TCF Bank 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

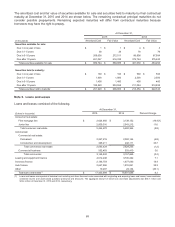

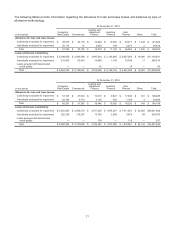

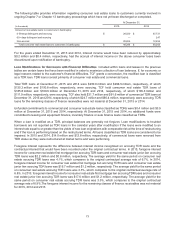

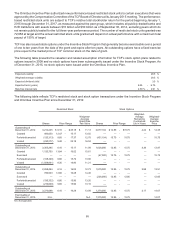

Impaired Loans TCF considers impaired loans to include non-accrual commercial loans, non-accrual equipment

finance loans and non-accrual inventory finance loans, as well as all TDR loans. Non-accrual impaired loans, including

non-accrual TDR loans, are included in non-accrual loans and leases within the previous tables. Accruing TDR loans

have been disclosed by delinquency status within the previous tables of accruing and non-accrual loans and leases.

In the following tables, the loan balance of impaired loans represents the amount recorded within loans and leases

on the Consolidated Statements of Financial Condition, whereas the unpaid contractual balance represents the

balances legally owed by the borrowers.

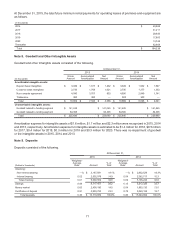

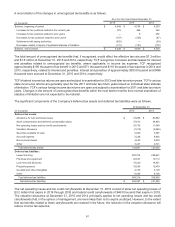

The following table summarizes impaired loans.

At December 31,

2015 2014

(In thousands)

Unpaid

Contractual

Balance Loan

Balance

Related

Allowance

Recorded

Unpaid

Contractual

Balance Loan

Balance

Related

Allowance

Recorded

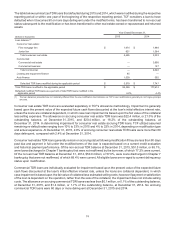

Impaired loans with an allowance recorded:

Consumer real estate:

First mortgage lien $ 145,749 $ 123,728 $ 20,880 $ 114,526 $ 101,668 $ 18,140

Junior lien 70,122 58,366 6,837 65,413 55,405 9,427

Total consumer real estate 215,871 182,094 27,717 179,939 157,073 27,567

Commercial:

Commercial real estate 298 298 12 58,157 54,412 3,772

Commercial business 16 16 3 18 18 1

Total commercial 314 314 15 58,175 54,430 3,773

Leasing and equipment finance 7,259 7,259 822 8,257 8,257 1,457

Inventory finance 867 873 199 1,754 1,758 393

Auto finance 8,275 8,062 2,942 3,074 2,928 1,184

Other 21 11 2 92 89 4

Total impaired loans with an allowance recorded 232,607 198,613 31,697 251,291 224,535 34,378

Impaired loans without an allowance recorded:

Consumer real estate:

First mortgage lien 7,100 3,228 — 53,606 35,147 —

Junior lien 26,031 520 — 33,796 7,398 —

Total consumer real estate 33,131 3,748 — 87,402 42,545 —

Commercial:

Commercial real estate 37,598 31,157 — 57,809 50,500 —

Commercial business 3,738 3,585 — 482 480 —

Total commercial 41,336 34,742 — 58,291 50,980 —

Inventory finance 274 276 — 848 851 —

Auto finance 2,003 1,177 — 1,484 748 —

Other 2 — — — — —

Total impaired loans without an allowance recorded 76,746 39,943 — 148,025 95,124 —

Total impaired loans $ 309,353 $ 238,556 $ 31,697 $ 399,316 $ 319,659 $ 34,378