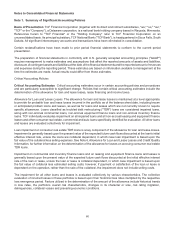

TCF Bank 2015 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.52

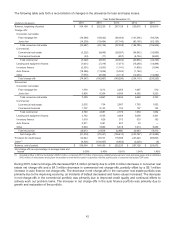

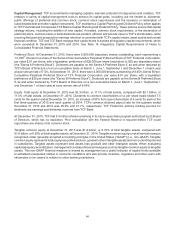

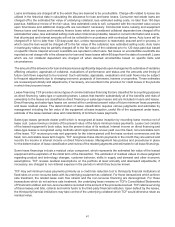

As of December 31, 2015, 55.8% of TCF's loan and lease balances are expected to reprice, amortize or prepay in the

next 12 months and 62.6% of TCF's deposit balances are low cost or no cost deposits. The mix of assets repricing

compared with low cost or no cost deposits should enable TCF to increase net interest income as interest rates rise.

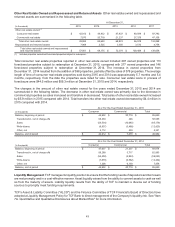

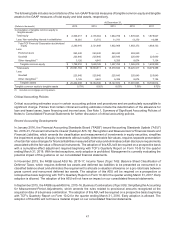

Management also uses EVE and interest rate gap analyses to measure risk in the balance sheet that might not be

taken into account in the net interest income simulation analysis. Net interest income simulation highlights exposure

over a relatively short time period, while EVE analysis incorporates all cash flows over the estimated remaining life of

all balance sheet positions. The valuation of the balance sheet, at a point in time, is defined as the discounted present

value of asset cash flows minus the discounted present value of liability cash flows. EVE analysis addresses only the

current balance sheet and does not incorporate the growth assumptions that are used in the net interest income

simulation model. As with the net interest income simulation model, EVE analysis is based on key assumptions about

the timing and variability of balance sheet cash flows and does not take into account any potential responses by

management to anticipated changes in interest rates.

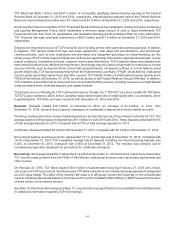

Interest rate gap is the difference between interest-earning assets and interest-bearing liabilities repricing within a

given period and represents the net asset or liability sensitivity at a point in time. An interest rate gap measure could

be significantly affected by external factors such as loan prepayments, early withdrawals of deposits, changes in the

correlation of various interest-bearing instruments, competition, or a rise or decline in interest rates.

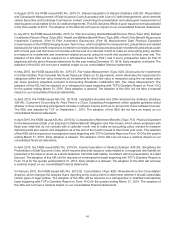

Credit Risk

Credit risk is defined as the risk to earnings or capital if an obligor fails to meet the terms of any contract with the

Company or otherwise fails to perform as agreed, such as the failure of customers and counterparties to meet their

contractual obligations, as well as contingent exposures from unfunded loan commitments and letters of credit.

TCF's Enterprise Risk Management Committee meets at least quarterly and is responsible for monitoring the loan and

lease portfolio composition and risk tolerance within the various segments of the portfolio. The Enterprise Risk

Management Committee and the Board of Directors have adopted a Risk Appetite Statement to manage the Company's

credit risk by setting (i) a desired balance between asset classes, (ii) concentration limits based on loan type, business

line and geographic region and (iii) maximum tolerances for credit performance. To manage credit risk arising from

lending and leasing activities, management has adopted and maintains underwriting policies and procedures and

periodically reviews the appropriateness of these policies and procedures. Customers and guarantors or recourse

providers are evaluated as part of initial underwriting processes and through periodic reviews. For consumer loans,

credit scoring models are used to help determine eligibility for credit and terms of credit. These models are periodically

reviewed to verify that they are predictive of borrower performance. Limits are established on the exposure to a single

customer (including affiliates) and on concentrations for certain categories of customers. Loan and lease credit approval

levels are established so that larger credit exposures receive managerial review at the appropriate level through the

credit committees.

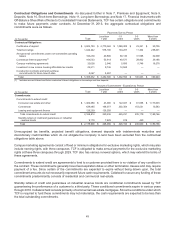

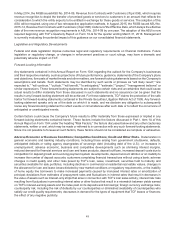

Management continuously monitors asset quality in order to manage the Company's credit risk and to determine the

appropriateness of valuation allowances, including, in the case of commercial loans, inventory finance loans and

equipment finance loans and leases, a risk rating methodology under which a rating of one through nine is assigned

to each loan or lease. The rating reflects management's assessment of the potential impact on repayment of the

customer's financial and operational condition. Asset quality is monitored separately based on the type or category of

loan or lease. The rating process allows management to better define the Company's loan and lease portfolio risk

profile. Management also uses various risk models to estimate probable impact on payment performance under various

scenarios, both expected and unexpected.

The Company also has credit risk in its securities portfolio related to obligations of states and political subdivisions.

The Company maintains a restrictive set of underwriting criteria and regularly monitors credit performance under the

direction and supervision of the TCF Bank Credit Committee to manage this risk. Credit risk in the remainder of the

securities portfolio is minimal. The remainder of the securities available for sale and securities held to maturity portfolios

as of December 31, 2015 consist primarily of fixed-rate mortgage-backed securities issued and guaranteed by Fannie

Mae. All investment related counterparties and transaction limits are reviewed and approved annually by both ALCO

and the TCF Bank Credit Committee.