TCF Bank 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

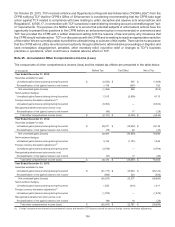

On October 29, 2015, TCF received a Notice and Opportunity to Respond and Advise letter ("NORA Letter") from the

CFPB notifying TCF that the CFPB’s Office of Enforcement is considering recommending that the CFPB take legal

action against TCF related to compliance with laws relating to unfair, deceptive and abusive acts and practices and

Regulation E, §1005.17, in connection with TCF’s practices in administering checking account overdraft program "opt-

in" requirements. The purpose of a NORA Letter is to ensure that potential subjects of enforcement actions have the

opportunity to present their positions to the CFPB before an enforcement action is recommended or commenced and

TCF has provided the CFPB with a written statement setting forth the reasons of law and policy why it believes that

the CFPB should not take action. TCF is in discussions with the CFPB and is seeking to reach an appropriate resolution

of the matter. We are currently unable to predict the ultimate timing or outcome of this matter. There can be no assurance

that the CFPB will not utilize its enforcement authority through settlement, administrative proceedings or litigation and

seek remediation, disgorgement, penalties, other monetary relief, injunctive relief or changes to TCF’s business

practices or operations, which could have a material adverse effect on TCF.

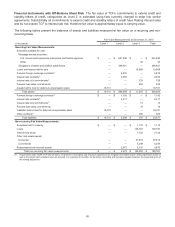

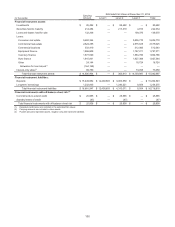

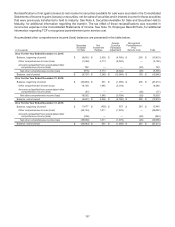

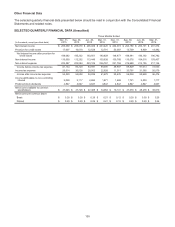

Note 25. Accumulated Other Comprehensive Income (Loss)

The components of other comprehensive income (loss) and the related tax effects are presented in the table below.

(In thousands) Before Tax Tax Effect Net of Tax

Year Ended December 31, 2015:

Securities available for sale:

Unrealized gains (losses) arising during the period $ (2,523) $ 955 $(1,568)

Reclassification of net (gains) losses to net income 1,159 (407)752

Net unrealized gains (losses) (1,364) 548 (816)

Net investment hedges:

Unrealized gains (losses) arising during the period 7,613 (2,900) 4,713

Foreign currency translation adjustment:(1)

Unrealized gains (losses) arising during the period (8,304) — (8,304)

Recognized postretirement prior service cost:

Reclassification of net (gains) losses to net income (46) 17 (29)

Total other comprehensive income (loss) $ (2,101) $ (2,335) $ (4,436)

Year Ended December 31, 2014:

Securities available for sale:

Unrealized gains (losses) arising during the period $ 29,071 $ (10,932) $ 18,139

Reclassification of net (gains) losses to net income (76) 29 (47)

Net unrealized gains (losses) 28,995 (10,903) 18,092

Net investment hedges:

Unrealized gains (losses) arising during the period 3,126 (1,181) 1,945

Foreign currency translation adjustment:(1)

Unrealized gains (losses) arising during the period (3,704) — (3,704)

Recognized postretirement prior service cost:

Reclassification of net (gains) losses to net income (47) 17 (30)

Total other comprehensive income (loss) $ 28,370 $ (12,067) $ 16,303

Year Ended December 31, 2013:

Securities available for sale:

Unrealized gains (losses) arising during the period $ (61,177) $ 23,053 $ (38,124)

Reclassification of net (gains) losses to net income (860)324 (536)

Net unrealized gains (losses) (62,037) 23,377 (38,660)

Net investment hedges:

Unrealized gains (losses) arising during the period 1,625 (614)1,011

Foreign currency translation adjustment:(1)

Unrealized gains (losses) arising during the period (1,979) — (1,979)

Recognized postretirement prior service cost:

Reclassification of net (gains) losses to net income (46) 18 (28)

Total other comprehensive income (loss) $ (62,437) $ 22,781 $ (39,656)

(1) Foreign investments are deemed to be permanent in nature and therefore TCF does not provide for taxes on foreign currency translation adjustments.