TCF Bank 2015 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

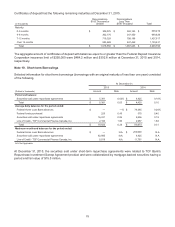

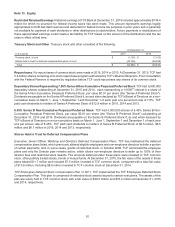

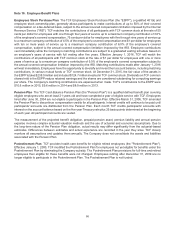

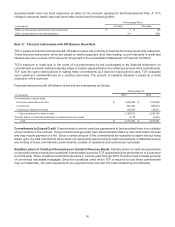

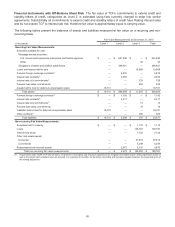

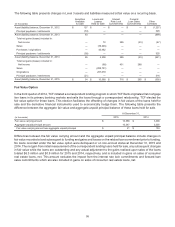

The following table sets forth the changes recognized in accumulated other comprehensive income (loss) that are

attributed to the Postretirement Plan.

Postretirement Plan

Year Ended December 31,

(In thousands) 2015 2014 2013

Accumulated other comprehensive income (loss) before tax, beginning of period $ (331) $ (378) $ (424)

Amortization (recognized in net periodic benefit cost):

Prior service credit 46 47 46

Total recognized in other comprehensive income (loss) 46 47 46

Accumulated other comprehensive income (loss) before tax, end of period $ (285) $ (331) $ (378)

The Pension Plan does not have any accumulated other comprehensive income (loss).

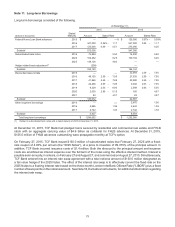

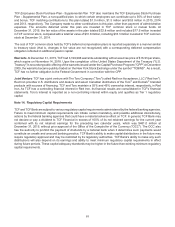

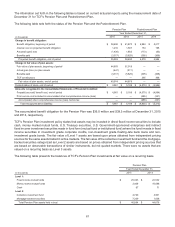

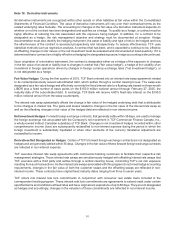

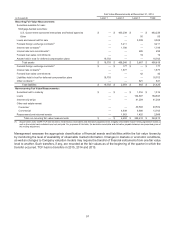

The following tables set forth the net periodic benefit plan (income) cost included in compensation and employee

benefits expense for the Pension Plan and the Postretirement Plan.

Pension Plan

Year Ended December 31,

(In thousands) 2015 2014 2013

Interest cost $ 1,216 $1,587 $1,292

Loss on plan assets 447 511 336

Recognized actuarial (gain) loss (1,436) 1,862 (2,196)

Net periodic benefit plan (income) cost $ 227 $3,960 $(568)

Postretirement Plan

Year Ended December 31,

(In thousands) 2015 2014 2013

Interest cost $ 154 $198 $174

Recognized actuarial (gain) loss (173)(63)(1,241)

Amortization of prior service cost (46)(47)(46)

Net periodic benefit plan (income) cost $ (65) $ 88 $ (1,113)

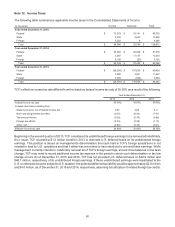

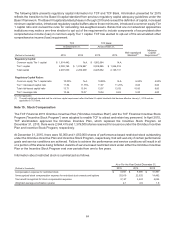

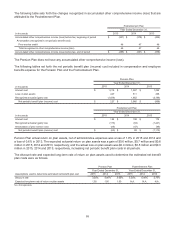

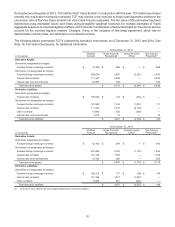

Pension Plan actual return on plan assets, net of administrative expenses was a loss of 1.0% in 2015 and 2014 and

a loss of 0.6% in 2013. The expected actuarial return on plan assets was a gain of $0.6 million, $0.7 million and $0.8

million in 2015, 2014 and 2013, respectively, and the actual loss on plan assets was $0.4 million, $0.5 million and $0.3

million in 2015, 2014 and 2013, respectively, increasing net periodic benefit plan costs in all periods.

The discount rate and expected long-term rate of return on plan assets used to determine the estimated net benefit

plan costs were as follows.

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

Assumptions used to determine estimated net benefit plan cost 2015 2014 2013 2015 2014 2013

Discount rate 3.25%4.00%3.00%3.25%4.00%2.75%

Expected long-term rate of return on plan assets 1.50 1.50 1.50 N.A. N.A. N.A.

N.A. Not Applicable.