TCF Bank 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1 See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Capital Management”

(for reconciliation of GAAP to non-GAAP measures)

2 Interest income presented on a fully tax-equivalent basis

SELECT FINANCIAL HIGHLIGHTS

7

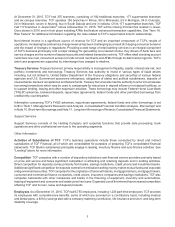

Net Interest Margin

(Percent)

3.99%

2011 2012 2013 2014 2015

4.65%4.68% 4.61% 4.42%

Loans & Leases

(Billions of dollars)

$14.2

2011 2012 2013 2014 2015

$15.4 $15.8 $16.4 $17.4

Total Loans & Leases

Average Yield on Loans & Leases

5.83% 5.53%5.27% 5.06% 4.92%

Total Deposits

Average Interest Rate on Deposits

Deposits

(Billions of dollars)

$12.2

2011 2012 2013 2014 2015

$14.1 $14.4$15.4 $16.7

0.38% 0.31% 0.26% 0.26% 0.30%

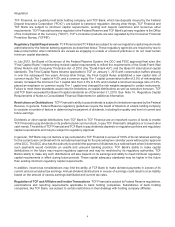

Net Charge-offs

(Percent)

2011 2012 2013 2014 2015

1.54%

0.81%

0.49%

0.30%

1.45%

Non-accrual Loans & Leases and

Other Real Estate Owned

(Millions of dollars)

2011 2012 2013 2014 2015

$476

$346

$282 $250

$433

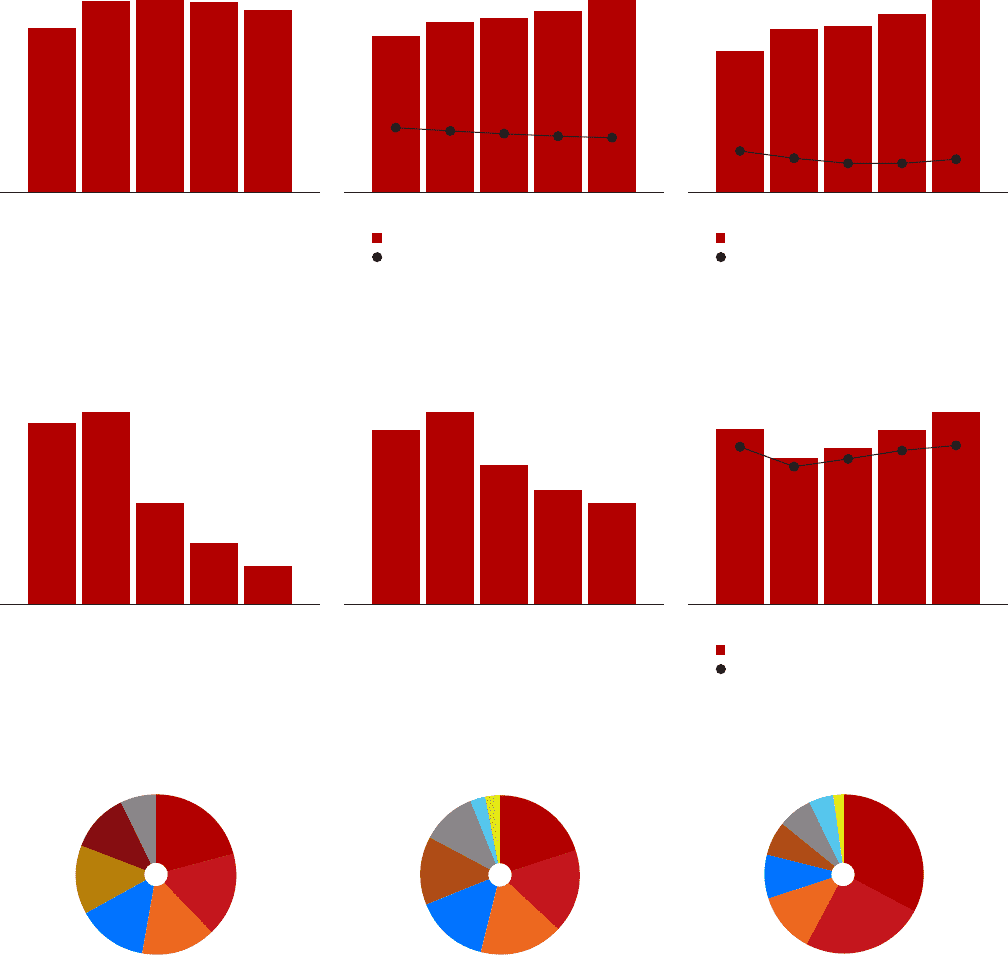

2015 Earning Assets

$18.8 billion

■ 21% Leasing & equipment finance

■ 17% Commercial

■ 15% Consumer real estate (junior liens)

■ 14% Auto finance

■ 14% Consumer real estate & other

(first mortgages)

■ 12% Inventory finance

■ 7% Securities & other

2015 Interest Income2

$897 million

■ 20% Leasing & equipment finance

■ 17% Consumer real estate & other

(first mortgages)

■ 17% Consumer real estate (junior liens)

■ 15% Commercial

■ 14% Inventory finance

■ 11% Auto finance

■ 3% Loans & leases held for sale

■ 2% Securities

■ 1% Investments and other

2015 Non-interest Income

$442 million

■ 33% Fees & service charges

■ 25% Leasing & equipment finance

■ 12% Card revenue

■ 9% Gains on sales of consumer real

estate loans, net

■ 7% Gains on sales of auto loans, net

■ 7% Servicing fee income

■ 5% ATM revenue

■ 2% Other

Tangible Common Equity

Tangible Common Equity/Tangible Assets

Tangible Common Equity1

(Millions of dollars)

$1,635

2011 2012 2013 2014 2015

$1,366 $1,458

$1,628

$1,799

8.72%

7.59% 8.03% 8.50% 8.79%