TCF Bank 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

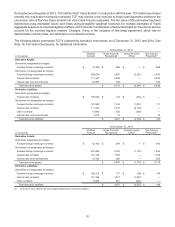

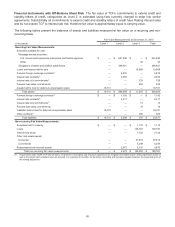

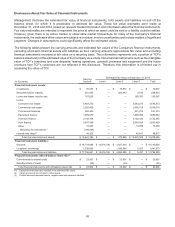

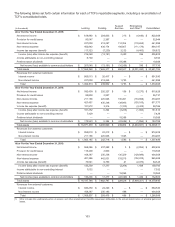

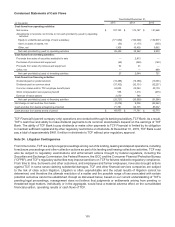

Disclosures About Fair Value of Financial Instruments

Management discloses the estimated fair value of financial instruments, both assets and liabilities on and off the

balance sheet, for which it is practicable to estimate fair value. These fair value estimates were made at

December 31, 2015 and 2014, based on relevant market information and information about the financial instruments.

Fair value estimates are intended to represent the price at which an asset could be sold or a liability could be settled.

However, given there is no active market or observable market transactions for many of the Company's financial

instruments, the estimates of fair values are subjective in nature, involve uncertainties and include matters of significant

judgment. Changes in assumptions could significantly affect the estimated values.

The following tables present the carrying amounts and estimated fair values of the Company's financial instruments,

excluding short-term financial assets and liabilities as their carrying amounts approximate fair value and excluding

financial instruments recorded at fair value on a recurring basis. This information represents only a portion of TCF's

balance sheet and not the estimated value of the Company as a whole. Non-financial instruments such as the intangible

value of TCF's branches and core deposits, leasing operations, goodwill, premises and equipment and the future

revenues from TCF's customers are not reflected in this disclosure. Therefore, this information is of limited use in

assessing the value of TCF.

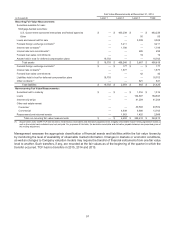

Carrying

Amount

Estimated Fair Value at December 31, 2015

(In thousands) Level 1 Level 2 Level 3 Total

Financial instrument assets:

Investments $ 70,537 $ — $ 70,537 $ — $ 70,537

Securities held to maturity 201,920 — 202,443 4,510 206,953

Loans and leases held for sale 157,625 — — 165,387 165,387

Loans:

Consumer real estate 5,464,272 — — 5,543,273 5,543,273

Commercial real estate 2,593,429 — — 2,556,018 2,556,018

Commercial business 552,403 — — 531,274 531,274

Equipment finance 1,909,672 — — 1,888,664 1,888,664

Inventory finance 2,146,754 — — 2,132,435 2,132,435

Auto finance 2,647,596 — — 2,650,429 2,650,429

Other 19,297 — — 14,699 14,699

Allowance for loan losses(1) (156,054)————

Interest-only strips(2) 44,332 — — 48,817 48,817

Total financial instrument assets $ 15,651,783 $ — $ 272,980 $ 15,535,506 $15,808,486

Financial instrument liabilities:

Deposits $ 16,719,989 $12,816,196 $3,927,434 $ — $ 16,743,630

Long-term borrowings 1,036,652 —1,035,846 5,427 1,041,273

Total financial instrument liabilities $ 17,756,641 $12,816,196 $4,963,280 $5,427 $17,784,903

Financial instruments with off-balance sheet risk:(3)

Commitments to extend credit $ 23,937 $ — $ 23,937 $ — $ 23,937

Standby letters of credit (35) — (35) — (35)

Total financial instruments with off-balance sheet risk $ 23,902 $ — $ 23,902 $ — $ 23,902

(1) Expected credit losses are included in the estimated fair values.

(2) Carrying amounts are included in other assets.

(3) Positive amounts represent assets, negative amounts represent liabilities.