TCF Bank 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

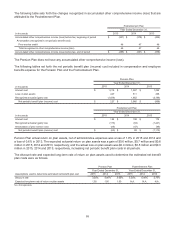

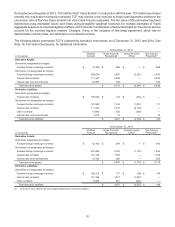

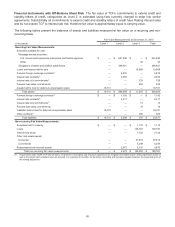

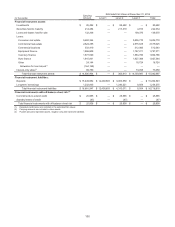

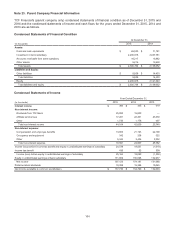

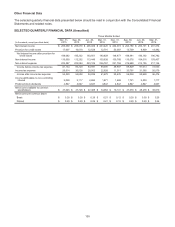

The following table presents changes in Level 3 assets and liabilities measured at fair value on a recurring basis.

(In thousands)

Securities

Available

for Sale

Loans and

Leases

Held for Sale

Interest

Rate Lock

Commitments

Forward

Loan Sales

Commitments Other

Contracts

Asset (liability) balance, December 31, 2012 $ 127 $ — $ — $ — $ (1,227)

Principal paydowns / settlements (34) — — — 328

Asset (liability) balance, December 31, 2013 93 ———(899)

Total net gains (losses) included in:

Net income — 72 285 (23)(47)

Sales — (39,246) — — —

Purchases / originations — 42,482 ———

Principal paydowns / settlements (38) — — — 325

Asset (liability) balance, December 31, 2014 55 3,308 285 (23)(621)

Total net gains (losses) included in:

Net income — (68)431 288 —

Sales — (289,751) — — —

Originations — 297,079 — — —

Principal paydowns / settlements (21) — — — 316

Asset (liability) balance, December 31, 2015 $34 $10,568 $716 $265 $(305)

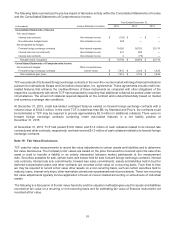

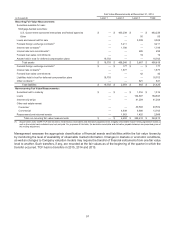

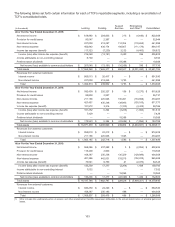

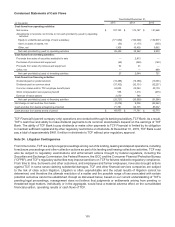

Fair Value Option

In the third quarter of 2014, TCF initiated a correspondent lending program in which TCF Bank originates first mortgage

lien loans in its primary banking markets and sells the loans through a correspondent relationship. TCF elected the

fair value option for these loans. This election facilitates the offsetting of changes in fair values of the loans held for

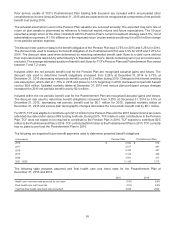

sale and the derivative financial instruments used to economically hedge them. The following table presents the

difference between the aggregate fair value and aggregate unpaid principal balance of these loans held for sale.

At December 31,

(In thousands) 2015 2014

Fair value carrying amount $ 10,568 $ 3,308

Aggregate unpaid principal amount 10,547 3,205

Fair value carrying amount less aggregate unpaid principal $ 21 $ 103

Differences between the fair value carrying amount and the aggregate unpaid principal balance include changes in

fair value recorded at and subsequent to funding and gains and losses on the related loan commitment prior to funding.

No loans recorded under the fair value option were delinquent or on non-accrual status at December 31, 2015 and

2014. The net gain from initial measurement of the correspondent lending loans held for sale, any subsequent changes

in fair value while the loans are outstanding and any actual adjustment to the gains realized upon sales of the loans

totaled $6.3 million and $0.9 million for 2015 and 2014, respectively, and is included in gains on sales of consumer

real estate loans, net. This amount excludes the impact from the interest rate lock commitments and forward loan

sales commitments which are also included in gains on sales of consumer real estate loans, net.