TCF Bank 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A-4

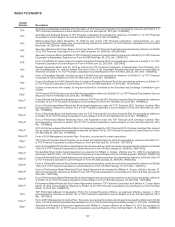

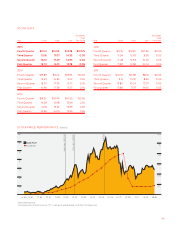

CREDIT RATINGS

Last Review

Standard & Poor’s September 2015

Outlook Stable

TCF Financial Corporation:

Long-term Counterparty BBB-

Short-term Counterparty A-3

TCF National Bank:

Long-term Counterparty BBB

Short-term Counterparty A-2

Preferred Stock BB-

Subordinated Debt BBB-

Last Review

Fitch Ratings January 2016

Outlook Stable

TCF Financial Corporation:

Long-term IDR BBB-

Short-term IDR F3

TCF National Bank:

Long-term IDR BBB-

Short-term IDR F3

Preferred Stock B

Subordinated Debt BB+

Last Review

Moody’s October 2015

Outlook Stable

TCF National Bank:

Long-term Issuer Baa2

Long-term Deposits A2

Short-term Deposits Prime-1

Subordinated Debt Baa2

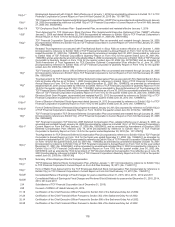

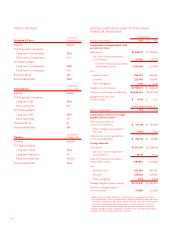

RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES1

At December 31,

(Dollars in thousands) 2015 2014

Computation of tangible book value

per common share:

Total equity $2,306,917 $ 2,135,364

Less: Non-controlling interest

in subsidiaries 16,001 13,715

Total TCF Financial Corporation

stockholders’ equity 2,290,916 2,121,649

Less:

Preferred stock 263,240 263,240

Goodwill 225,640 225,640

Other intangibles 3,126 4,641

Tangible common equity $ 1,798,910 $ 1,628,128

Common stock shares outstanding 169,844,464 167,461,002

Tangible book value per

common share $ 10.59 $ 9.72

Year Ended December 31,

(Dollars in thousands) 2015 2014

Computation of return on average

tangible common equity:

Net income available to

common stockholders $ 177,735 $ 154,799

Other intangibles amortization,

net of tax 1,000 1,062

Adjusted net income available to

common stockholders $ 178,735 $ 155,861

Average balances:

Total equity $2,217,204 $2,058,442

Less: Non-controlling interest

in subsidiaries 19,514 17,014

Total TCF Financial Corporation

stockholders’ equity 2,197,690 2,041,428

Less:

Preferred stock 263,240 263,240

Goodwill 225,640 225,640

Other intangibles 3,913 5,498

Average tangible common equity $1,704,897 $ 1,547,050

Return on average tangible

common equity 10.48% 10.08%

1 When evaluating capital adequacy and utilization, management considers

financial measures such as tangible book value per common share and return

on average tangible common equity. These measures are non-GAAP financial

measures and are viewed by management as useful indicators of capital

levels available to withstand unexpected market or economic conditions

and also provide investors, regulators and other users with information to be

viewed in relation to other banking institutions.