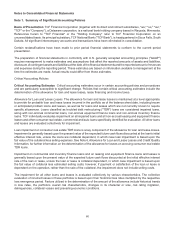

TCF Bank 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

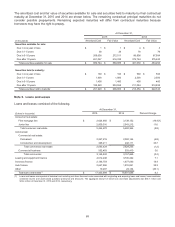

There were no transfers from securities available for sale to securities held to maturity in 2015. During 2014, TCF

transferred $191.7 million of available for sale mortgage-backed securities to held to maturity, reflecting TCF's intent

and ability to hold these securities to maturity. At December 31, 2015 and 2014, the unrealized holding loss on the

transferred securities retained in accumulated other comprehensive income (loss) totaled $14.8 million and

$16.0 million, respectively. These amounts are amortized over the remaining lives of the transferred securities. Other

held to maturity securities consist of bonds which qualify for investment credit under the Community Reinvestment

Act. In 2015, 2014, and 2013, TCF recorded an impairment charge of $0.3 million, $0.1 million, and $0.2 million,

respectively, on held to maturity securities, which had a carrying value of $1.1 million, $1.5 million and $1.9 million at

December 31, 2015, 2014, and 2013, respectively.

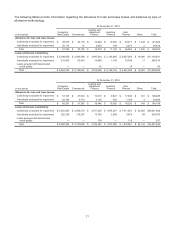

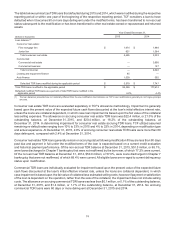

The following tables show the gross unrealized losses and fair value of securities available for sale and securities held

to maturity at December 31, 2015 and 2014, aggregated by investment category and the length of time the securities

were in a continuous loss position.

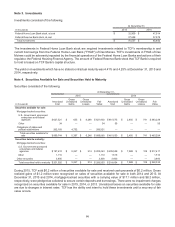

At December 31, 2015

Less than 12 months 12 months or more Total

(In thousands) Fair Value Unrealized

Losses Fair Value Unrealized

Losses Fair Value Unrealized

Losses

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises

and federal agencies $ 552,127 $ 6,246 $ — $ — $ 552,127 $6,246

Total securities available for sale $ 552,127 $ 6,246 $ — $ — $ 552,127 $6,246

Securities held to maturity:

Mortgage-backed securities:

U.S. Government sponsored enterprises

and federal agencies $ 12,333 $ 100 $1,732 $114 $14,065 $214

Total securities held to maturity $ 12,333 $ 100 $1,732 $114 $14,065 $214

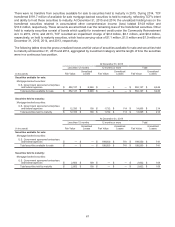

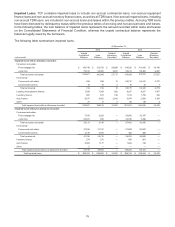

At December 31, 2014

Less than 12 months 12 months or more Total

(In thousands) Fair Value Unrealized

Losses Fair Value Unrealized

Losses Fair Value Unrealized

Losses

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises

and federal agencies $ — $ — $ 198,550 $ 741 $198,550 $741

Total securities available for sale $ — $ — $ 198,550 $ 741 $198,550 $741

Securities held to maturity:

Mortgage-backed securities:

U.S. Government sponsored enterprises

and federal agencies $ 2,602 $109 $ — $ — $ 2,602 $109

Total securities held to maturity $ 2,602 $109 $ — $ — $ 2,602 $109