TCF Bank 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

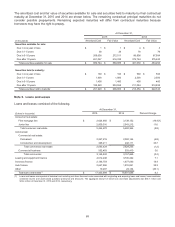

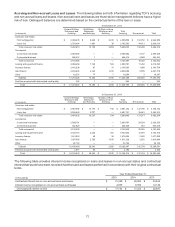

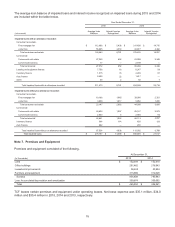

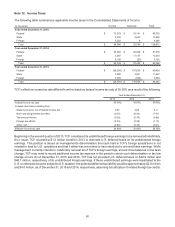

The following table provides information regarding consumer real estate loans to customers currently involved in

ongoing Chapter 7 or Chapter 13 bankruptcy proceedings which have not yet been discharged or completed.

At December 31,

(In thousands) 2015 2014

Consumer real estate loans to customers in bankruptcy:

0-59 days delinquent and accruing $ 26,020 $ 47,731

60+ days delinquent and accruing — 247

Non-accrual 20,264 12,284

Total consumer real estate loans to customers in bankruptcy $ 46,284 $ 60,262

For the years ended December 31, 2015 and 2014, interest income would have been reduced by approximately

$0.2 million and $0.4 million, respectively, had the accrual of interest income on the above consumer loans been

discontinued upon notification of bankruptcy.

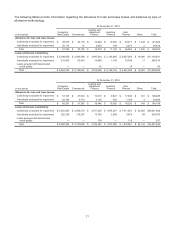

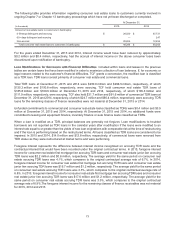

Loan Modifications for Borrowers with Financial Difficulties Included within loans and leases in the previous

tables are certain loans that have been modified in order to maximize collection of loan balances. If, for economic or

legal reasons related to the customer's financial difficulties, TCF grants a concession, the modified loan is classified

as a TDR loan. TDR loans consist primarily of consumer real estate and commercial loans.

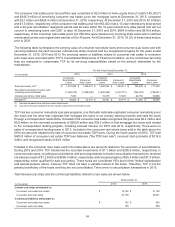

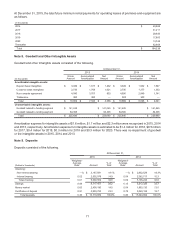

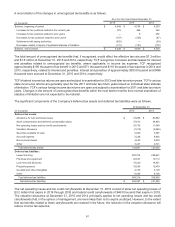

Total TDR loans at December 31, 2015 and 2014 were $230.6 million and $298.5 million, respectively, of which

$135.3 million and $193.8 million, respectively, were accruing. TCF held consumer real estate TDR loans of

$185.8 million and $199.6 million at December 31, 2015 and 2014, respectively, of which $106.8 million and

$111.9 million, respectively, were accruing. TCF also held $31.7 million and $91.6 million of commercial TDR loans at

December 31, 2015 and 2014, respectively, of which $24.7 million and $80.4 million, respectively, were accruing. TDR

loans for the remaining classes of finance receivables were not material at December 31, 2015 or 2014.

Unfunded commitments to commercial and consumer real estate loans classified as TDRs were $0.4 million and $3.9

million at December 31, 2015 and 2014, respectively. At December 31, 2015 and 2014, no additional funds were

committed to leasing and equipment finance, inventory finance or auto finance loans classified as TDRs.

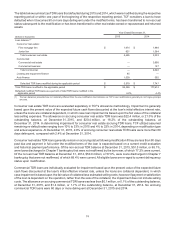

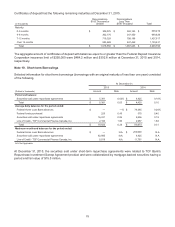

When a loan is modified as a TDR, principal balances are generally not forgiven. Loan modifications to troubled

borrowers are not reported as TDR loans in the calendar years after modification if the loans were modified to an

interest rate equal to or greater than the yields of new loan originations with comparable risk at the time of restructuring

and if the loan is performing based on the restructured terms. All loans classified as TDR loans are considered to be

impaired. In 2015 and 2014, $14.0 million and $12.8 million, respectively, of commercial loans were removed from

TDR status as they were restructured at market terms and were performing.

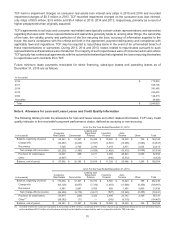

Foregone interest represents the difference between interest income recognized on accruing TDR loans and the

contractual interest that would have been recorded under the original contractual terms. In 2015, foregone interest

income for consumer real estate first mortgage lien accruing TDR loans and consumer real estate junior lien accruing

TDR loans was $2.2 million and $0.8 million, respectively. The average yield for the same period on consumer real

estate accruing TDR loans was 4.1%, which compares to the original contractual average rate of 6.7%. In 2014,

foregone interest income for consumer real estate first mortgage lien accruing TDR loans and consumer real estate

junior lien accruing TDR loans was $16.7 million and $1.2 million, respectively. The average yield for the same period

on consumer real estate accruing TDR loans was 3.3%, which compares to the original contractual average rate of

6.8%. In 2013, foregone interest income for consumer real estate first mortgage lien accruing TDR loans and consumer

real estate junior lien accruing TDR loans was $17.6 million and $1.2 million, respectively. The average yield for the

same period on consumer real estate accruing TDR loans was 3.3%, which compares to the original contractual

average rate of 6.9%.The foregone interest income for the remaining classes of finance receivables was not material

for 2015, 2014 and 2013.