TCF Bank 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

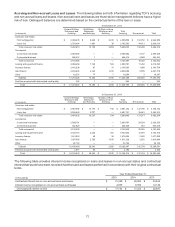

66

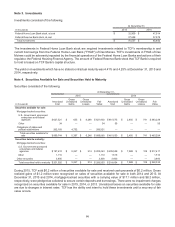

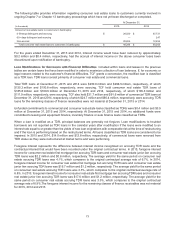

Note 3. Investments

Investments consisted of the following.

At December 31,

(In thousands) 2015 2014

Federal Home Loan Bank stock, at cost $ 32,909 $47,914

Federal Reserve Bank stock, at cost 37,628 37,578

Total investments $ 70,537 $85,492

The investments in Federal Home Loan Bank stock are required investments related to TCF's membership in and

current borrowings from the Federal Home Loan Bank ("FHLB") of Des Moines. TCF's investments in FHLB of Des

Moines could be adversely impacted by the financial operations of the Federal Home Loan Banks and actions of their

regulator, the Federal Housing Finance Agency. The amount of Federal Reserve Bank stock that TCF Bank is required

to hold is based on TCF Bank's capital structure.

The yield on investments which have no stated contractual maturity was 4.41% and 4.25% at December 31, 2015 and

2014, respectively.

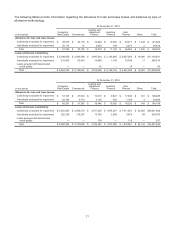

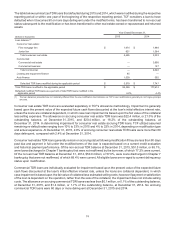

Note 4. Securities Available for Sale and Securities Held to Maturity

Securities consisted of the following.

At December 31,

2015 2014

(In thousands) Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored

enterprises and federal

agencies $ 627,521 $ 655 $ 6,246 $ 621,930 $ 461,575 $ 2,405 $741 $463,239

Other 34 — — 34 55 — — 55

Obligations of states and

political subdivisions 262,189 4,732 — 266,921 — — — —

Total securities available for

sale $ 889,744 $ 5,387 $6,246 $ 888,885 $ 461,630 $ 2,405 $741 $463,294

Securities held to maturity:

Mortgage-backed securities:

U.S. Government sponsored

enterprises and federal

agencies $ 197,410 $ 5,247 $214 $ 202,443 $ 209,538 $ 7,988 $109 $217,417

Other 1,110 — — 1,110 1,516 — — 1,516

Other securities 3,400 — — 3,400 3,400 — — 3,400

Total securities held to maturity $ 201,920 $ 5,247 $214 $ 206,953 $ 214,454 $ 7,988 $109 $222,333

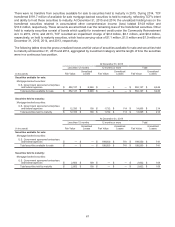

During 2015, TCF sold $0.2 million of securities available for sale and received cash proceeds of $0.2 million. Gross

realized gains of $1.2 million were recognized on sales of securities available for sale in both 2014 and 2013. At

December 31, 2015 and 2014, mortgage-backed securities with a carrying value of $17.1 million and $8.2 million,

respectively, were pledged as collateral to secure certain deposits and borrowings. There were no impairment charges

recognized on securities available for sale in 2015, 2014, or 2013. Unrealized losses on securities available for sale

are due to changes in interest rates. TCF has the ability and intent to hold these investments until a recovery of fair

value occurs.