TCF Bank 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

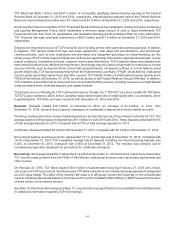

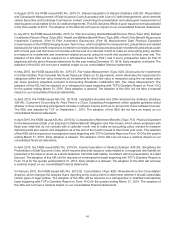

In August 2015, the FASB issued ASU No. 2015-15, Interest-Imputation of Interest (Subtopic 835-30): Presentation

and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements, which amends

certain Securities and Exchange Commission content concerning the presentation and subsequent measurement of

debt issuance costs related to line-of-credit arrangements. This ASU became effective upon issuance and was adopted

in the third quarter of 2015. The adoption of this ASU did not have an impact on our consolidated financial statements.

In July 2015, the FASB issued ASU No. 2015-12, Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined

Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive

Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient

(consensuses of the FASB Emerging Issues Task Force), which simplifies the measurement, presentation and related

disclosures for fully benefit-responsive investment contracts and disclosures about plan investments and allows a plan

with a fiscal year end that does not coincide with the end of a calendar month to make an accounting policy election

to measure its investments and investment-related accounts using the month end closest to its fiscal year end. The

adoption of this ASU will be required on a retrospective basis for Part I and II and a prospective basis for Part III

beginning with the plan’s financial statements for the year ending December 31, 2016. Early adoption is allowed. The

adoption of this ASU will not have a material impact on our consolidated financial statements.

In May 2015, the FASB issued ASU No. 2015-07, Fair Value Measurement (Topic 820): Disclosures for Investments

in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent), which eliminates the requirement to

categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value

per share practical expedient pursuant to Accounting Standards Codification 820, Fair Value Measurement. The

adoption of this ASU will be required on a retrospective basis beginning with TCF's Quarterly Report on Form 10-Q

for the quarter ending March 31, 2016. Early adoption is allowed. The adoption of this ASU will not have a material

impact on our consolidated financial statements.

In April 2015, the FASB issued ASU No. 2015-05, Intangibles-Goodwill and Other-Internal-Use Software (Subtopic

350-40); Customer's Accounting for Fees Paid in a Cloud Computing Arrangement, which updates guidance about

whether a cloud computing arrangement includes a software license and how to account for those software licenses.

The ASU was adopted by TCF on September 1, 2015. The adoption of this ASU did not have an impact on our

consolidated financial statements.

In April 2015, the FASB issued ASU No. 2015-04, Compensation-Retirement Benefits (Topic 715): Practical Expedient

for the Measurement Date of an Employer's Defined Benefit Obligation and Plan Assets, which allows employers with

fiscal year ends that do not coincide with a calendar month end to make an accounting policy election to measure

defined benefit plan assets and obligations as of the end of the month closest to their fiscal year ends. The adoption

of this ASU will be required on a prospective basis beginning with TCF's Quarterly Report on Form 10-Q for the quarter

ending March 31, 2016. Early adoption is allowed. The adoption of this ASU will not have a material impact on our

consolidated financial statements.

In April 2015, the FASB issued ASU No. 2015-03, Interest-Imputation of Interest (Subtopic 835-30): Simplifying the

Presentation of Debt Issuance Costs, which requires that debt issuance costs related to a recognized debt liability be

presented in the balance sheet as a direct deduction from that debt liability, consistent with the presentation of a debt

discount. The adoption of this ASU will be required on a retrospective basis beginning with TCF's Quarterly Report on

Form 10-Q for the quarter ending March 31, 2016. Early adoption is allowed. The adoption of this ASU will not have

a material impact on our consolidated financial statements.

In February 2015, the FASB issued ASU No. 2015-02, Consolidation (Topic 820): Amendments to the Consolidation

Analysis, which changes the analysis that a reporting entity must perform to determine whether it should consolidate

certain types of legal entities. The adoption of this ASU will be required on a retrospective or modified retrospective

basis beginning with TCF's Quarterly Report on Form 10-Q for the quarter ending March 31, 2016. The adoption of

this ASU will not have a material impact on our consolidated financial statements.