TCF Bank 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

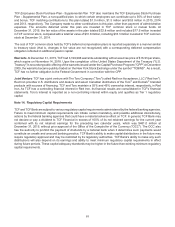

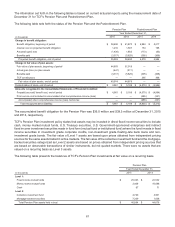

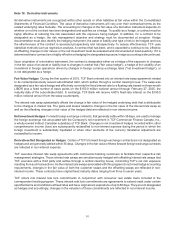

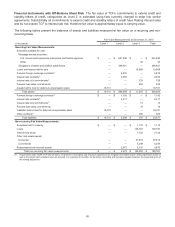

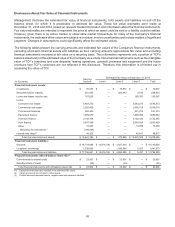

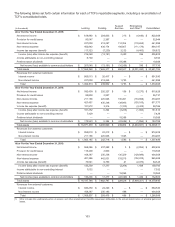

The following table summarizes the pre-tax impact of derivative activity within the Consolidated Statements of Income

and the Consolidated Statements of Comprehensive Income.

Year Ended December 31,

(In thousands) Income Statement Location 2015 2014 2013

Consolidated Statements of Income

Fair value hedges:

Interest rate contracts Non-interest income $ (142) $ — $ —

Non-derivative hedged items Non-interest income 209 — —

Not designated as hedges:

Forward foreign exchange contracts Non-interest expense 74,292 38,752 25,170

Interest rate lock commitments Non-interest income 431 285 —

Interest rate contracts Non-interest income 4 (79) —

Net gain (loss) recognized $ 74,794 $38,958 $25,170

Consolidated Statements of Comprehensive Income

Net investment hedges: Other comprehensive

Forward foreign exchange contracts income (loss) $ 7,613 $3,126 $1,625

Net unrealized gain (loss) $ 7,613 $3,126 $1,625

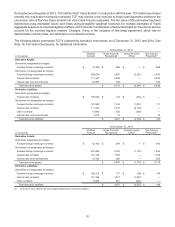

TCF executes all of its forward foreign exchange contracts in the over-the-counter market with large financial institutions

pursuant to International Swaps and Derivatives Association, Inc. agreements. These agreements include credit risk-

related features that enhance the creditworthiness of these instruments as compared with other obligations of the

respective counterparty with whom TCF has transacted by requiring that additional collateral be posted under certain

circumstances. The amount of collateral required depends on the contract and is determined daily based on market

and currency exchange rate conditions.

At December 31, 2015, credit risk-related contingent features existed on forward foreign exchange contracts with a

notional value of $144.5 million. In the event TCF is rated less than BB- by Standard and Poor's, the contracts could

be terminated or TCF may be required to provide approximately $2.9 million in additional collateral. There were no

forward foreign exchange contracts containing credit risk-related features in a net liability position at

December 31, 2015.

At December 31, 2015, TCF had posted $10.8 million and $1.4 million of cash collateral related to its interest rate

contracts and other contracts, respectively, and had received $1.0 million of cash collateral related to its forward foreign

exchange contracts.

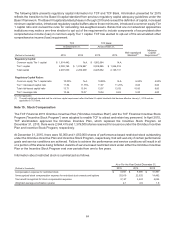

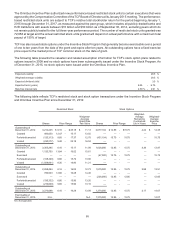

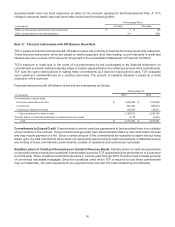

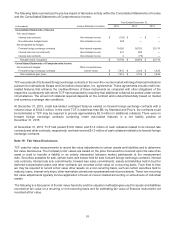

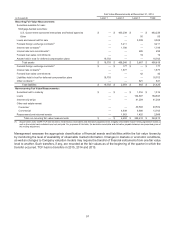

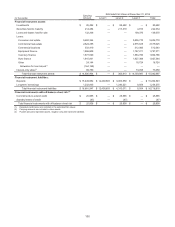

Note 19. Fair Value Disclosures

TCF uses fair value measurements to record fair value adjustments to certain assets and liabilities and to determine

fair value disclosures. The Company's fair values are based on the price that would be received upon the sale of an

asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

date. Securities available for sale, certain loans and leases held for sale, forward foreign exchange contracts, interest

rate contracts, interest rate lock commitments, forward loan sales commitments, assets and liabilities held in trust for

deferred compensation plans and other contracts are recorded at fair value on a recurring basis. From time to time

we may be required to record at fair value other assets on a non-recurring basis, such as certain securities held to

maturity, loans, interest-only strips, other real estate owned and repossessed and returned assets. These non-recurring

fair value adjustments typically involve application of lower-of-cost-or-market accounting or write-downs of individual

assets.

The following is a discussion of the fair value hierarchy and the valuation methodologies used for assets and liabilities

recorded at fair value on a recurring or non-recurring basis and for estimating fair value of financial instruments not

recorded at fair value.