of Directors

or, in his absence, by a director appointed for this purpose by

the General Meeting.

All shareholders have the right, upon proof of identity, to

take part in General Meetings by attending in person, by

appointing a proxy or by absentee voting, including by elec-

tronic means, subject to the following conditions:

- holders of registered shares or voting certificates must be

listed in the company’s share register under their own name,

- for holders of bearer shares, a certificate issued by an

authorized agent certifying that said listed shares are not

transferable up to the meeting date must be filed at the place

indicated in the notice of meeting.

These formalities must be completed prior to a date set by the

Board of Directors in the meeting notice, which may not be

more than five (5) days prior to the meeting date.

However, any shareholder who has requested an admission

card or already voted by absentee ballot (by mail or elec-

tronically) or has granted a proxy by presenting a share-

holding certificate issued by the custodian of the shares

may dispose of any or all of the shares for which the vote

or proxy was sent, provided that the shareholder sends to

the agent authorized by the company, by no later than

3:00 p.m. (Paris time) of the day before the meeting, the

information needed to cancel his vote or proxy or to

change the number of shares and corresponding votes.

The deadline for returning absentee voting ballots and

proxies is set by the Board of Directors and announced in the

notice of meeting published in the Bulletin of Mandatory

Legal Notices.

The Board of Directors may decide that the vote taking

place during the meeting may be cast remotely under the

conditions set out in the applicable regulations.

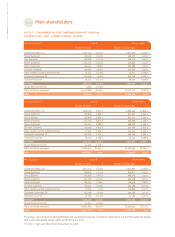

4.2.1.4 Provision establishing the

threshold over which

shareholdings must be disclosed

(Article 6 of the Articles of

Association)

Any shareholder acting alone or in concert, without prejudice

to the thresholds defined in Article L. 233-7 of the French

Commercial Code, who comes to hold, directly or indirectly,

at least 4% of the company’s capital or voting rights, or a

multiple thereof up to and including 28%, must inform the

company, by registered letter with acknowledgment of

receipt sent to its registered office and within the period

stipulated in Article L. 233-7 of the French Commercial Code,

of the total number of shares, voting rights and securities

granting future access to the company’s capital that said

shareholder holds directly, indirectly or in concert.

The notification referred to in the preceding paragraph for

exceeding the threshold by a multiple of 4% of the capital or

voting rights also applies if the share of capital or voting

rights falls below any of the aforementioned thresholds.

Failure to declare the attainment of the statutory thresholds

shall result in the loss of voting rights under the conditions set

forth in Article L. 233-14 of the French Commercial Code, at

the request, recorded in the minutes of the General Meeting,

of one or more shareholders who together hold at least 5% of

the company’s capital or voting rights.

4.2.1.5 Rights attached to shares

(Articles 7 and 8 of the Articles of

Association)

Each share shall give a right to ownership of the corporate

assets and the liquidating dividend equal to the proportion of

the share capital that it represents.

Whenever it is necessary to own several shares in order to

exercise a right of any kind, such as in the case of a share-for-

share exchange or a consolidation or allotment of shares,

or following an equity issue or reduction in capital, regardless

of the terms and conditions thereof, a merger or any other

operation, the owners of fewer shares than the number

required may exercise their rights only if they take it upon