TCF Bank 2015 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

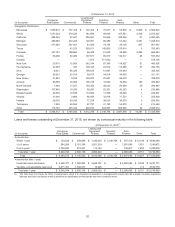

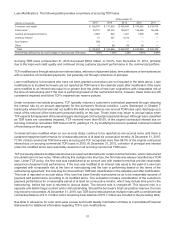

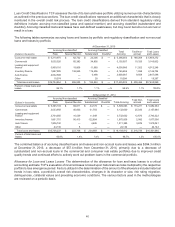

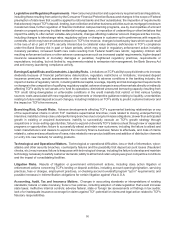

Loan Credit Classifications TCF assesses the risk of its loan and lease portfolio utilizing numerous risk characteristics

as outlined in the previous sections. The loan credit classifications represent an additional characteristic that is closely

monitored in the overall credit risk process. The loan credit classifications derived from standard regulatory rating

definitions include: accruing non-classified (pass and special mention) and accruing classified (substandard and

doubtful). Accruing classified loans and leases have well-defined weaknesses, but may never become non-accrual or

result in a loss.

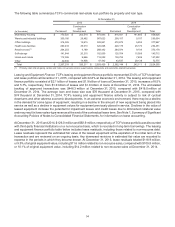

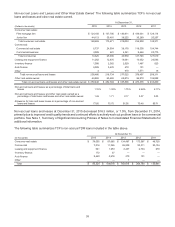

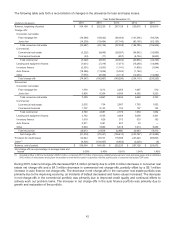

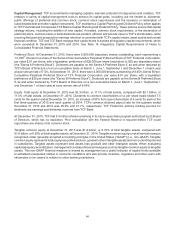

The following tables summarize accruing loans and leases by portfolio and regulatory classification and non-accrual

loans and leases by portfolio.

At December 31, 2015

Accruing Non-classified Accruing Classified Total

Accruing Total Non-

accrual Total Loans

and Leases

(Dollars in thousands) Pass Special Mention Substandard Doubtful

Consumer real estate $ 5,210,975 $ 62,722 $ 22,306 $ — $ 5,296,003 $ 168,269 $ 5,464,272

Commercial 3,035,320 65,382 34,805 — 3,135,507 10,325 3,145,832

Leasing and equipment

finance 3,969,191 19,806 11,989 — 4,000,986 11,262 4,012,248

Inventory finance 1,887,505 138,945 119,206 — 2,145,656 1,098 2,146,754

Auto finance 2,632,589 — 5,498 —2,638,087 9,509 2,647,596

Other 19,274 — 20 — 19,294 3 19,297

Total loans and leases $16,754,854 $ 286,855 $ 193,824 $ — $17,235,533 $ 200,466 $

17,435,999

Percent of total loans and

leases 96.1% 1.7% 1.1% —% 98.9% 1.1% 100.0%

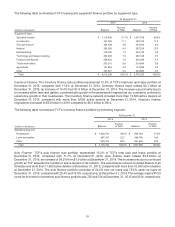

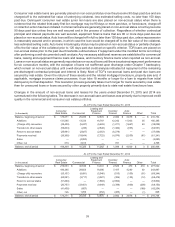

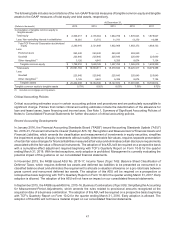

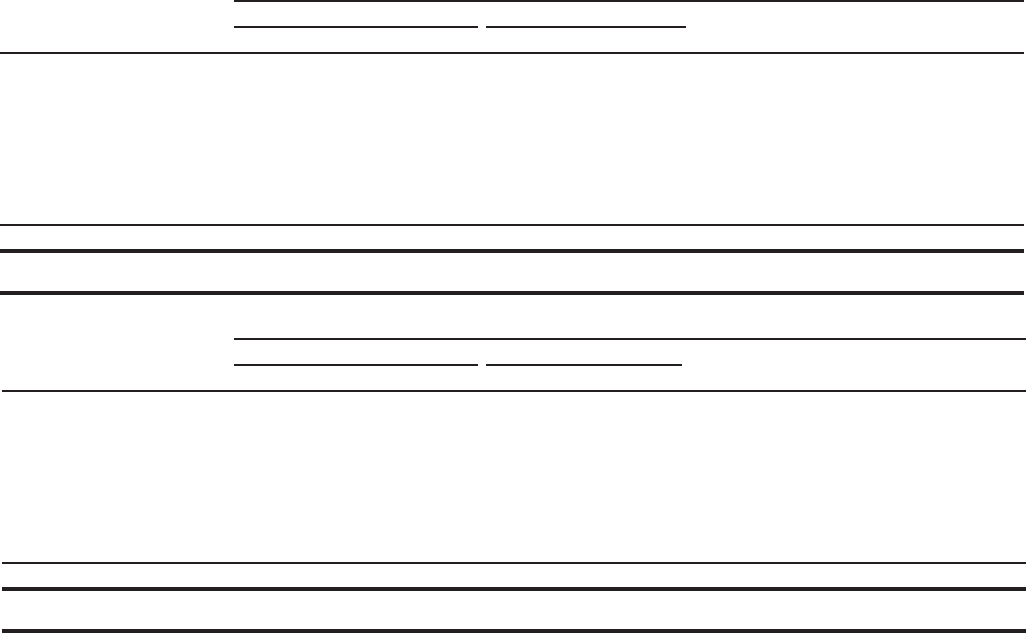

At December 31, 2014

Accruing Non-classified Accruing Classified

Total Accruing Total Non-

accrual Total Loans

and Leases

(Dollars in thousands) Pass Special Mention Substandard Doubtful

Consumer real estate $ 5,395,103 $ 69,811 $ 44,179 $ — $ 5,509,093 $ 173,271 $ 5,682,364

Commercial 3,033,992 46,935 51,703 — 3,132,630 25,035 3,157,665

Leasing and equipment

finance 3,704,565 16,539 11,548 — 3,732,652 12,670 3,745,322

Inventory finance 1,661,701 90,413 122,894 — 1,875,008 2,082 1,877,090

Auto finance 1,906,740 — 4,645 —1,911,385 3,676 1,915,061

Other 24,136 8 — — 24,144 — 24,144

Total loans and leases $15,726,237 $ 223,706 $ 234,969 $ — $ 16,184,912 $ 216,734 $16,401,646

Percent of total loans and

leases 95.9% 1.4% 1.4% —% 98.7% 1.3% 100.0%

The combined balance of accruing classified loans and leases and non-accrual loans and leases was $394.3 million

at December 31, 2015, a decrease of $57.4 million from December 31, 2014, primarily due to a decrease of

substandard and non-accrual loans in the commercial and consumer real estate portfolios due to improved credit

quality trends and continued efforts to actively work out problem loans in the commercial portfolio.

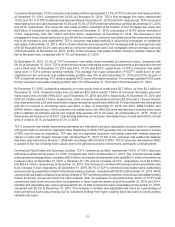

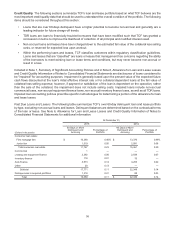

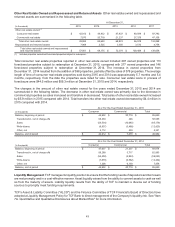

Allowance for Loan and Lease Losses The determination of the allowance for loan and lease losses is a critical

accounting estimate. TCF's evaluation of incurred losses is based upon historical loss rates multiplied by the respective

portfolio's loss emergence period. Factors utilized in the determination of the amount of the allowance include historical

trends in loss rates, a portfolio's overall risk characteristics, changes in its character or size, risk rating migration,

delinquencies, collateral values and prevailing economic conditions. The various factors used in the methodologies

are reviewed on a periodic basis.