TCF Bank 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

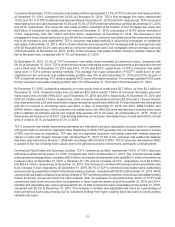

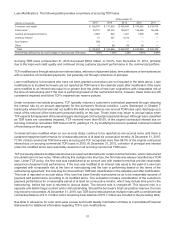

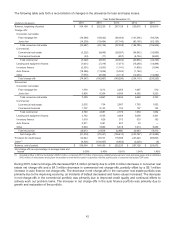

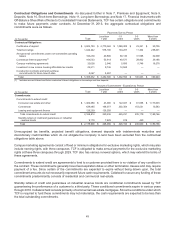

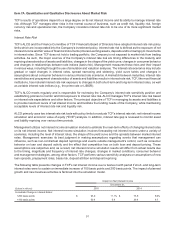

Other Real Estate Owned and Repossessed and Returned Assets Other real estate owned and repossessed and

returned assets are summarized in the following table.

At December 31,

(In thousands) 2015 2014 2013 2012 2011

Other real estate owned:(1)

Consumer real estate $ 42,912 $44,932 $47,637 $69,599 $87,792

Commercial real estate 7,070 20,718 21,237 27,379 47,106

Total other real estate owned 49,982 65,650 68,874 96,978 134,898

Repossessed and returned assets 7,969 3,525 3,505 3,510 4,758

Total other real estate owned and repossessed

and returned assets $ 57,951 $69,175 $72,379 $100,488 $139,656

(1) Includes properties owned and foreclosed properties subject to redemption.

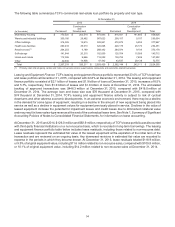

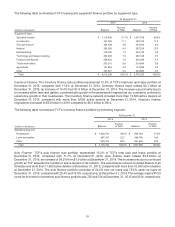

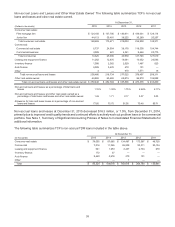

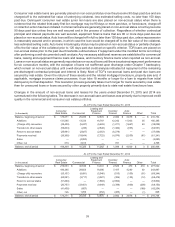

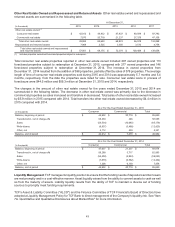

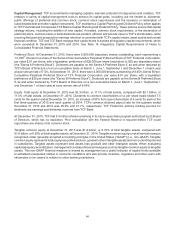

Total consumer real estate properties reported in other real estate owned included 297 owned properties and 113

foreclosed properties subject to redemption at December 31, 2015, compared with 277 owned properties and 146

foreclosed properties subject to redemption at December 31, 2014. The increase in owned properties from

December 31, 2014 resulted from the addition of 598 properties, partially offset by sales of 578 properties. The average

length of time of consumer real estate properties sold during 2015 and 2014 was approximately 5.7 months and 5.4

months, respectively, from the date the properties were listed for sale. Consumer real estate loans in process of

foreclosure were $44.5 million and $59.3 million at December 31, 2015 and 2014, respectively.

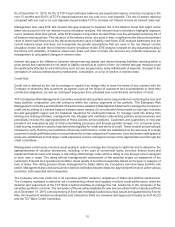

The changes in the amount of other real estate owned for the years ended December 31, 2015 and 2014 are

summarized in the following tables. The decrease in other real estate owned was primarily due to the decrease in

commercial properties as sales increased and transfers in decreased. Total sales of other real estate owned increased

by $5.9 million in 2015 compared with 2014. Total transfers into other real estate owned decreased by $4.4 million in

2015 compared with 2014.

At or For the Year Ended December 31, 2015

(In thousands) Consumer Commercial Total

Balance, beginning of period $ 44,932 $20,718 $65,650

Transferred in, net of charge-offs 58,339 246 58,585

Sales (54,534) (10,645) (65,179)

Write-downs (8,937) (3,488) (12,425)

Other, net 3,112 239 3,351

Balance, end of period $ 42,912 $7,070 $49,982

At or For the Year Ended December 31, 2014

(In thousands) Consumer Commercial Total

Balance, beginning of period $ 47,637 $21,237 $68,874

Transferred in, net of charge-offs 59,268 3,717 62,985

Sales (55,409) (3,824) (59,233)

Write-downs (7,870) (6,562) (14,432)

Other, net 1,306 6,150 7,456

Balance, end of period $ 44,932 $20,718 $65,650

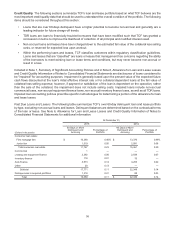

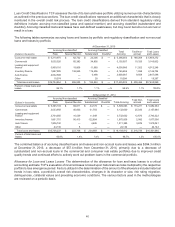

Liquidity Management TCF manages its liquidity position to ensure that the funding needs of depositors and borrowers

are met promptly and in a cost-effective manner. Asset liquidity arises from the ability to convert assets to cash as well

as from the maturity of assets. Liability liquidity results from the ability of TCF to maintain a diverse set of funding

sources to promptly meet funding requirements.

TCF's Asset & Liability Committee ("ALCO") and the Finance Committee of TCF Financial's Board of Directors have

adopted a Liquidity Management Policy for TCF Bank to direct management of the Company's liquidity risk. See "Item

7A. Quantitative and Qualitative Disclosures about Market Risk" for more information.