TCF Bank 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

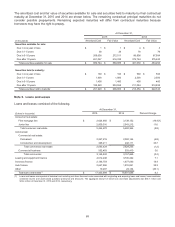

The consumer real estate junior lien portfolio was comprised of $2.5 billion of home equity lines of credit ("HELOCs")

and $345.3 million of amortizing consumer real estate junior lien mortgage loans at December 31, 2015, compared

with $2.1 billion and $424.4 million at December 31, 2014, respectively. At December 31, 2015 and 2014, $1.8 billion

and $1.3 billion, respectively, of the consumer real estate junior lien HELOCs had a 10-year interest-only draw period

and a 20-year amortization repayment period and all were within the 10-year interest-only draw period and will not

convert to amortizing loans until 2021 or later. At December 31, 2015 and 2014, $664.5 million and $816.0 million,

respectively, of the consumer real estate junior lien HELOCs were interest-only revolving draw loans with no defined

amortization period and original draw periods of 5 to 40 years. As of December 31, 2015, 18.2% of these loans mature

prior to 2021.

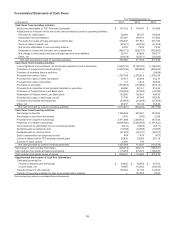

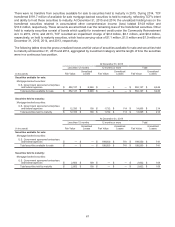

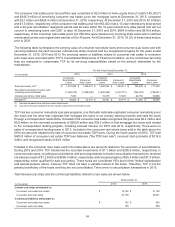

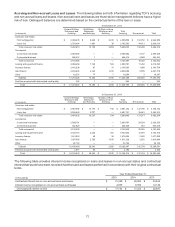

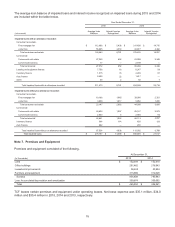

The following table summarizes the carrying value of consumer real estate loans and consumer auto loans sold with

servicing retained, the cash received, interest-only strips received and the recognized net gains for the years ended

December 31, 2015, 2014 and 2013. No servicing assets or liabilities related to consumer real estate or consumer

auto loans were recorded within TCF's Consolidated Statements of Financial Condition, as the contractual servicing

fees are adequate to compensate TCF for its servicing responsibilities based on the amount demanded by the

marketplace.

For the Year Ended December 31,

(In thousands) 2015 2014 2013

Consumer

Real Estate

Loans Consumer

Auto Loans

Consumer

Real Estate

Loans Consumer

Auto Loans

Consumer

Real Estate

Loans Consumer

Auto Loans

Sales proceeds, net(1) $ 1,301,438 $ 1,390,231 $1,450,244 $1,364,611 $765,849 $777,300

Recorded investment in loans sold,

including accrued interest (1,269,108)(1,358,040)(1,426,969)(1,337,791)(766,307)(798,281)

Interest-only strips, initial value 7,495 —10,816 17,927 22,150 50,680

Net gains(2) $ 39,825 $ 32,191 $34,091 $44,747 $21,692 $29,699

(1) Includes transaction fees and other sales related costs.

(2) Excludes subsequent adjustments and valuation adjustments while held for sale.

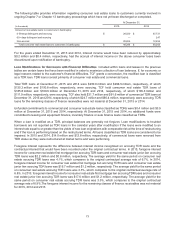

TCF has two consumer real estate loan sale programs; one that sells nationally originated consumer real estate junior

lien loans and the other that originates first mortgage lien loans in our primary banking markets and sells the loans

through a correspondent relationship. Included in the consumer real estate recognized net gains was $6.4 million and

$0.9 million on the recorded investments of $289.8 million and $39.2 million in first mortgage lien loans sold related

to the correspondent lending program, including accrued interest, for 2015 and 2014, respectively. There were no

sales of correspondent lending loans in 2013. Included in the consumer real estate loans sold in the table above for

2014 are amounts related to the sale of consumer real estate TDR loans. During the fourth quarter of 2014, TCF sold

$405.9 million of consumer real estate TDR loan balances ("the TDR loan sale"), received cash proceeds of $314.0

million and recognized losses of $4.8 million.

Included in the consumer auto loans sold in the table above are amounts related to the execution of securitizations.

During 2015 and 2014, TCF transferred the recorded investments of $1.1 billion and $258.6 million, respectively, in

consumer auto loans, including accrued interest, with servicing retained, to trusts in securitization transactions, received

net sales proceeds of $1.2 billion and $266.0 million, respectively, and recognized gains of $25.5 million and $7.4 million,

respectively, which qualified for sale accounting. These trusts are considered VIEs due to their limited capitalization

and special purpose nature, however TCF does not have a variable interest in the trusts. Therefore, TCF is not the

primary beneficiary of the trusts and they are not consolidated. There were no securitization transactions in 2013.

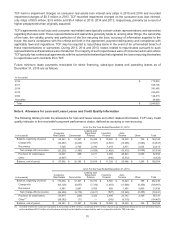

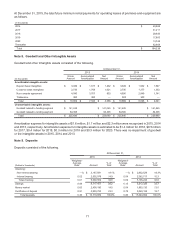

Total interest-only strips and the contractual liabilities related to loan sales are shown below.

At December 31,

(In thousands) 2015 2014

Interest-only strips attributable to:

Consumer real estate loan sales $ 19,182 $ 21,198

Consumer auto loan sales 25,150 48,591

Contractual liabilities attributable to:

Consumer real estate loan sales $ 702 $563

Consumer auto loan sales 185 699