TCF Bank 2015 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2015 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

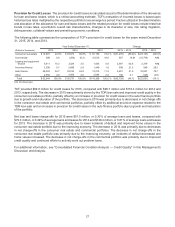

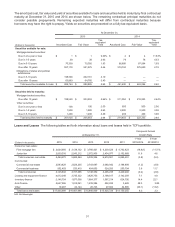

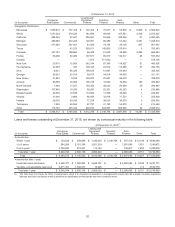

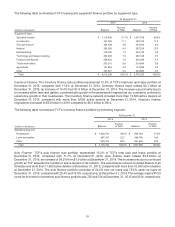

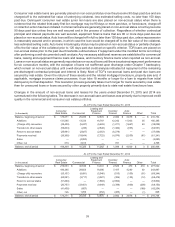

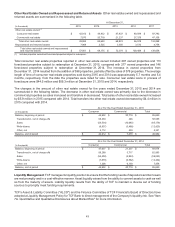

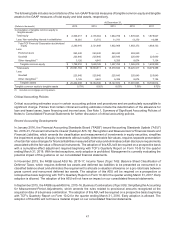

Loan Modifications The following table provides a summary of accruing TDR loans.

At December 31,

(Dollars in thousands) 2015 2014 2013 2012 2011

Consumer real estate $ 106,787 $ 111,933 $ 506,640 $ 478,262 $ 433,078

Commercial 24,731 80,375 120,871 144,508 98,448

Leasing and equipment finance 2,904 924 1,021 1,050 776

Inventory finance 51 527 4,212 — —

Auto finance 799 — — — —

Other 11 89 93 38 —

Total $ 135,283 $ 193,848 $ 632,837 $ 623,858 $ 532,302

Over 60-day delinquency as a percentage of total accruing TDR loans 1.54%1.39%1.28%4.34%5.69%

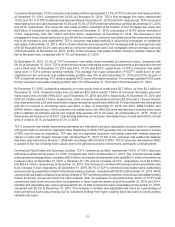

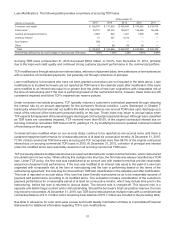

Accruing TDR loans at December 31, 2015 decreased $58.6 million, or 30.2%, from December 31, 2014, primarily

due to the improved credit quality and continued strong customer payment performance in the commercial portfolio.

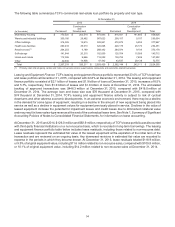

TCF modifies loans through reductions in interest rates, extension of payment dates, term extensions or term extensions

with a reduction of contractual payments, but generally not through reductions of principal.

Loan modifications to borrowers who have not been granted concessions are not included in the table above. Loan

modifications to troubled borrowers are not reported as TDR loans in the calendar years after modification if the loans

were modified to an interest rate equal to or greater than the yields of new loan originations with comparable risk at

the time of restructuring and if the loan is performing based on the restructured terms; however, these loans are still

considered impaired and follow TCF's impaired loan reserve policies.

Under consumer real estate programs, TCF typically reduces a customer's contractual payments through reducing

the interest rate by an amount appropriate for the borrower's financial condition. Loans discharged in Chapter 7

bankruptcy where the borrower did not reaffirm the debt are reported as non-accrual TDR loans upon discharge as a

result of the removal of the borrower's personal liability on the loan. These loans may return to accrual status when

TCF expects full repayment of the remaining pre-discharged contractual principal and interest. Although loans classified

as TDR loans are considered impaired, TCF received more than 60.0% of the original contractual interest due on

accruing consumer real estate TDR loans in 2015, yielding 4.1%, by modifying the loans to qualified customers instead

of foreclosing on the property.

Commercial loans modified when on non-accrual status continue to be reported as non-accrual loans until there is

sustained repayment performance for a reasonable period of at least six consecutive months. At December 31, 2015,

77.9% of total commercial TDR loans were accruing and TCF recognized more than 88.0% of the original contractual

interest due on accruing commercial TDR loans in 2015. At December 31, 2015, collection of principal and interest

under the modified terms was reasonably assured on all accruing commercial TDR loans.

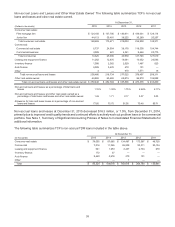

TCF previously utilized a multiple note structure as a workout alternative for certain commercial loans, which restructured

a troubled loan into two notes. When utilizing this multiple note structure, the first note was always classified as a TDR

loan. Under TCF policy, the first note was established at an amount and with market terms that provide reasonable

assurance of payment and performance. If the loan was modified at an interest rate equal to the yield of a new loan

originated with comparable risk at the time of restructuring and the loan is performing based on the terms of the

restructuring agreement, this note may be removed from TDR loan classification in the calendar year after modification.

This note is reported on accrual status if the loan has been formally restructured so as to be reasonably assured of

payment and performance according to its modified terms. This evaluation includes consideration of the customer's

payment performance for a reasonable period of at least six consecutive months, which may include time prior to the

restructuring, before the loan is returned to accrual status. The second note is charged-off. This second note is a

separate and distinct legal contract and is still outstanding. Should the borrower's financial position improve, the loan

may become recoverable. At December 31, 2015, two TDR loans restructured as multiple notes with a combined total

contractual balance of $11.3 million and a remaining book balance of $10.7 million are included in the preceding table.

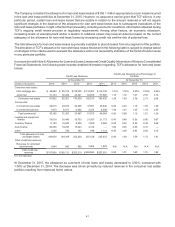

See Note 6, Allowance for Loan and Lease Losses and Credit Quality Information of Notes to Consolidated Financial

Statements for additional information regarding TCF's loan modifications.