TCF Bank 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.62

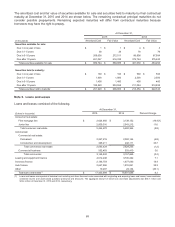

Leases which do not transfer substantially all benefits and risks of ownership to the lessee are classified as operating

leases. Such leased equipment and related initial direct costs are included in other assets on the Consolidated

Statements of Financial Condition and depreciated on a straight-line basis over the term of the lease to its estimated

salvage value. Depreciation expense is recorded as operating lease expense and included in non-interest expense.

Operating lease rental income is recognized when it is due and is reflected as a component of non-interest income.

An allowance for lease losses is not provided on operating leases.

Income Taxes Income taxes are accounted for using the asset and liability method. Under this method, deferred tax

assets and liabilities are recognized for the future tax consequences attributable to differences between the financial

statement carrying amounts of existing assets and liabilities and their respective tax basis carrying amounts. Deferred

tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in

which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and

liabilities of a change in tax rates is recorded in income tax expense in the Consolidated Statements of Income in the

period in which the enactment date occurs. Also, if current period income tax rates change, the impact on the annual

effective income tax rate is applied year to date in the period of enactment.

The determination of current and deferred income taxes is a critical accounting estimate which is based on complex

analyses of many factors, including interpretation of income tax laws, the evaluation of uncertain tax positions,

differences between the tax and financial reporting bases of assets and liabilities (temporary differences), estimates

of amounts due or owed, the timing of reversals of temporary differences and current financial accounting standards.

Additionally, there can be no assurance that estimates and interpretations used in determining income tax liabilities

will not be challenged by taxing authorities. Actual results could differ significantly from the estimates and tax law

interpretations used in determining the current and deferred income tax liabilities.

In the preparation of income tax returns, tax positions are taken based on interpretation of income tax laws for which

the outcome is uncertain. Management periodically reviews and evaluates the status of uncertain tax positions and

makes estimates of amounts ultimately due or owed. The benefits of tax positions are recorded in income tax expense

in the Consolidated Statements of Income, net of the estimates of ultimate amounts due or owed, including any

applicable interest and penalties. Changes in the estimated amounts due or owed may result from closing of the

statute of limitations on tax returns, new legislation, clarification of existing legislation through government

pronouncements, judicial action and through the examination process. TCF's policy is to report interest and penalties,

if any, related to unrecognized tax benefits in income tax expense in the Consolidated Statements of Income.

Other Significant Accounting Policies

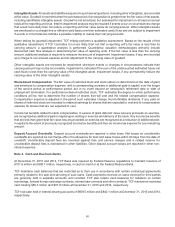

Investments Investments are carried at cost. TCF periodically evaluates investments for other than temporary

impairment with losses, if any, recorded in non-interest income within gains (losses) on securities, net.

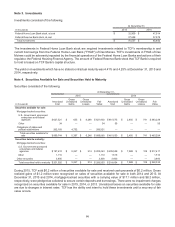

Securities Held to Maturity Securities held to maturity are carried at cost and adjusted for amortization of premiums

or accretion of discounts using a level yield method; however, transfers of securities available for sale to securities

held to maturity are made at fair value at the date of transfer. The unrealized holding gain or loss at the date of each

transfer is retained in accumulated other comprehensive income (loss) and in the carrying value of the held to maturity

investment security. Such amounts are then amortized over the remaining life of the transferred security as an

adjustment of the yield on those securities. TCF periodically evaluates securities held to maturity for other than

temporary impairment. Declines in value considered other than temporary, if any, would be recorded in non-interest

income within gains (losses) on securities, net.

Securities Available for Sale Securities available for sale are carried at fair value with the unrealized gains or losses,

net of related deferred income taxes, reported within accumulated other comprehensive income (loss), a separate

component of equity. The cost of securities sold is determined on a specific identification basis and gains or losses on

sales of securities available for sale are recognized on trade dates. TCF evaluates securities available for sale for

other than temporary impairment on a quarterly basis. Declines in the value of securities available for sale that are

considered other than temporary are recorded in non-interest income within gains (losses) on securities, net. Discounts

and premiums on securities available for sale are amortized using a level yield method over the expected life of the

security, or to the call date for securities with call features.