TCF Bank 2015 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

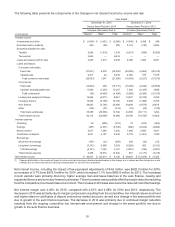

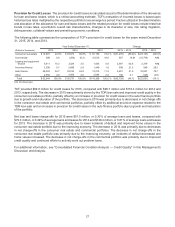

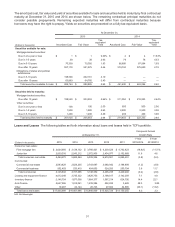

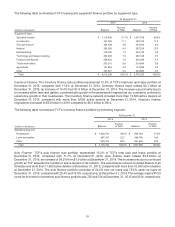

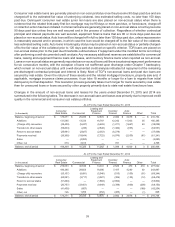

At December 31, 2015

(In thousands) Consumer

Real Estate Commercial

Leasing and

Equipment

Finance Inventory

Finance Auto

Finance Other Total

Geographic Distribution:

Minnesota $ 1,555,919 $ 797,109 $ 107,454 $ 73,817 $ 53,856 $ 6,668 $2,594,823

Illinois 1,271,024 479,220 161,988 48,829 107,531 4,335 2,072,927

California 885,462 47,647 554,991 63,826 448,292 27 2,000,245

Michigan 489,480 472,204 126,051 85,980 51,344 2,951 1,228,010

Wisconsin 271,682 467,451 61,088 74,144 26,195 877 901,437

Texas — 41,573 359,011 149,060 215,814 5 765,463

Colorado 337,167 189,664 66,499 21,632 49,998 3,984 668,944

Florida 50,498 60,499 197,571 85,919 142,517 48 537,052

Canada — — 1,073 517,032 — — 518,105

New York 23,915 15,069 245,194 67,349 114,927 51 466,505

Pennsylvania 27,259 497 156,445 63,012 113,480 57 360,750

Ohio 6,031 66,326 156,533 61,891 64,654 — 355,435

Georgia 36,301 45,514 99,573 44,818 94,935 — 321,141

New Jersey 41,862 4,535 150,203 22,597 89,479 — 308,676

Arizona 86,858 20,662 105,748 16,639 72,852 183 302,942

North Carolina 1,485 17,231 135,382 49,222 83,508 39 286,867

Washington 107,845 10,333 56,200 25,251 40,253 4 239,886

Massachusetts 40,305 18,538 114,595 17,238 44,620 1 235,297

Virginia 31,600 2,688 86,994 32,918 71,727 1 225,928

Indiana 22,003 49,166 77,228 39,523 36,670 2 224,592

Tennessee 1,830 46,564 67,797 41,190 54,979 2 212,362

Other 175,746 293,342 924,630 544,867 669,965 62 2,608,612

Total $ 5,464,272 $ 3,145,832 $ 4,012,248 $2,146,754 $2,647,596 $ 19,297 $ 17,435,999

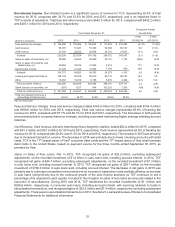

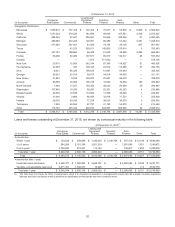

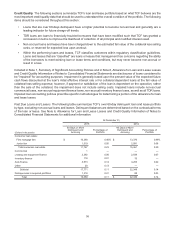

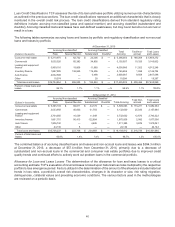

Loans and leases outstanding at December 31, 2015, are shown by contractual maturity in the following table.

At December 31, 2015(1)

(In thousands) Consumer

Real Estate Commercial

Leasing and

Equipment

Finance Inventory

Finance Auto

Finance Other Total

Amounts due:

Within 1 year $ 123,528 $ 509,696 $ 1,348,225 $2,146,754 $ 557,100 $ 10,146 $ 4,695,449

1 to 5 years 584,204 2,161,789 2,551,239 —1,951,089 1,551 7,249,872

Over 5 years 4,756,540 474,347 112,784 — 139,407 7,600 5,490,678

Total after 1 year 5,340,744 2,636,136 2,664,023 —2,090,496 9,151 12,740,550

Total $ 5,464,272 $ 3,145,832 $ 4,012,248 $2,146,754 $2,647,596 $ 19,297 $17,435,999

Amounts due after 1 year:

Fixed-rate loans and leases $ 2,369,377 $ 1,090,063 $ 2,648,797 $ — $ 2,090,496 $ 9,038 $ 8,207,771

Variable- and adjustable-rate loans 2,971,367 1,546,073 15,226 — — 113 4,532,779

Total after 1 year $ 5,340,744 $ 2,636,136 $ 2,664,023 $ — $ 2,090,496 $ 9,151 $12,740,550

(1) This table does not include the effect of prepayments, which is an important consideration in management's interest-rate risk analysis. Company experience

indicates that loans and leases remain outstanding for significantly shorter periods than their contractual terms.