TCF Bank 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our strong origination, loan sale and securitization capabilities

also give us flexibility to control our balance sheet growth to

respond to changing economic conditions. In 2015, loan and

lease balances would have grown by 23 percent had we de-

cided to keep all originations on the balance sheet. Clearly, this

level of growth is not desirable, but it highlights the fact that

we can manage our growth through our own actions.

Growing profitably also requires us to be mindful of risks

in the marketplace. With many banks recently announcing

plans to reduce growth in auto finance, we continue to

use our expertise in the market, make investments in

infrastructure and maintain consistent underwriting to

drive responsible and profitable growth. On the other hand,

despite many opportunities, we have made the conscious

decision to avoid more volatile markets such as energy-

related lending.

Operating Leverage

One of the key priorities for 2016, and a critical driver to

our long term success, is increasing our operating leverage.

We have built a unique business model that generates

strong revenue and provides an expanded and diversified

origination capability. This strategy results in higher expenses

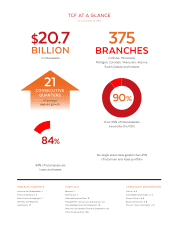

because 84 percent of our total assets are comprised of

loans and leases while our business model focuses on small

transaction sizes. We also see added expenses as a result of

our large servicing and operating lease portfolios. However,

these expenses are more than offset by the revenue they

generate. As a result, the nature of our business will continue

to lead to elevated expenses compared to our peers.

I believe there are many areas across the organization where

we can optimize our spending to increase operating leverage.

It begins with consistent and stable revenue growth across

all of our businesses. I am proud of our track record in this

area. Second, we need to grow the asset base while reducing

the rate at which expenses are increasing. Efficient expense

management starts with looking at our spending holistically

across the company to identify redundancy and streamline

our processes by adopting best practices.

One of the tenets of our “One TCF” rallying cry is to promote

shared ownership in driving efficiency and common practices.

In early 2015, we took an important step forward with the

addition of an enterprise chief information officer who is

charged with aligning our information technology resources

across the company. As our businesses have matured and

the opportunities for synergies in areas such as technology

have strengthened, we have a laser focus on driving efficiency

across the business. I am optimistic we will quickly see the

benefits of these initiatives.

Our individual business units have also shown their commit-

ment to improving effeciencies within the organization. In early

2016, we announced plans to close 33 in-store branches in

the Chicago market and replace them with ATMs that feature

advanced transaction capabilities. These changes are expected

to be completed in May 2016.

4

LEADERSHIP CONTINUITY

From left: Thomas J. Butterfield, chief information officer; Thomas F. Jasper, chief operating officer; Gloria J. Charley, director of talent management;

Michael S. Jones, executive vice president of consumer banking; Craig R. Dahl, chief executive officer; William S. Henak, executive vice president of wholesale

banking; Barbara E. Shaw, director of corporate human resources; Mark A Bagley, chief credit officer; Brian W. Maass, chief financial officer;

James M. Costa, chief risk officer and Tamara K. Schuette, corporate controller.