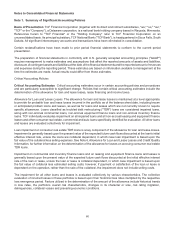

TCF Bank 2015 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

TCF's results of operations depend to a large degree on its net interest income and its ability to manage interest rate

risk. Although TCF manages other risks in the normal course of business, such as credit risk, liquidity risk, foreign

currency risk and operational risk, the Company considers interest rate risk to be one of its more significant market

risks.

Interest Rate Risk

TCF's ALCO and the Finance Committee of TCF Financial's Board of Directors have adopted interest rate risk policy

limits which are incorporated into the Company's investment policy. Interest rate risk is defined as the exposure of net

interest income and fair value of financial instruments (interest-earning assets, deposits and borrowings) to movements

in interest rates. Since TCF does not hold a trading portfolio, the Company is not exposed to market risk from trading

activities. As such, the major sources of the Company's interest rate risk are timing differences in the maturity and

repricing characteristics of assets and liabilities, changes in the shape of the yield curve, changes in consumer behavior

and changes in relationships between rate indices (basis risk). Management measures these risks and their impact

in various ways, including through the use of simulation and valuation analyses. The interest rate scenarios may include

gradual or rapid changes in interest rates, spread narrowing and widening, yield curve twists and changes in

assumptions about consumer behavior in various interest rate scenarios. A mismatch between maturities, interest rate

sensitivities and prepayment characteristics of assets and liabilities results in interest rate risk. TCF, like most financial

institutions, has material interest rate risk exposure to changes in both short-term and long-term interest rates, as well

as variable interest rate indices (e.g., the prime rate or LIBOR).

TCF's ALCO meets regularly and is responsible for reviewing the Company's interest rate sensitivity position and

establishing policies to monitor and limit exposure to interest rate risk. ALCO manages TCF's interest rate risk based

on interest rate expectations and other factors. The principal objective of TCF in managing its assets and liabilities is

to provide maximum levels of net interest income and facilitate the funding needs of the Company, while maintaining

acceptable levels of interest rate risk and liquidity risk.

ALCO primarily uses two interest rate risk tools with policy limits to evaluate TCF's interest rate risk: net interest income

simulation and economic value of equity ("EVE") analysis. In addition, interest rate gap is reviewed to monitor asset

and liability repricing over various time periods.

Management utilizes net interest income simulation models to estimate the near-term effects of changing interest rates

on its net interest income. Net interest income simulation involves forecasting net interest income under a variety of

scenarios, including the level of interest rates, the shape of the yield curve and the spreads between market interest

rates. Management exercises its best judgment in making assumptions regarding events that management can

influence, such as non-contractual deposit repricings and events outside management's control, such as consumer

behavior on loan and deposit activity and the effect that competition has on both loan and deposit pricing. These

assumptions are subjective and, as a result, net interest income simulation results will differ from actual results due

to the timing, magnitude and frequency of interest rate changes, changes in market conditions, consumer behavior

and management strategies, among other factors. TCF performs various sensitivity analyses on assumptions of new

loan spreads, prepayment rates, basis risk, deposit attrition and deposit repricing.

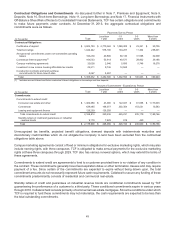

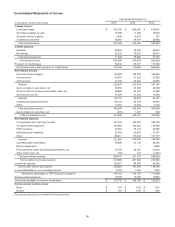

The following table presents changes in TCF's net interest income over a twelve month period if short- and long-term

interest rates were to sustain an immediate increase of 100 basis points and 200 basis points. The impact of planned

growth and new business activities is factored into the simulation model.

Impact on Net Interest Income

December 31,

(Dollars in millions) 2015 2014

Immediate Change in Interest Rates:

+200 basis points $ 93.9 11.1% $ 73.6 8.9%

+100 basis points 50.4 5.9 39.4 4.7