TCF Bank 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

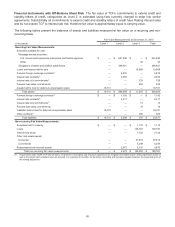

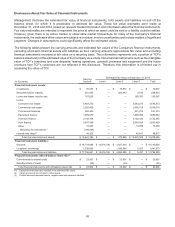

Financial Instruments with Off-Balance Sheet Risk The fair value of TCF's commitments to extend credit and

standby letters of credit, categorized as Level 2, is estimated using fees currently charged to enter into similar

agreements. Substantially all commitments to extend credit and standby letters of credit have floating interest rates

and do not expose TCF to interest rate risk; therefore fair value is approximately equal to carrying value.

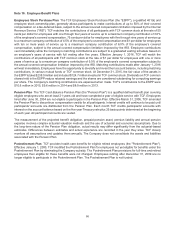

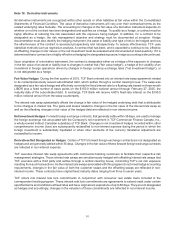

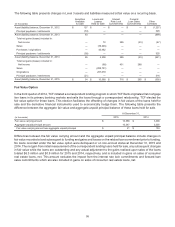

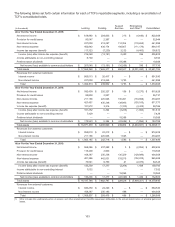

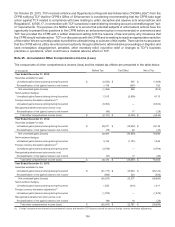

The following tables present the balances of assets and liabilities measured at fair value on a recurring and non-

recurring basis.

Fair Value Measurements at December 31, 2015

(In thousands) Level 1 Level 2 Level 3 Total

Recurring Fair Value Measurements:

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises and federal agencies $ — $ 621,930 $ — $ 621,930

Other — — 34 34

Obligations of states and political subdivisions — 266,921 — 266,921

Loans and leases held for sale — — 10,568 10,568

Forward foreign exchange contracts(1) —5,915 —5,915

Interest rate contracts(1) —2,093 —2,093

Interest rate lock commitments(1) — — 729 729

Forward loan sales commitments — — 284 284

Assets held in trust for deferred compensation plans 19,731 — — 19,731

Total assets $ 19,731 $ 896,859 $ 11,615 $928,205

Forward foreign exchange contracts(1) $ — $ 1,192 $ — $ 1,192

Interest rate contracts(1) —2,317 —2,317

Interest rate lock commitments(1) — — 13 13

Forward loan sales commitments — — 19 19

Liabilities held in trust for deferred compensation plans 19,731 — — 19,731

Other contracts(1) — — 305 305

Total liabilities $ 19,731 $3,509 $337 $23,577

Non-recurring Fair Value Measurements:

Securities held to maturity $ — $ — $ 1,110 $1,110

Loans — — 130,797 130,797

Interest-only strips — — 7,122 7,122

Other real estate owned:

Consumer — — 37,619 37,619

Commercial — — 5,249 5,249

Repossessed and returned assets — 2,673 2,197 4,870

Total non-recurring fair value measurements $ — $ 2,673 $184,094 $186,767

(1) As permitted under GAAP, TCF has elected to net derivative receivables and derivative payables when a legally enforceable master netting agreement exists as

well as the related cash collateral received and paid. For purposes of this table, the derivative receivable and derivative payable balances are presented gross of

this netting adjustment.