TCF Bank 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

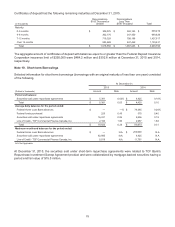

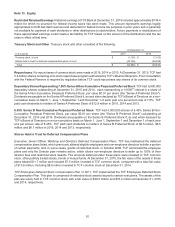

The Omnibus Incentive Plan authorized new performance-based restricted stock units to certain executives that were

approved by the Compensation Committee of the TCF Board of Directors at its January 2015 meeting. The performance-

based restricted stock units are subject to TCF’s relative total stockholder return for the period beginning January 1,

2015 through December 31, 2017, as measured against the peer group, which includes all publicly-traded banks and

thrift institutions with assets between $10 billion and $50 billion as of September 30, 2014, excluding peers which do

not remain publicly traded for the full three-year performance period. The number of restricted stock units granted was

72,858 at target and the actual restricted stock units granted will depend on actual performance with a maximum total

payout of 150% of target.

TCF has also issued stock options under the Incentive Stock Program that generally become exercisable over a period

of one to ten years from the date of the grant and expire after ten years. All outstanding options have a fixed exercise

price equal to the market price of TCF common stock on the date of grant.

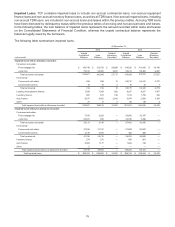

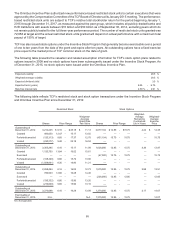

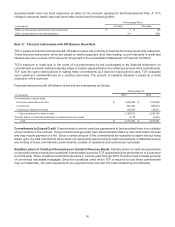

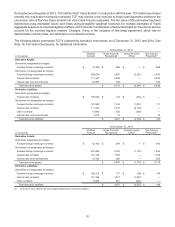

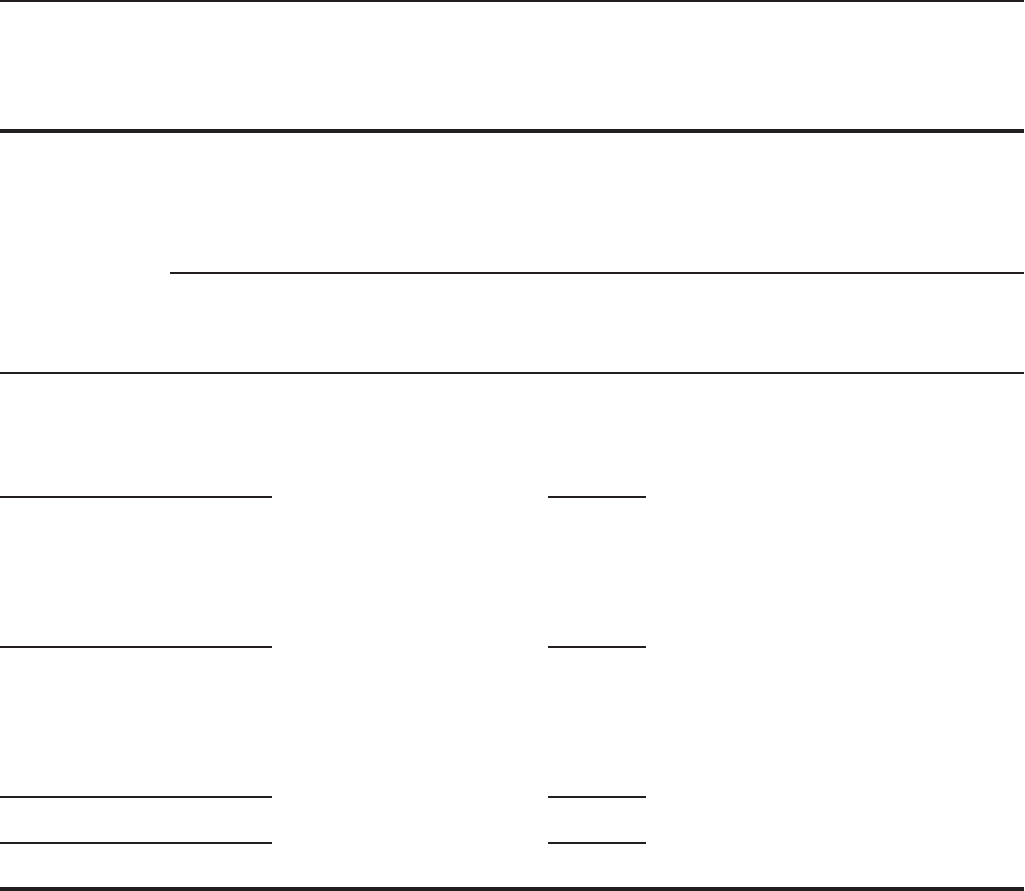

The following table presents the valuation and related assumption information for TCF's stock option plans related to

options issued in 2008 and no stock options have been subsequently issued under the Incentive Stock Program. As

of December 31, 2015, no stock options were issued under the Omnibus Incentive Plan.

Expected volatility 28.5 %

Weighted-average volatility 28.5 %

Expected dividend yield 3.5 %

Expected term (years) 6.25 - 6.75

Risk-free interest rate 2.58 %- 2.91 %

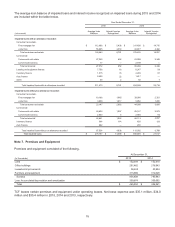

The following table reflects TCF's restricted stock and stock option transactions under the Incentive Stock Program

and Omnibus Incentive Plan since December 31, 2012.

Restricted Stock Stock Options

Shares Price Range

Weighted-

Average

Grant Date

Fair Value Shares Price Range

Weighted-

Average

Remaining

Contractual

Life in Years

Weighted-

Average

Exercise

Price

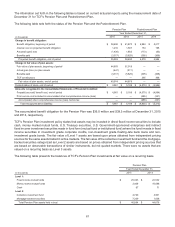

Outstanding at

December 31, 2012 3,212,235 $ 6.16 - $ 25.18 $11.13 2,077,104 $ 12.85 - $15.75 4.22 $ 14.35

Granted 493,650 12.47 -15.17 13.55 — — - — — —

Forfeited/canceled (120,313) 9.65 - 17.37 12.75 (451,104) 15.75 - 15.75 — 15.75

Vested (230,277) 9.48 - 25.18 16.04 — — - — — —

Outstanding at

December 31, 2013 3,355,295 6.16 - 15.17 11.09 1,626,000 12.85 - 15.75 4.36 13.97

Granted 1,120,750 13.84 -16.02 15.61 — — - — — —

Exercised — — - —— (47,000) 15.75 - 15.75 — 15.75

Forfeited/canceled (108,490) 6.80 - 15.79 13.06 — — - — — —

Vested (1,509,061) 8.35 - 14.90 11.21 — — - — — —

Outstanding at

December 31, 2014 2,858,494 6.16 - 16.02 12.73 1,579,000 12.85 - 15.75 2.98 13.91

Granted 786,933 12.86 -16.28 14.45 — — - — — —

Exercised — — - ——(200,000) 12.85 - 12.85 — 12.85

Forfeited/canceled (156,332) 6.80 - 15.96 13.20 — — - — — —

Vested (216,009) 9.65 - 15.96 13.16 — — - — — —

Outstanding at

December 31, 2015 3,273,086 6.16 - 16.28 13.09 1,379,000 12.85 - 15.75 2.17 14.07

Exercisable at

December 31, 2015 N.A. N.A. 1,379,000 12.85 - 15.75 14.07

N.A. Not Applicable.