TCF Bank 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

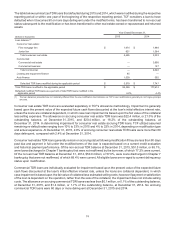

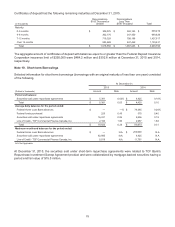

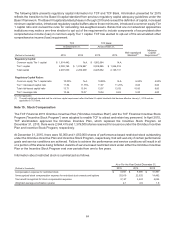

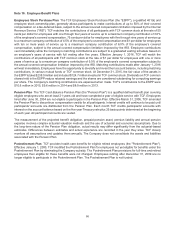

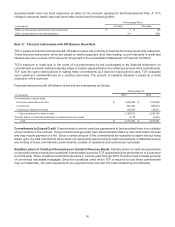

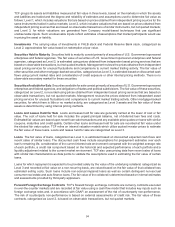

The following table presents regulatory capital information for TCF and TCF Bank. Information presented for 2015

reflects the transition to the Basel III capital standard from previous regulatory capital adequacy guidelines under the

Basel I framework. The Basel III capital standard phases in through 2019 and revised the definition of capital, increased

minimum capital ratios, introduced regulatory capital buffers above those minimums, introduced a common equity Tier

1 capital ratio and revised the rules for calculating risk-weighted assets. Banks that are not advanced approaches

institutions may make a one-time election to opt out of the requirement to include components of accumulated other

comprehensive income (loss) in common equity Tier 1 capital. TCF has elected to opt-out of the accumulated other

comprehensive income (loss) requirement.

TCF TCF Bank

At December 31, At December 31,

(Dollars in thousands) 2015 2014 2015 2014 Well-capitalized

Standard(1)

Minimum

Capital

Requirement(1)

Regulatory Capital:

Common equity Tier 1 capital $ 1,814,442 N.A. $ 1,992,584 N.A.

Tier 1 capital 2,092,195 $ 1,919,887 2,008,585 $1,836,019

Total capital 2,487,060 2,209,999 2,425,682 2,126,131

Regulatory Capital Ratios:

Common equity Tier 1 capital ratio 10.00% N.A. 10.99% N.A. 6.50%4.50%

Tier 1 risk-based capital ratio 11.54 11.76%11.07 11.25%8.00 6.00

Total risk-based capital ratio 13.71 13.54 13.37 13.03 10.00 8.00

Tier 1 leverage ratio 10.46 10.07 10.04 9.63 5.00 4.00

N.A. Not Applicable.

(1) The well-capitalized standard and the minimum capital requirement reflect the Basel III capital standards that became effective January 1, 2015 and are

applicable to TCF Bank.

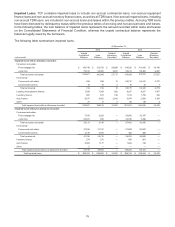

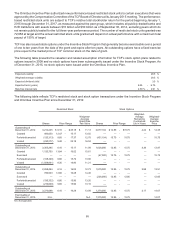

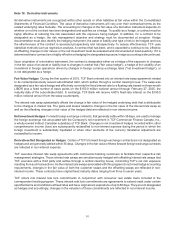

Note 15. Stock Compensation

The TCF Financial 2015 Omnibus Incentive Plan ("Omnibus Incentive Plan") and the TCF Financial Incentive Stock

Program ("Incentive Stock Program") were adopted to enable TCF to attract and retain key personnel. In April 2015,

TCF stockholders approved the Omnibus Incentive Plan, which replaced the Incentive Stock Program. At

December 31, 2015, there were 2,544,415 and 1,379,000 shares reserved for issuance under the Omnibus Incentive

Plan and Incentive Stock Program, respectively.

At December 31, 2015, there were 50,000 and 1,050,000 shares of performance-based restricted stock outstanding

under the Omnibus Incentive Plan and Incentive Stock Program, respectively, that will vest only if certain performance

goals and service conditions are achieved. Failure to achieve the performance and service conditions will result in all

or a portion of the shares being forfeited. Awards of service-based restricted stock under either the Omnibus Incentive

Plan or the Incentive Stock Program vest over periods from one to five years.

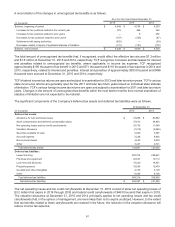

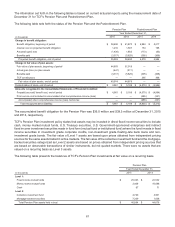

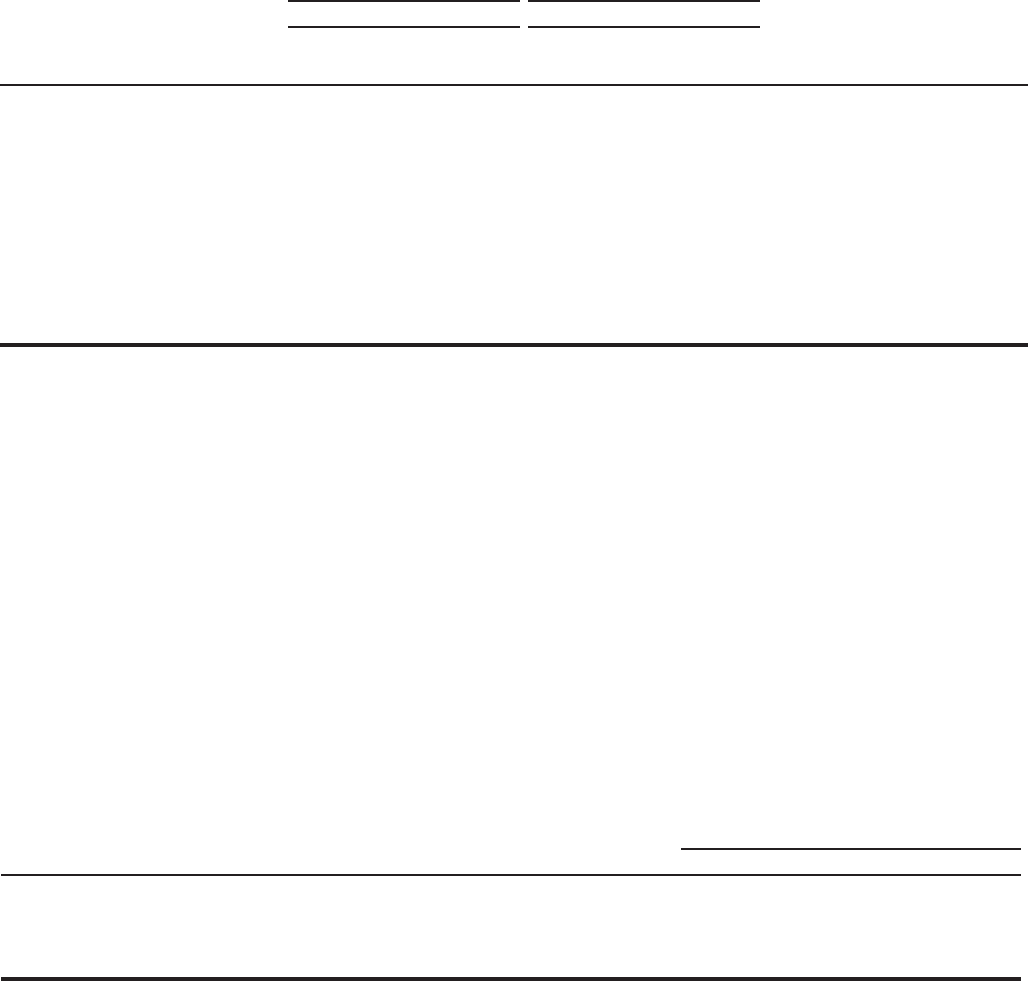

Information about restricted stock is summarized as follows.

At or For the Year Ended December 31,

(Dollars in thousands) 2015 2014 2013

Compensation expense for restricted stock $ 5,931 $8,690 $10,467

Unrecognized stock compensation expense for restricted stock awards and options 25,919 22,532 14,482

Tax benefit recognized for stock compensation expense 2,127 3,424 4,034

Weighted average amortization (years) 2.1 2.6 1.6