TCF Bank 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

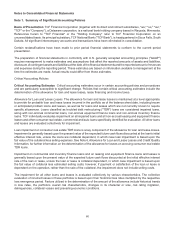

Loans and Leases Held for Sale Loans and leases designated as held for sale are generally carried at the lower

of cost or fair value. Any amount by which cost exceeds fair value is initially recorded as a valuation allowance and

subsequently reflected in the gain or loss on sale when sold. Certain other loans and leases held for sale are recorded

at fair value under the elected fair value option. From time to time, management identifies and designates primarily

consumer real estate and auto finance loans held in the loan portfolios for sale. These loans are transferred to loans

and leases held for sale at the lower of cost or fair value at the time of transfer. Any associated allowance for loan

and lease losses is transferred to the valuation allowance.

Loans and Leases Loans and leases are reported at historical cost including net direct fees and costs associated

with originating and acquiring loans and leases. The net direct fees and costs for sales-type leases are offset against

revenues recorded at the commencement of sales-type leases. Discounts and premiums on acquired loans, net direct

fees and costs, unearned discounts and finance charges and unearned lease income are amortized to interest income

using methods which approximate a level yield over the estimated remaining lives of the loans and leases. Net direct

fees and costs on all lines of credit are amortized on a straight line basis over the contractual life of the line of credit

and adjusted for payoffs. Net deferred fees and costs on consumer real estate lines of credit are amortized to service

fee income.

Non-accrual Loans and Leases Loans and leases are generally placed on non-accrual status when the collection

of interest and principal is 90 days or more past due unless, in the case of commercial loans, they are well secured

and in the process of collection. Auto loans are placed on non-accrual status when interest and principal are 120 days

past due. Delinquent consumer real estate junior lien loans are also placed on non-accrual status when there is

evidence that the related third-party first lien mortgage may be 90 days or more past due, or foreclosure, charge-off

or collection action has been initiated. TDR loans are placed on non-accrual status prior to the past due thresholds

outlined above if repayment under the modified terms is not likely after performing a well-documented credit analysis.

Loans on non-accrual status are generally reported as non-accrual loans until there is sustained repayment

performance for six consecutive months, with the exception of loans not reaffirmed upon discharge under Chapter 7

bankruptcy, which remain on non-accrual status until a well-documented credit analysis indicates full repayment of

the remaining pre-discharged contractual principal and interest is likely. Income on these loans is recognized on a

cash basis when there is sustained repayment performance for six or 12 consecutive months based on the credit

evaluation and the loan is not more than 60 days delinquent.

Generally, when a loan or lease is placed on non-accrual status, uncollected interest accrued in prior years is charged-

off against the allowance for loan and lease losses and interest accrued in the current year is reversed against interest

income. For non-accrual leases that have been discounted with third-party financial institutions on a non-recourse

basis, the related liability is also placed on non-accrual status. Interest payments received on loans and leases in

non-accrual status are generally applied to principal unless the remaining principal balance has been determined to

be fully collectible, in which case interest income is recognized on a cash basis.

Premises and Equipment Premises and equipment, including leasehold improvements, are carried at cost and are

depreciated or amortized on a straight-line basis over estimated useful lives of owned assets and for leasehold

improvements over the estimated useful life of the related asset or the lease term, whichever is shorter. Maintenance

and repairs are charged to expense as incurred. Rent expense for leased land with facilities is recognized in occupancy

and equipment expense. Rent expense for leases with free rent periods or scheduled rent increases is recognized

on a straight-line basis over the lease term.