TCF Bank 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

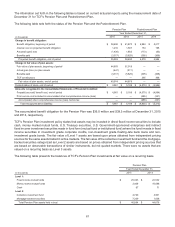

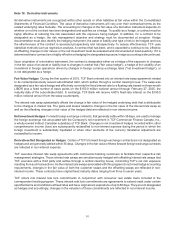

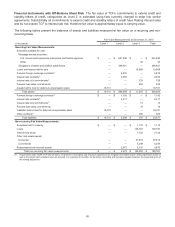

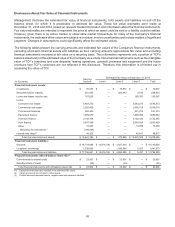

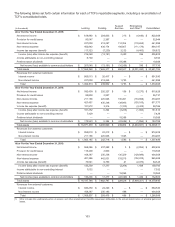

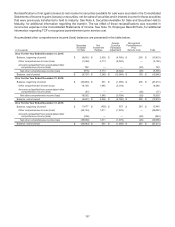

Fair Value Measurements at December 31, 2014

(In thousands) Level 1 Level 2 Level 3 Total

Recurring Fair Value Measurements:

Securities available for sale:

Mortgage-backed securities:

U.S. Government sponsored enterprises and federal agencies $ — $ 463,239 $ — $ 463,239

Other — — 55 55

Loans and leases held for sale — — 3,308 3,308

Forward foreign exchange contracts(1) —3,211 —3,211

Interest rate contracts(1) —1,798 —1,798

Interest rate lock commitments(1) — — 285 285

Forward loan sales commitments — — 19 19

Assets held in trust for deferred compensation plans 18,703 — — 18,703

Total assets $ 18,703 $ 468,248 $ 3,667 $490,618

Forward foreign exchange contracts(1) $ — $ 177 $ — $ 177

Interest rate contracts(1) —1,877 —1,877

Forward loan sales commitments — — 42 42

Liabilities held in trust for deferred compensation plans 18,703 — — 18,703

Other contracts(1) — — 621 621

Total liabilities $ 18,703 $2,054 $663 $21,420

Non-recurring Fair Value Measurements:

Securities held to maturity $ — $ — $ 1,516 $1,516

Loans — — 164,897 164,897

Interest-only strips — — 41,204 41,204

Other real estate owned:

Consumer — — 40,502 40,502

Commercial — 4,839 8,866 13,705

Repossessed and returned assets — 1,563 1,425 2,988

Total non-recurring fair value measurements $ — $ 6,402 $258,410 $264,812

(1) As permitted under GAAP, TCF has elected to net derivative receivables and derivative payables when a legally enforceable master netting agreement exists as

well as the related cash collateral received and paid. For purposes of this table, the derivative receivable and derivative payable balances are presented gross of

this netting adjustment.

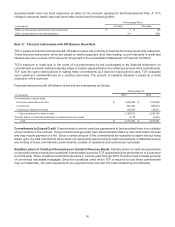

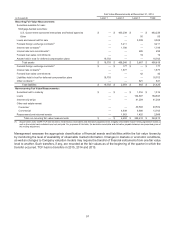

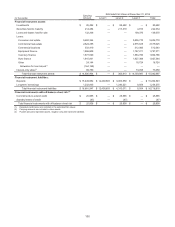

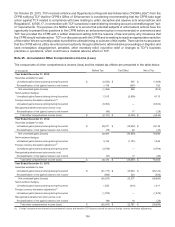

Management assesses the appropriate classification of financial assets and liabilities within the fair value hierarchy

by monitoring the level of availability of observable market information. Changes in markets or economic conditions,

as well as changes to Company valuation models may require the transfer of financial instruments from one fair value

level to another. Such transfers, if any, are recorded at the fair values as of the beginning of the quarter in which the

transfer occurred. TCF had no transfers in 2015, 2014 and 2013.