TCF Bank 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

Prior service credits of TCF's Postretirement Plan totaling $46 thousand are included within accumulated other

comprehensive income (loss) at December 31, 2015 and are expected to be recognized as components of net periodic

benefit cost during 2016.

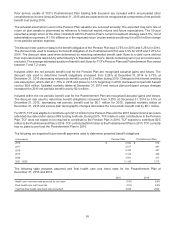

The actuarial assumptions used in the Pension Plan valuation are reviewed annually. The expected long-term rate of

return on plan assets is determined by reference to historical market returns and future expectations. The 10-year

expected average return of the index consistent with the Pension Plan's current investment strategy was 2.5%, net of

administrative expenses. A 1.0% difference in the expected return on plan assets would result in a $0.4 million change

in net periodic pension expense.

The discount rate used to measure the benefit obligation of the Pension Plan was 3.75% for 2015 and 3.25% for 2014.

The discount rate used to measure the benefit obligation of the Postretirement Plan was 3.5% for 2015 and 3.25% for

2014. The discount rates used were determined by matching estimated benefit cash flows to a yield curve derived

from corporate bonds rated AA by either Moody's or Standard and Poor's. Bonds containing call or put provisions were

excluded. The average estimated duration of benefit cash flows for TCF's Pension Plan and Postretirement Plan varied

between 7 and 7.2 years.

Included within the net periodic benefit cost for the Pension Plan are recognized actuarial gains and losses. The

discount rate used to determine benefit obligations increased from 3.25% at December 31, 2014 to 3.75% at

December 31, 2015 decreasing net periodic benefit cost by $1.2 million during 2015. Changes to the interest crediting

rate assumption, which start at 1.75% in 2016 and phase to 3.5% beginning in 2019, decreased net periodic benefit

cost by $0.6 million. Updated mortality tables at December 31, 2015 and various plan participant census changes

increased the 2015 net periodic benefit cost by $0.4 million.

Included within the net periodic benefit cost for the Postretirement Plan are recognized actuarial gains and losses.

The discount rate used to determine benefit obligations increased from 3.25% at December 31, 2014 to 3.5% at

December 31, 2015, decreasing net periodic benefit cost by $0.1 million for 2015. Updated mortality tables at

December 31, 2015 and various plan demographic changes decreased the net periodic benefit cost by $0.1 million.

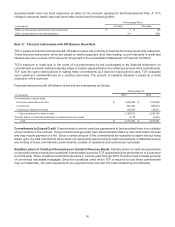

For 2015, TCF was eligible to contribute up to $11.2 million to the Pension Plan until the 2015 federal income tax return

extended due date under various IRS funding methods. During 2015, TCF made no cash contributions to the Pension

Plan. TCF does not expect to be required to contribute to the Pension Plan in 2016. TCF expects to contribute $0.5

million to the Postretirement Plan in 2016. TCF contributed $0.4 million to the Postretirement Plan in 2015. TCF currently

has no plans to pre-fund the Postretirement Plan in 2016.

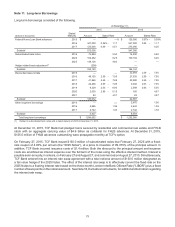

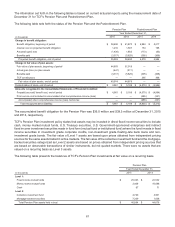

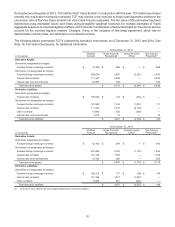

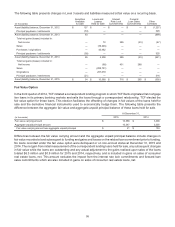

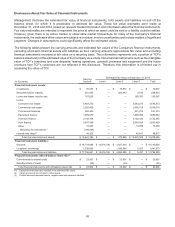

The following are expected future benefit payments used to determine projected benefit obligations.

(In thousands) Pension Plan Postretirement Plan

2016 $ 3,592 $514

2017 3,017 491

2018 3,100 467

2019 3,144 442

2020 3,051 417

2021 - 2025 11,165 1,713

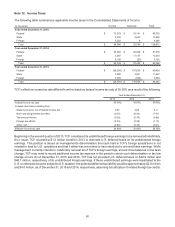

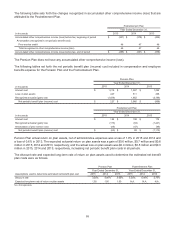

The following table presents assumed and final health care cost trend rates for the Postretirement Plan at

December 31, 2015 and 2014.

2015 2014

Health care cost trend rate assumed for next year 5.9% 5.8%

Final health care cost trend rate 4.5% 5.0%

Year that final health care trend rate is reached 2038 2023