TCF Bank 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Finally, I expect the investments we have made in our

enterprise risk management function over the past few years

to be a driver of positive operating leverage moving forward.

We have worked hard to build a best-in-class program that

will reduce balance sheet risk, minimize future losses and

ultimately benefit the bottom line.

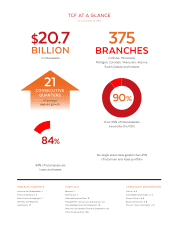

Core Funding

If the engine of our growth is strong loan and lease

originations, then we need to ensure we have a stable and

consistent source of funding to keep it running. Core funding

growth enables us to meet the growing demand for our

loan and lease products. Our funding strategy is primarily

anchored by a low-cost deposit base, of which more than

90 percent are insured by the FDIC. Sustaining this strategy

requires us to continue increasing the quality of our deposit

accounts while reducing attrition. We have been successful

in doing this but, as competition for customers increases,

we need the right combination of technology, products and

services to capture additional market share.

We are committed to making smart and strategic invest-

ments to deliver a differentiated customer experience that

is in rhythm with the needs of our customers. This means

delivering the right solutions, in the right way whenever and

wherever our customers need them. Throughout 2015, we

introduced new technologies, enhanced existing service

channels and delivered resources to our team members that

helped them provide a consistently good customer experi-

ence. This combination of investments ultimately improves

our standing in attracting new customers while strengthen-

ing our relationships with existing customers. New product

offerings such as credit cards and mortgages give us addi-

tional opportunities to capture greater wallet share.

M&A opportunities may also provide a way for us to

supplement our funding capabilities. A potential deposit

acquisition that makes sense for us will be prudently

evaluated. Nonetheless, we continue to invest in our retail

franchise to effectively fund our strong loan and lease

growth into the future.

Our responsibility to shareholders is to generate growth

prudently while managing risk and our credit profile. This

is why we consistently emphasize the importance of a

strong enterprise risk management and credit culture. The

investments we have made in these areas are helping us

make better decisions, more effectively manage our risks

and ensure we have the processes and accountabilities in

place to meet and exceed today’s regulatory requirements.

MOVING AHEAD IN RHYTHM AS ONE

We would be remiss if we did not acknowledge the one

critical component that makes all of our success possible: our

team members. Their passion, hard work and commitment

to living by our mission, vision and values is what makes

TCF a great company. We are also fortunate to have a strong

board with the diverse skills and expertise necessary to

lead our bank in today’s environment. We appreciate their

support and guidance.

With the chairman and CEO roles now split, you have our

commitment that we are aligned on our strategy for the

future and the pathway we will follow to achieve strong

results in 2016 and beyond. We appreciate and respect the

trust you have placed in us and the expectations you have of

us as an investor in our company. We are In Rhythm As One.

We are “One TCF.”

Craig R. Dahl

Vice Chairman, President and Chief Executive Officer

William A. Cooper

Chairman of the Board

Cooper Innovation Award

We established the William A. Cooper Innovation Award

in 2015 in recognition of his 30 years with TCF. It is given

annually to team members who embody Mr. Cooper’s

pioneering spirit of innovation, leadership and service.

The first William A. Cooper Innovation Award was given

to President of National Residential Lending Mark Rohde,

and members of his team. The business has demon-

strated consistent growth and also great success from a

customer experience standpoint in servicing the portfolio.

5