TCF Bank 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

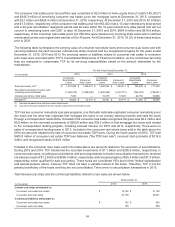

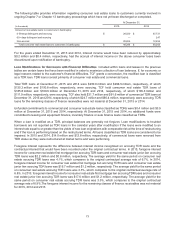

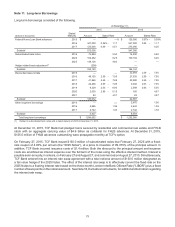

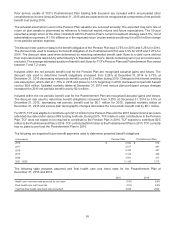

Note 11. Long-term Borrowings

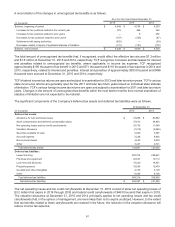

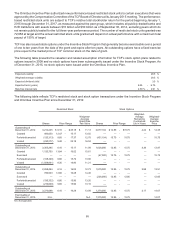

Long-term borrowings consisted of the following.

At December 31,

2015 2014

(Dollars in thousands) Stated

Maturity Amount Stated Rate Amount Stated Rate

Federal Home Loan Bank advances 2015 $ — —% $ 125,000 0.37% - 0.38%

2016 447,000 0.54% - 1.17 547,000 0.25 -1.17

2017 125,000 0.49 -0.51 275,000 0.25

Subtotal 572,000 947,000

Subordinated bank notes 2016 74,994 5.50 74,930 5.50

2022 109,282 6.25 109,194 6.25

2025 149,126 4.60 ——

Hedge-related basis adjustment(1) (209) —

Subtotal 333,193 184,124

Discounted lease rentals 2015 — — 32,904 2.39 -7.95

2016 48,120 2.39 -7.95 27,539 2.39 -7.95

2017 41,969 2.45 -7.88 20,580 2.45 -7.95

2018 24,496 2.55 -7.95 9,032 2.63 -7.95

2019 9,329 2.53 -6.00 2,589 2.63 -5.05

2020 2,035 2.95 -5.15 160 4.57

2021 83 4.57 83 4.57

Subtotal 126,032 92,887

Other long-term borrowings 2015 — —2,670 1.36

2016 2,685 1.36 2,642 1.36

2017 2,742 1.36 2,742 1.36

Subtotal 5,427 8,054

Total long-term borrowings $ 1,036,652 $1,232,065

(1) Related to subordinated bank notes with a stated maturity of 2025 at December 31, 2015.

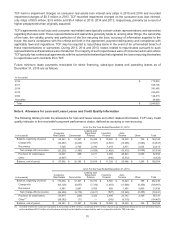

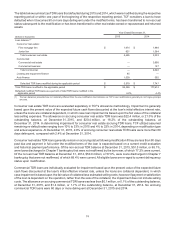

At December 31, 2015, TCF Bank had pledged loans secured by residential and commercial real estate and FHLB

stock with an aggregate carrying value of $4.6 billion as collateral for FHLB advances. At December 31, 2015,

$125.0 million of FHLB advances outstanding were prepayable monthly at TCF's option.

On February 27, 2015, TCF Bank issued $150.0 million of subordinated notes due February 27, 2025 with a fixed-

rate coupon of 4.60% per annum (the "2025 Notes"), at a price to investors of 99.375% of the principal amount. In

addition, TCF Bank incurred issuance costs of $1.4 million. Both the discount to the principal amount and issuance

costs are amortized as interest expense over the full term of the notes using the effective interest method. Interest is

payable semi-annually, in arrears, on February 27 and August 27, and commenced on August 27, 2015. Simultaneously,

TCF Bank entered into an interest rate swap agreement with a total notional amount of $150.0 million designated as

a fair value hedge of the 2025 Notes. The effect of the interest rate swap is to effectively convert the fixed-rate on the

2025 Notes to a floating interest rate based on the three-month London InterBank Offered Rate ("LIBOR") plus a fixed

number of basis points on the notional amount. See Note 18, Derivative Instruments, for additional information regarding

the interest rate swap.