Ubisoft 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Ubisoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UBISOFT • FINANCIAL REPORT 2007

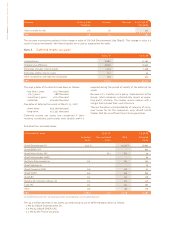

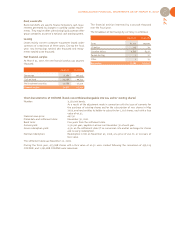

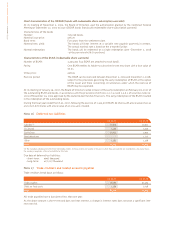

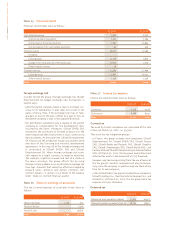

Stock options

The capital increases and issue premiums during the past fiscal year were partly driven by the exercise of stock options. The

exercise conditions of the stock option plans are as follows:

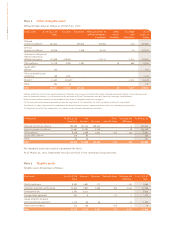

The average price of options exercised during the period

was €7.61.

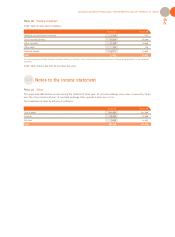

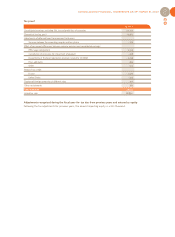

The impact of share-based payments on the accounts was

as follows:

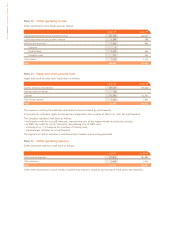

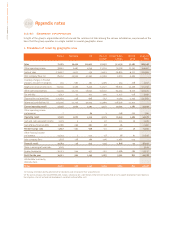

The assumptions used for the calculation of the fair value

of the options are as follows:

- volatility rate: 30%

- dividend rate: 0%

- turnover rate of beneficiaries: 3%

- risk-free interest rate: yield rate of zero-coupon bonds

with five- or ten-year maturit, based on the plan maturity.

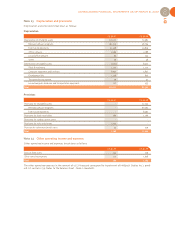

Own shares

As of March 31, 2007, the company held 22,059 of its own

shares. These shares are valued at an average price of

€36.06 and were booked as a deduction from equity.

(1) Limitation of the exercise period approved by the Board of Directors on November 2, 2005 to ensure compliance with the maximum period allowed by US law.

(2) As a result of the 2-for-1 stock split on December 11, 2006, the total number of shares allotted and the number of options at April 1, 2006 doubled and the

price of the options was reduced by one-half.

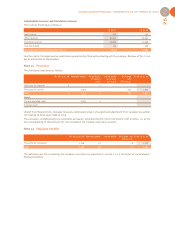

03.31.07 03.31.06

Wages and social security costs 3,344 2,692

Stock options 3,318 2,662

Group Savings Plan - 30

USA Savings Plan 26 -

Equity 11,564 8,220

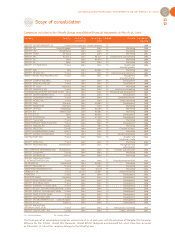

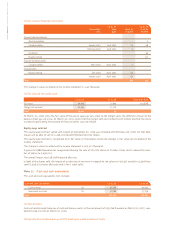

5th 6th 7th 8th 9th

Plan Plan Plan Plan Plan

Total number of share alloted (2) 641,852 89,210 778,130 706,362 18,440

Start date for exercising options 04.09.02 04.25.02 01.19.05 10.16.03 01.29.04

Expiration date for options 04.08.06 04.24.06 08.15.12 10.15.07 01.28.08

Options price (2) 17.26 € 17.26 € 6.41 € 4.60 € 5.13 €

Options on April 1, 2006 (2) 153,870 13,772 576,730 480,676 13,080

Options exercised during the fiscal year 100,950 12,000 400,875 275,657 2,800

Options cancelled during the fiscal year 52,920 1,772 - 16,130 -

Options not yet exercised at March 31, 2007 0 0 175,855 188,889 10,280

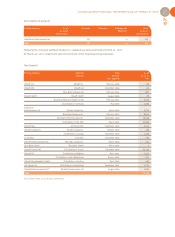

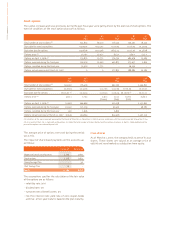

10th 11th 12th 13th

Plan Plan Plan Plan

Total number of share alloted (2) 143,592 776,300 992,100 1,355,892

Start date for exercising options 10.28.03 10.14.05 11.17.05 11.17.05 07.01.05 02.23.07

Expiration date for options 06.15.07 (1) 10.13.14 11.16.14 11.16.14 06.15.09 (1) 02.22.11

Options price (2) 4.60 € 7.75 € 7.36 € 7.74 € 6.78 € 15.82 €

(France) (Italy) (USA)

Options on April 1, 2006 (2) 52,618 666,684 939,558 1,355,892

Options exercised during the fiscal year 41,542 171,204 99,320 48,782

Options cancelled during the fiscal year 450 1,656 6,820 -

Options not yet exercised at March 31, 2007 10,626 493,824 833,418 1,307,110