TCF Bank 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

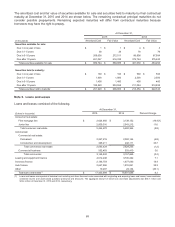

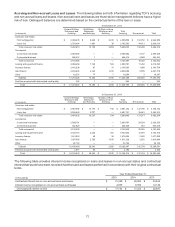

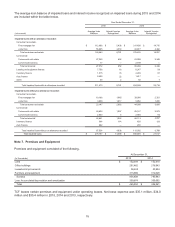

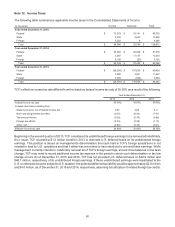

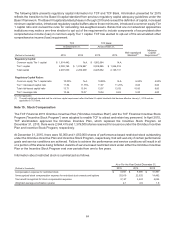

Certificates of deposit had the following remaining maturities at December 31, 2015.

(In thousands)

Denominations

$100 Thousand or

Greater

Denominations

Less Than

$100 Thousand Total

Maturity:

0-3 months $ 309,076 $ 384,143 $ 693,219

4-6 months 302,176 347,450 649,626

7-12 months 719,329 708,188 1,427,517

Over 12 months 585,969 547,462 1,133,431

Total $ 1,916,550 $1,987,243 $3,903,793

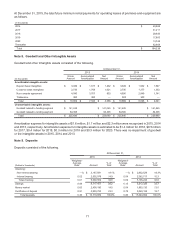

The aggregate amount of certificates of deposit with balances equal to or greater than the Federal Deposit Insurance

Corporation insurance limit of $250,000 were $484.2 million and $302.8 million at December 31, 2015 and 2014,

respectively.

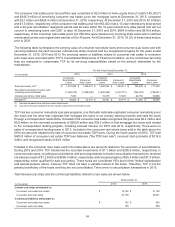

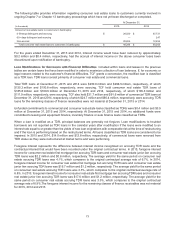

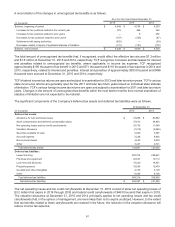

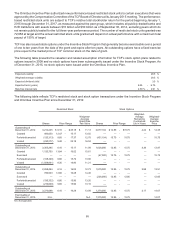

Note 10. Short-term Borrowings

Selected information for short-term borrowings (borrowings with an original maturity of less than one year) consisted

of the following.

At December 31,

2015 2014

(Dollars in thousands) Amount Rate Amount Rate

Period end balance:

Securities sold under repurchase agreements $ 5,381 0.03% $ 4,425 0.10%

Total $ 5,381 0.03 $4,425 0.10

Average daily balances for the period ended:

Federal Home Loan Bank advances $ — —% $ 74,385 0.26%

Federal funds purchased 225 0.45 375 0.40

Securities sold under repurchase agreements 16,431 0.06 5,956 0.18

Line of Credit - TCF Commercial Finance Canada, Inc. 2,166 1.96 2,957 1.88

Total $ 18,822 0.28 $83,673 0.31

Maximum month-end balances for the period ended:

Federal Home Loan Bank advances $ — N.A. $ 250,000 N.A.

Securities sold under repurchase agreements 62,995 N.A. 4,425 N.A.

Line of Credit - TCF Commercial Finance Canada, Inc. 5,519 N.A. 11,751 N.A.

N.A. Not Applicable.

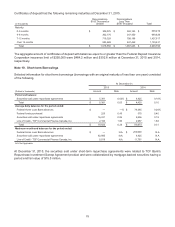

At December 31, 2015, the securities sold under short-term repurchase agreements were related to TCF Bank's

Repurchase Investment Sweep Agreement product and were collateralized by mortgage-backed securities having a

period end fair value of $15.5 million.